The two major real estate markets in Canada where speculation has been the greatest for decades are in Toronto and Vancouver.

The most recent data release from the government’s Canada Mortgage and Housing Corporation (CMHC) reveals very sudden change in these two markets as the shock interest rate increase from the Bank of Canada (BoC) bites.

Housing starts in June 2024 compared to June 2023 are down 60% in Toronto and down 55% in Vancouver.

Housing Starts June 2024 vs June 2023; source: CMHC

A slow-down in activity typically front-runs a decline in real estate prices and there is no mistaking this slowing activity.

There is No Housing Shortage - The BoC Has Created a Housing Bubble Where Shelter Has Become Unaffordable

Both of these markets have 10s of thousands of empty homes that have been purchased by investors over the past decades and it appears that declining purchaser forward interest is sending a strong signal to builders.

As the Bank of Canada (BoC) ran interest rates effectively down to zero % and held them there over a prolonged period, the Canadian real estate market developed into a massive speculative bubble and housing prices were predictably driven multiples higher.

The BoC has now snapped interest rates higher.

Bank of Canada Overnight Interest Rates; source: OECD

Scale of the Bank Of Canada’s Housing Bubble

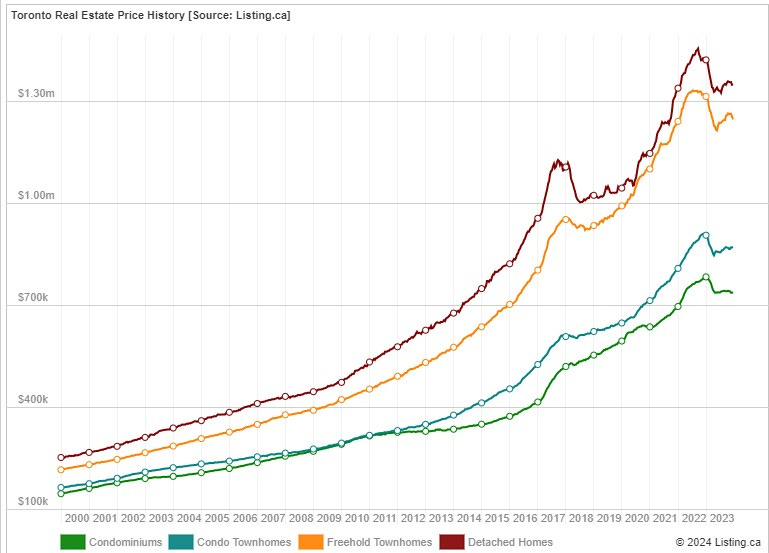

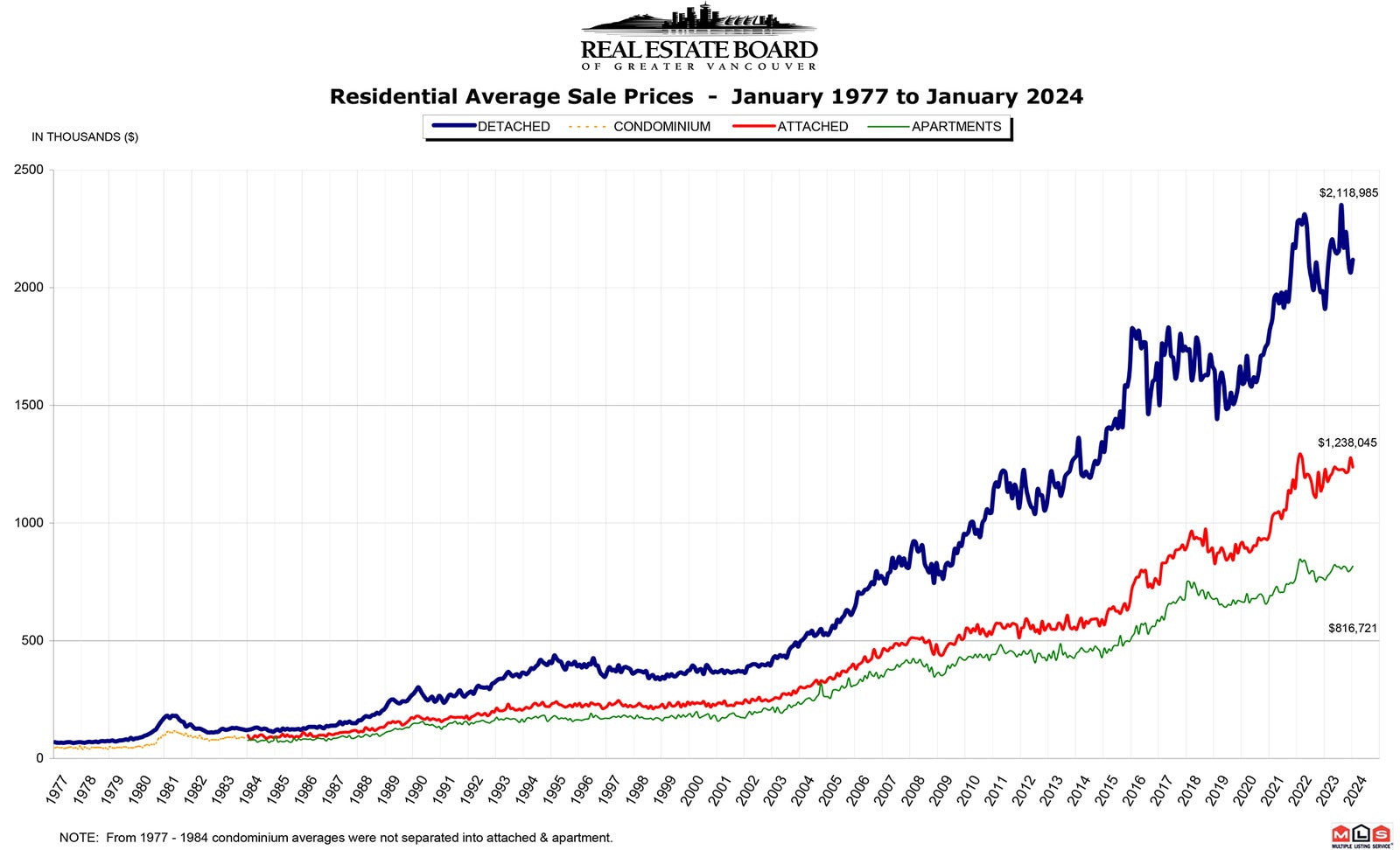

For decades, a benchmark of typical home prices in Canada was 3x household before-tax income.

The CMHC gives the following as 2022 Median Household Income Before Tax:

Toronto CAD $127,300

Vancouver CAD $117,600

Keeping these household incomes and the 3x scaling metric in mind, consider the following graphs of Toronto and Vancouver home prices:

The Bank of Canada Act specifies that the BoC acts under the oversight of Cabinet and the Minister of Finance.

The nation-wide bubble we are seeing, and its collapse, is direct policy of the central planners at the BoC and the Government of Canada, effected over decades.

As this structured bubble collapses, we can be sure that the central planners will state much more central planning authority is required and that there is a need for digital currency (CBDC), Universal Basic Income (UBI), etc. to allow more control of the economy and citizens.

Finally, keep an eye on Canadian banks that hold large portions of their assets in mortgages.

The Canadian Repo Market is starting to send signals of a liquidity squeeze amongst the banks, as one would expect as bank asset quality declines ( https://jensendavid.substack.com/p/bank-of-canada-restarts-overnight ).

Silver and gold, in direct possession, are no one else’s liability and have a 4,000 year history as money and safe haven.

Best regards,

David Jensen

Unfortunately when the correction is complete it will be investment funds and the Zillows of the world who will benefit and not the average citizen.

Great post

this is a DIRECT 'mirror' of the CURRENT USA housing market.

CurentlY, the ONLY THING KEEPING THE usa BANKS from going under is the ESF 's LIQUIDITY INJECTION/'loans' to the banks which are $ TRILLIONS 'underwater' on nonperforming CBS's. When the USA economy tanks further... then.. the MBS (retail housing mortgages) WILL FOLLOW THE CBS's AND...DEFAULT ALSO.

The last few months there have been Almost NO...ZERO... MBS's resold by the banks into the open market. Almost ALL went "NO Bid" and the financing 'fell thru". JUST TRY to get a retail mortgage...AT ANY RATE... approved. The banks aren;t lending BECAUSE they can't 'repackage" those loans into MBS's ... take a quick profit...get them off their balance sheets...and walk away.

This is 2008 Redux 2.0...ON Steroids..

The ONLY CURRENT realestate buyers are Blackrock/ Vanguard ...et al. , who get FREE taxpayer MONEY ...to 'manage; USA pension funds. They currently 'own' upwards of 30% of the realestate market.

IN EFFECT, the USA GOVT IS bankrupting the ENTIRE COUNTRY (THRU DEFICIT INFLATION[read - CRIMMINAL THEFT])...buying MBS thru Blackrock etc to hide it all.

OVER 40 % of USA 'homeowners are behind on their mortgage payments..

This IS EXACTLY what happens when the bribed gov't repealed GlassSTEAGAL Act (which OUTLAWED derivative speculation by banks/0... ANF let the Bankster CRIMMINALS 'legally' STEAL from the American People.

The Oligarcical GREEDY CRIMMINALS HAVE KILLED the golden egg goose.

SAME in Canada.