As Currency Debasement Squeezes The US, The Age Old Question: Is The Gold All There David Rockefeller?

“Whenever destroyers appear among men, they start by destroying money, for money is men’s protection and the base of a moral existence. Destroyers seize gold and leave to its owners a counterfeit pile of paper. This kills all objective standards and delivers men into the arbitrary power of an arbitrary setter of values. Gold was an objective value, an equivalent of wealth produced. Paper is a mortgage on wealth that does not exist, backed by a gun aimed at those who are expected to produce it.”

Ayn Rand

As we are told the economy is strong and citizens are doing well, we continue to note and see further signs that this is not the case.

And as price inflation continues along with a sudden increase in interest rates, those who work for a living are being squeezed with their income barely sufficient to meet everyday expenses.

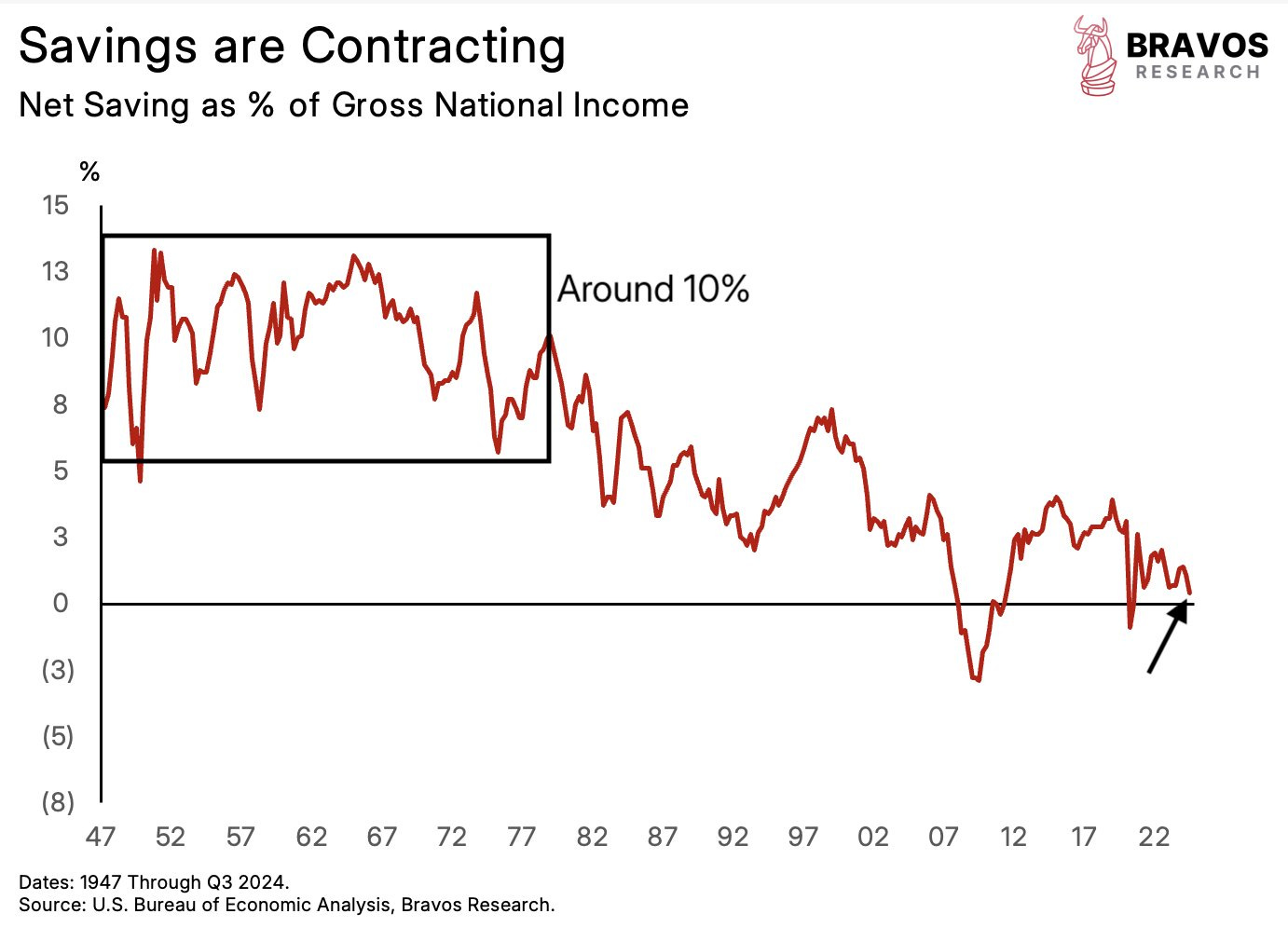

This can clearly be seen in this graph tweeted by Bravos Research:

Note that in August 1971, President Nixon defaulted on the fixed price convertibility of US dollars for gold by other central banks removing an important limiting factor on the ability of the US Fed to debase the nation’s currency.

Since that time, net savings that had generally run between 8% and 13% of Gross National Income steadily declined toward zero.

As central banks debase, incomes do not keep pace with rising costs resulting in a steady impoverishment of the middle and lower income earners even while asset prices are spurred higher by loose monetary policy that drives price inflation.

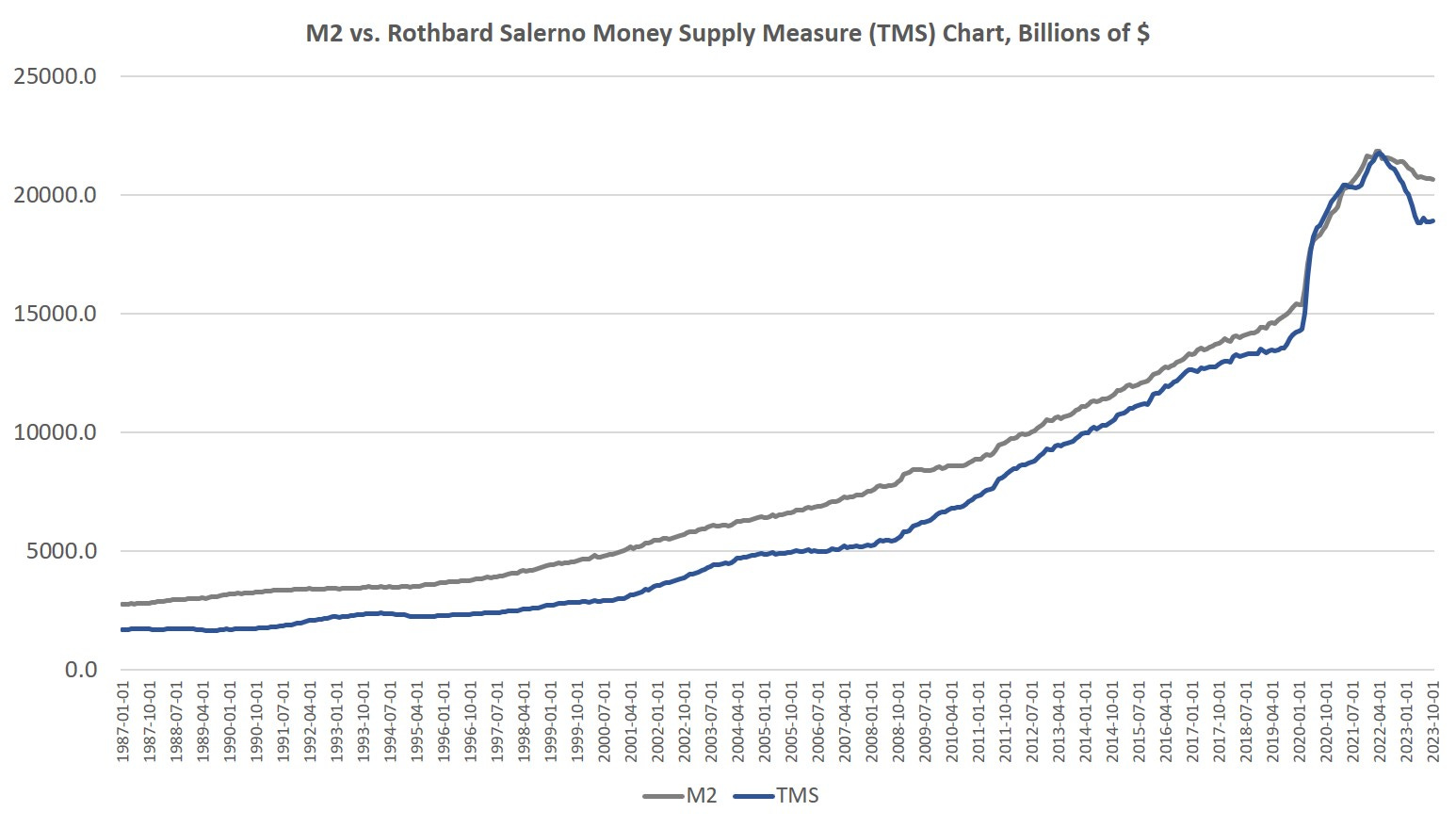

From January 2020, the Fed increased the True Money Stock (TMS) from ca. $14 trillion (T) to $22T - an increase of 57%.

It should be no surprise that goods price inflation has been ignited in the US economy.

(For a discussion about the True Money Stock and Supply and monetary aggregates see: https://mises.org/austrian-economics-newsletter/true-money-supply-measure-supply-medium-exchange-us-economy-0)

Figure 1 - True Money Stock (TMS) vs M2 Money Stock Levels 1987 - 2023; source: Mises.org

From January 2020 until today, the Truflation cost of living index that tracks 13 million different prices in the economy on a daily basis has shown a 26% increase. The Fed has now started to loosen monetary policy and more price inflation can be expected.

Figure 2 - Truflation Cost of Living Index January 2020 to December 2024; source: truflation.com

Incomes have not increased 26% over the last 5 years and the middle and lower income households are consequently increasingly squeezed as price inflation again accelerates.

This failure of fiat currency central planning is moving the world back toward gold and silver money to the horror of Globalists and their central planning plans.

Now, About US Gold Reserves

On August 15, 1971 President Nixon announced that the US would ‘temporarily’ suspend US dollar gold convertibility at $35 /oz.

Unknown to many today is that America’s default on US dollar gold convertibility in 1971 was organized by future Federal Reserve Chairman Paul Volcker as he states:

“I certainly was a major proponent of suspending gold convertibility, in fact the principal planner.”

Paul Volcker, July 10, 2013 NBER interview with Martin Feldstein

From 1957 until 1962 and then from 1965 until 1969, Paul Volcker worked at Chase Manhattan Bank working as David Rockefeller’s special assistant for the latter 5 years at Chase. This subsequently brings up interesting questions regarding claims about America’s gold reserves.

Is The Gold There And Safe…

Many questions have been raised about US vaulted gold reserves. In recent years, former Congressman Dr. Ron Paul has commented that the last time US gold reserves were audited was in 1953 and that if it was all there then it would have been audited more recently.

Many of these gold questions originated in 1974, 3 years after the 1971 gold default.

Mrs. Louise Auchincloss Boyer was a personal assistant to Nelson Rockefeller having worked for the Rockefellers for 40 years and directly for Nelson for 30 years.

Mrs. Boyer came from famous banking circle roots in that her Grandfather ‘Col.’ Edward M. House secured Woodrow Wilson’s nomination for President and was the point man to lobby Congress and secure passing of the Federal Reserve Act in 1913.

On July 1, 1974 an article was published in The National Tattler that claimed David Rockefeller had been sold US gold reserves held in Fort Knox, one of three principal US gold repositories, and that the gold had been removed to Holland.

The alleged source of the story was Mrs. Boyer who two days later had a bad fall - right out of her 10th floor apartment window.

Newspapers across America including the LA Times carried the story first published by the Tattler.

This would have been a very good time to audit America’s gold to put the stories to rest.

Central to the allegations at that time regarding the sale of America’s gold was that it was alleged that Mrs. Boyer stated that the Federal Reserve had coordinated the gold sale to Rockefeller through 3rd parties.

Ron Paul’s repeated calls over the years for the Federal Reserve to be audited have yielded nothing to date but would be very interesting, in this light.

Steve Mnuchin Goes To Fort Knox

In 2017, US Treasury Secretary Steve Mnuchin announced he was travelling to Ft. Knox in Kentucky with a gaggle of senators and congressmen to check on America’s gold.

What ensued is what can best be described as a dog-and-pony show.

A few photos were taken (released by Treasury after later FOIA requests) and showed very little of substance:

Figure 3 - Steve Mnuchin With Gold Bar

Mnuchin then reported the following comprehensive observations about his trip and America’s gold on Twitter:

“Glad gold is safe!" can mean many things and is inappropriate given the sensitivity of the issue.

Overall, Mnuchin’s visit to Ft. Knox and his comments afterward raise further questions that need to be answered.

With President Trump now calling to make America the “crypto capital of the planet” and proposals being floated to sell US gold to create a ‘strategic bitcoin reserve’, there has not been a better time to audit US gold reserves.

Best regards,

David Jensen

I always enjoy reading your research. Please keep up the good work.

WOW!!

I never knew that, about the sale to Holland and the death of Ms Auchincloss.

Such a sordid business, even from the start.

Many thanks,