China's Central Bank Discussing Quantitative Easing This Week Puts Shanghai Silver Vault Stocks on Endangered Species List

As China's Housing Bubble Collapses

During the week ending June 21, 2024, the Shanghai Futures Exchange (SFE) vault stock of silver dropped from 699 tonnes to 685 tonnes, a 2% decline in vault holdings.

This follows a 7.4% decline in SFE vault holdings during the prior week.

While Chinese industrial users of silver are known to draw strongly on its silver stockpiles, there also appears to be strong interest from Western bullion banks in the silver vault stocks in Shanghai.

There is now a third source of potential accelerating demand for silver in China - retail investors. The primary asset of Chinese families is real estate with real estate holdings representing 78% of household wealth. Estimates ranging from 20% of all real estate in China standing empty up to China having total housing stock to house 3B persons compared to its country population of 1.4B give a sense of the scale of China’s housing bubble. Throw in China’s aging population as a further complicating factor.

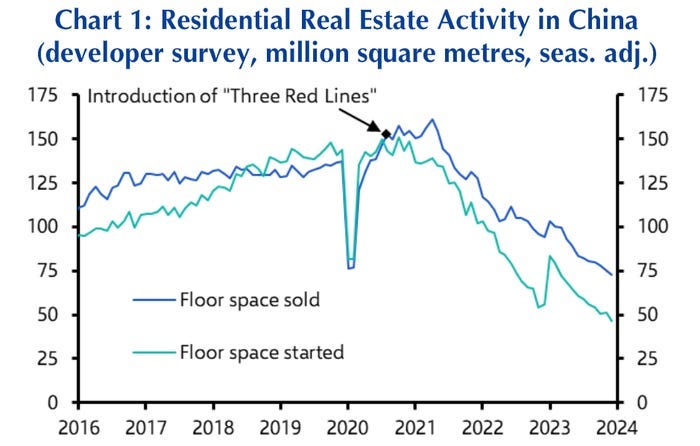

Chinese monetary central bankers have showed they are at least as adept at blowing asset bubbles with loose monetary policy as those in the West. However with government “Three Red Lines” policy looking to deflate the decades of rampant housing speculation, the shine has come off this investment sector so central to China’s citizens.

Residential real-estate activity in China. Capital Economics, CEIC

Enter the PBOC With Its ‘Juice’

On June 18, 2024, former Bank of China monetary policy committee member Yu Yongding stated that China should “shake off the taboo” of Quantitative Easing (QE) and recognize QE as a monetary tool.

The next day on June 19, PBOC Governor Pan Gongsheng stated in a speech that the PBOC was in talks with the Finance Ministry to purchase bonds but such printing of currency and purchasing of their own bonds by China should not be looked upon as QE but instead as “liquidity-management”. Okay.

You can see where this is going. China’s representatives are preparing to further foam the runway with currency to try to ease their real estate crash.

China already has intense interest in the gold, and increasingly, silver asset market. China’s citizens will quickly read between the lines and understand the meaning of this weeks official statements and this can only drive China’s demand for gold and silver safe havens higher.

The SFE’s 22M oz. liquid stockpile of vaulted silver valued at $660M may not last long.

Best regards,

David Jensen

As a serious if small scale silver stacker I’ve got a lot of questions despite listening to your recent excellent Palisades interview twice.

1) Who issues these “promissory notes” at the LBMA, the seller or the Bank of England, or both?

2) This week saw an incredible middle of the global night smackdown for the spot COMEX price. This had to be done primarily by naked shorting at the LBMA. Are the bullion banks doing this or the LBMA directly? Doesn’t this naked shorting put them even deeper in the hole? Is their motto, "when you find yourself in a hole, keep on digging?"

I certainly hope that all the exchanges run out of silver bullion. I will pop a bottle of champagne when the first one defaults, though I am just a spectator and have no intentions of selling my silver until (maybe) the ratio with gold is less than 40 to one.