Blackrock CEO Larry Fink Sashays Into London To Discuss Regulatory Delay (And Silver?) with Kier Starmer

When Bankers Dance, Trouble Abounds

There is a global push by large banks and financial interests to ‘tokenize’ and track all assets globally as well as to create new digital assets such as crypto. This gives the ability not only to create new digital assets and claims from nothing (e.g. carbon credits and Amazon rain forest units) but to control assets and individuals by digitally metering individuals’ access to, or even expropriating, their assets. The advent of AI guarantees digital anonymity will be lost.

Physical gold and silver directly held by their owners are a direct threat to this planned system system of expropriation, command, and control.

Directly held physical gold and silver are anonymous.

Directly held physical gold and silver are no-one else’s liability - they have no counter-party risk. This extraordinary yet simple quality as well as their ability to hold and increase value over time represent an extraordinary threat to those marketing financial assets and financial services in our destabilized financial markets.

Over the past few months, this Substack has observed concerning patterns in the silver market.

A sampling:

September 27, 2024 - the very large bullion bank metal liabilities that have developed in the City of London’s silver market cannot be negated by a commodity exchange as was the 1980 silver squeeze. The cash/spot contracts traded in London are party-to-party and governed primarily by Common Law property rights and contract law. If the Starmer government were to attempt to override the law and intervene it would create a crisis simply driving the silver and gold trade from London to other global centers causing a huge rise on physical demand.

October 19, 2024 - due to the enormity of the estimated 4.2 billion (B) oz. to 6.4B oz. of physical silver sold short in the London cash/spot silver market, as demand for physical silver continues to soar, major bullion banks and silver Exchange Traded Funds (ETFs) will rupture. A $100 price move higher for silver would impose a $420B to $640B liability bringing-down major financial institutions.

November 1, 2024 - Goldman Sachs’ former Global Head of Commodity Research Jeff Currie has stated on CNBC that silver ETFs are the silver shorts in the market by selling silver bullion they hold for shareholders into the market to contain the price of silver. Currie stated that these illegal claims being put on silver ETF assets is merely hedging, which it is not. Blythe Masters, JPMorgan’s former head of its Global Commodities division, has stated on CNBC that clients storing silver in JPMorgan’s vaults hedge their holdings through JPMorgan and that JPMorgan then hedges itself in the markets.

Now on November 21, 2024 we learned that Black Rock’s Board and Larry Fink were in London meeting with Keir Starmer to discuss “regulatory delays and boosting UK growth”.

Black Rock operates the world’s largest silver ETF called iShares Silver Trust (‘SLV’-NY) that Black Rock says holds a total of 474 million (M) oz. of silver for its shareholders.

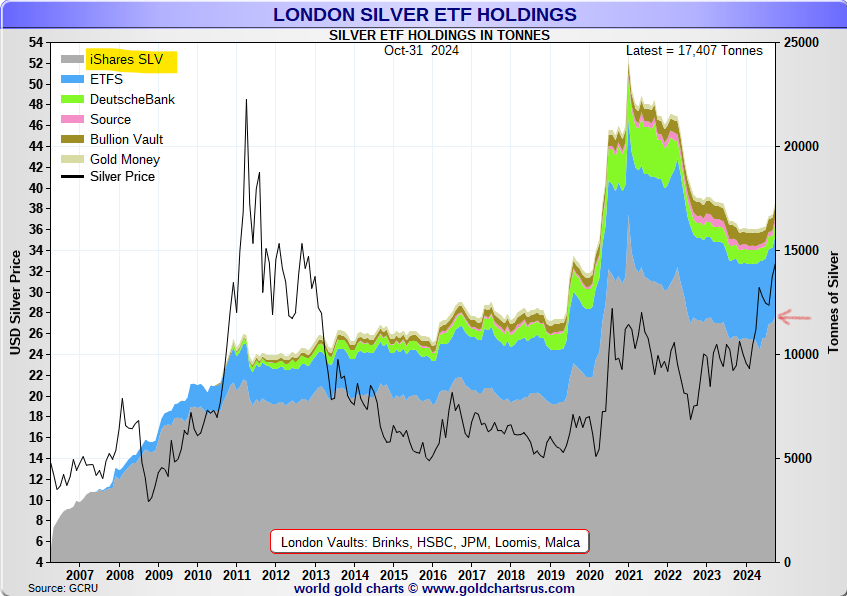

Of that 474M oz. of shareholder silver, 385M oz. are held in London vaults as can be seen here:

Figure 1 - London Silver ETF Vault Holdings; source: goldchartsRus.com

Now if 1) Jeff Currie is right and if 2) SLV, as the world’s largest silver ETF, has been illegally rehypothecating silver into the market, as demand for secure assets such as physical silver grows, those who have been sold the rehypothecated silver claims on ETF silver in the London cash/spot silver market are - at the margins - going to ask for physical delivery.

Once an ETF has started to rehypothecate shareholder silver, there would be no limit to how many times each silver bar could be resold. There would also be a strong inducement to continue to sell additional claims on silver to prevent a market squeeze and a run on demand for physical silver.

Given the 4.2B to 6.4B oz. of cash/spot claims for immediate delivery physical silver sold into the London market, this can quickly become a problem.

To illustrate, consider the chart in Figure 2 below of total silver vault holdings in London.

According to the Silver Institute, since mid-2022 the global silver market has seen a cumulative global silver supply deficit of 450M oz. of silver that has had to be met by silver vault stock draw-down.

Yet during this time London vault stocks of silver have flat-lined indicating to the observer that in the face of a global shortage, London silver physical vault stocks are closely held and not available to market.

Figure 2 - London Silver Vault Holdings; source: goldchartsRus.com

What UK Regulatory Delays Are Concerning Larry?

Physical gold and silver effectively undermine the raison d'etre of the financial industry. And physical silver and gold’s zero counter-party risk sounds quite good.

However if citizens move to directly hold gold and silver in a soaring silver and gold market, there is no reason for many trillions of dollars of investments to be managed by financial institutions.

Further, the Globalist rush to digitize, tokenize, and control all assets would be lost if citizens turned to gold and silver en masse.

And if the massive silver short position indicated to exist in London blows-up and if Jeff Currie is right about silver ETFs rehypothecating shareholder silver, Larry’s black rock could potentially be shown to be just a boiling pit of feces with Larry in the middle. Marketing Brown Pit Inc. would be tough.

Which leaves us to wonder what UK ‘regulatory delays’ are now concerning Larry.

The UK has coercive power, real coercive power, that could be used to regulate spot contract holders asking for delivery on their London contracts. But word would get around and a physical run would still occur.

Limiting the scale of unallocated digital spot contract holdings in the London metals market where the Bank of England oversees a purely voluntary Code of Conduct would not work either as the message would be clear driving demand to other physical markets where real demand could be met.

Suspending the Common Law contract and property law for London metals contract claims would see Keir out on his ear and would end London markets.

For the Globalists’ dream of digital central control of all assets to be effected, termination of property rights and personal holding of assets cannot come soon enough but there seems to be no good near-term path available.

Frauds though, always collapse. And the London gold and silver market fraud overseen by the regulators at the Bank of England is on the way out.

It appears to this observer that Larry is stuck.

There seems to be this certain odor.

Best regards,

David Jensen

Your article reads to me like a war hymn that thunders in the blood. This, coupled with the image of criminals drowning in their own product, underpins the optimism inherent in sound money. Starmer likes the stink you refer to. He will do his evil whilst he can. Then he too will be taken by the poop.

What a glorious sight that would be. I'm sure there are many dairy farmers around the country who would gladly offer up their slurry pits to drop them in.