Are Major Western Banks Entering China the Marginal 'Chinese' Gold and Silver Buyers Driving High Chinese Gold and Silver Premia?

Are Western Banks Seeking Metal in China?

A Twitter poster who goes by the handle @oriental_ghost has been posting daily updates of gold and silver price premia at the Shanghai Gold Exchange (SGE) and Shanghai Futures Exchange (SFE) as well as the draw-down of the vault stocks of both gold and silver at the SGE and SFE.

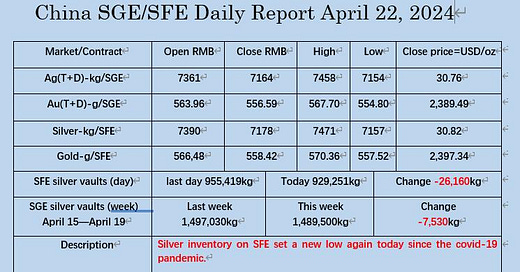

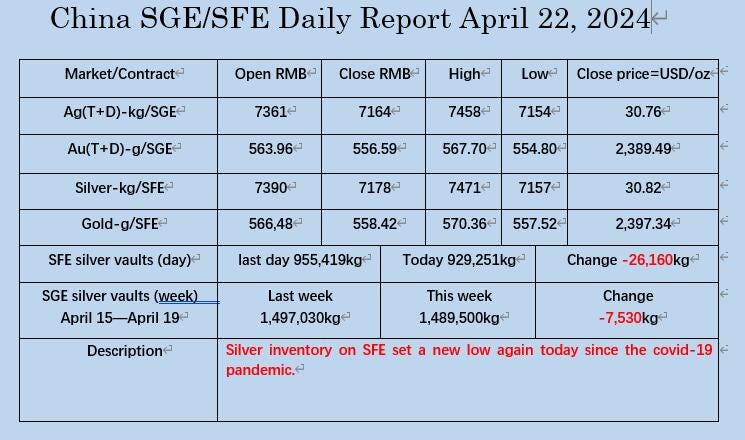

His daily post from April 22, 2024 can be seen as follows:

https://twitter.com/oriental_ghost/status/1782316119564648492

Before discussing further, consider first the unique characteristics of the SGE spot contract for gold and silver:

Pages 16 - 21 of this presentation to the Canadian Institute of Mining, Metallurgy, and Petroleum (CIM) in 2016 draws-out the characteristics of the SGE spot contract, notably, that to issue a spot contract for trading at the SGE, approved and refined metal bars with SGE serial numbers must first be deposited in SGE vaults to back each spot contract traded in the market.

No unbacked promissory note trading of spot gold and silver, such as are traded in the London spot market, are permitted on the SGE making it a unique major exchange. Without first depositing metal, there can be no issuance of an SGE spot contract for trading.

Much has been written about voracious Chinese buyers and traders of gold and silver driving very high premia in Shanghai compared to London and NY gold prices.

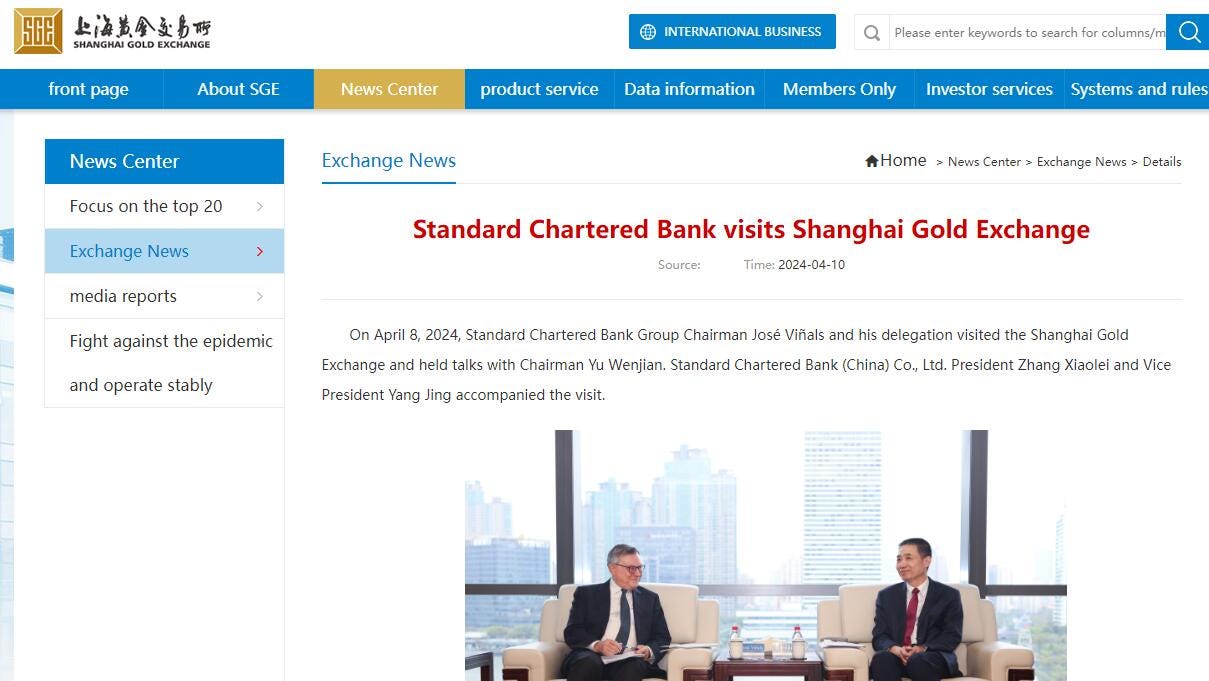

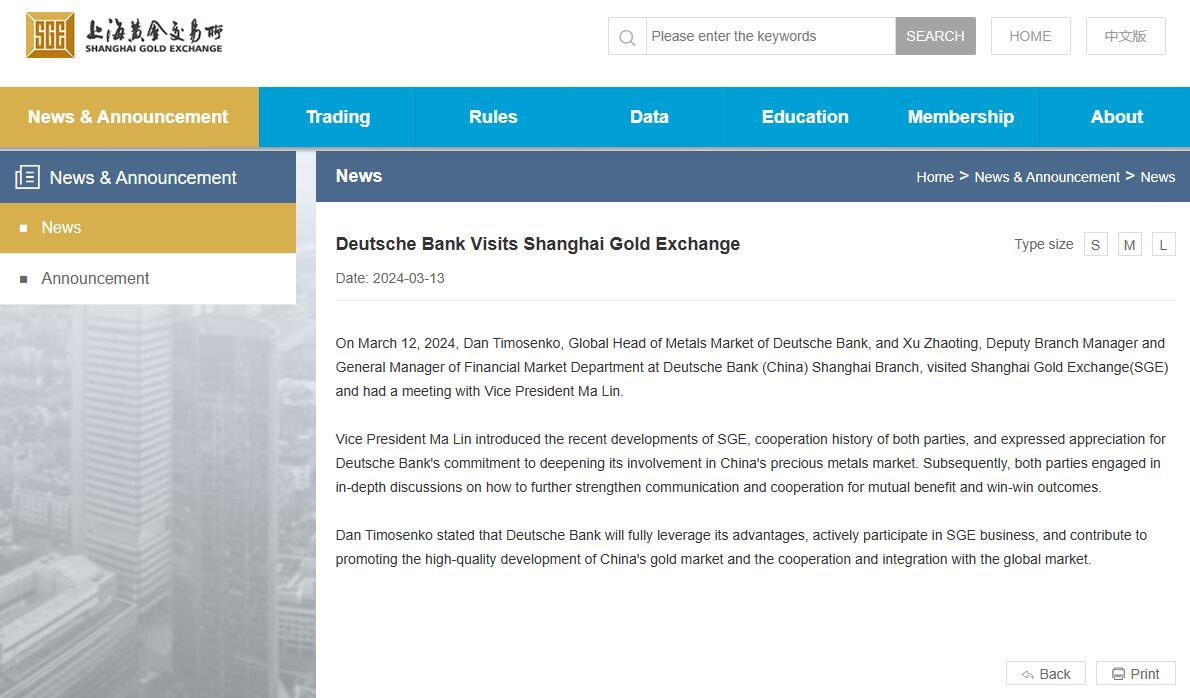

What is intriguing is that Oriental Ghost has recently posted 2024 vintage news releases from the SGE of representatives of major banks including JP Morgan, Standard Chartered, Deutsche Bank, and HSBC visiting the SGE to discuss ‘cooperation’ in China’s precious metals markets.

At the same time, premia for gold on the SGE have at times surpassed $30 /oz. for gold and $3 /oz. for silver in comparison to NY and London prices where these same banks have participated on their promissory note gold and silver spot (immediate ownership) markets.

Screen shots of the SGE news releases and further discussion are below:

In general, it is illegal to export gold from China (unless it is first imported into the Shanghai Free-Trade Zone (FTZ) from abroad and then re-exported from the FTZ).

There is no such limitation on the export of silver from China.

Is the ‘cooperation’ discussed of the form of securing gold and silver bars for delivery in China to investors and institutions holding London promissory spot contracts who can see the writing on the wall for fiat debt currency as the debt markets in the West roll-over due to currency debasement driving an incipient wave of debt default from high price inflation and high interest rates?

Are these Western banks the ‘Chinese’ gold and silver buyers driving, at least in part, Chinese precious metal premia?

At the moment it is unclear, however the high cadence of bank visits to the SGE tell us that something is afoot.

Let’s watch.

Best regards,

David Jensen

Bullion cartel cannot Buy gold from China, so No. They just begged China to slow the buying down.