On February 1, 2021 with silver at $26 /oz. and the silver vault holdings of the world’s largest Exchange Traded Fund (ETF) BlackRock’s iShares ‘SLV’ moving vertically, Goldman Sachs’ Global Head of Commodities Research at the time Jeff Currie announced on CNBC that retail investors could never cause a supply squeeze on silver.

The reason that Currie gave was that retail investors primarily bought ETF shares to invest in silver and that ETFs bought silver for their shareholder clients but then immediately sold claims against that vaulted shareholder silver to investors in the market.

Such action called rehypothecation, which is illegal, could in size indeed create an artificial supply of investment silver and attenuate upward price moves in silver.

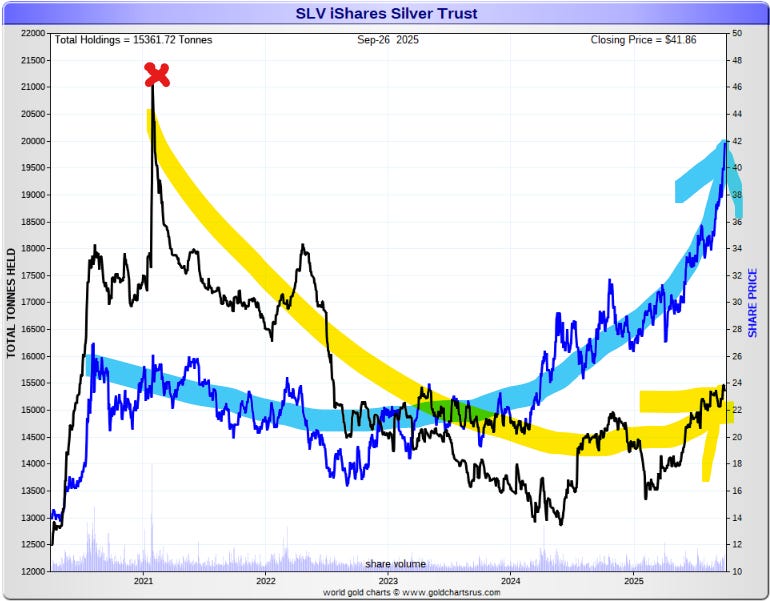

Vault holdings of SLV then plummeted ultimately dropping by 40% by early 2024 - see Figure 1 below.

On February 3, 2021, iShares’ SLV prospectus was revised to state: “The demand for silver may temporarily exceed available supply that is acceptable for delivery to the Trust, which may adversely affect an investment in the Shares… …Authorized Participants may be unable to acquire sufficient silver that is acceptable for delivery to the Trust… due to a limited then-available supply coupled with a surge in demand for the Shares.”

And yet through this time of distressed silver availability in 2020 and 2021, the London cash price of silver, set with unallocated promissory notes for immediate silver delivery, generally moved sideways and down.

Figure 1 - iShares SLV Silver Trust Holdings (Black Line) And Silver Price (Blue Line), Jeff Currie CNBC Appearance Denoted By Red ‘X’; source: GoldChartsRUs.com

Silver Supply Distress Returns

Today, with the price of silver moving parabolically higher and implied silver lease rates in London surging above 5% in London signaling a market shortage of bars, SLV silver vault holdings are barely increasing.

It may not be that retail investors are not interested in silver ETFs but that silver bars are simply not available for ETF acquisition in the tonnage required as indicated by a surging price coupled with a surging lease lease rate.

The SLV prospectus indicates that what it deems ‘Authorized Participants’ can turn in shares and receive silver bullion delivery. These authorized participants, generally banks, may be utilizing SLV as a silver slush supply to acquire silver bars for delivery against contracts sold in the London market given the tight market supply of silver that is available.

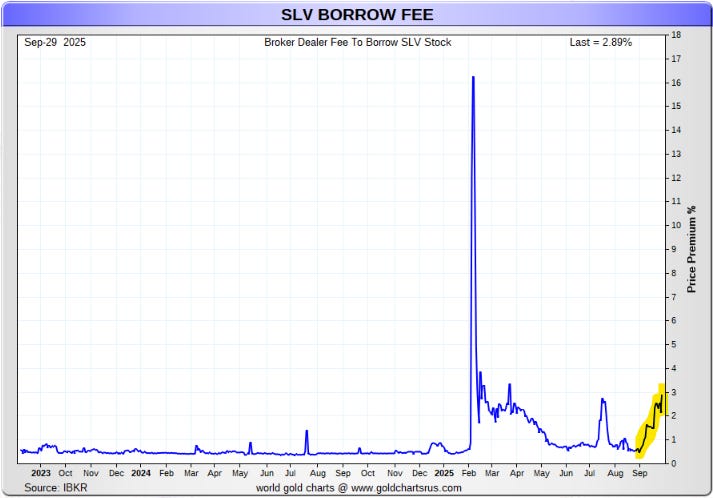

The cost to borrow SLV shares allowing Authorized Participant redemption of shares for silver to meet London market silver delivery shortage has also been increasing in September 2025 along with silver’s price and the silver lease rate.

Figure 2 - iShares SLV Silver Trust Share Borrow Fee; source: GoldChartsRUs.com

The global demand for physical gold, silver, and platinum in 2025 appears to be changing the nature of the London market by hobbling the price setting capacity of the promissory note cash/spot market trading system utilized there.

Let’s watch.

Best regards,

David Jensen

I am not selling regardless of price. This is my storage of wealth frozen at value before fiat inflated itself into oblivion. The price of the gold metric stays constant, the amount of fiat required to purchase is the moving component.

A tip for everyone: Should 'Something' happen, to the LBMA and Comex phony price discovery mechanisms.......Then the physical markets will also be rudderless for a period of time.

I would neither buy nor sell in those circumstances, regardless of prices offered????

But. By that time we might all have radioactive halos...............