Goldman Sachs Erroneously Posits that Central Banks Buying Gold is What's Driving the Gold Price Higher

So What About the Other Monetary Metals

Goldman Sachs, not generally known to pump the tires of gold investing, has recently put out a client letter identifying central bank gold buying as the central force driving the gold price higher with the potential for gold’s price to go higher still.

Goldman identifies recent US and global geopolitics as the prime driver of gold’s ascent.

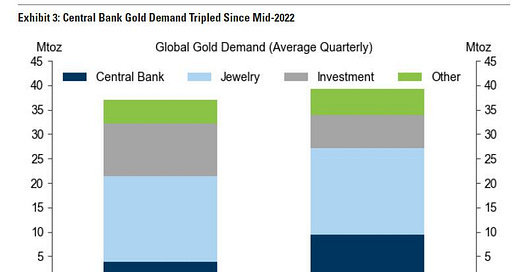

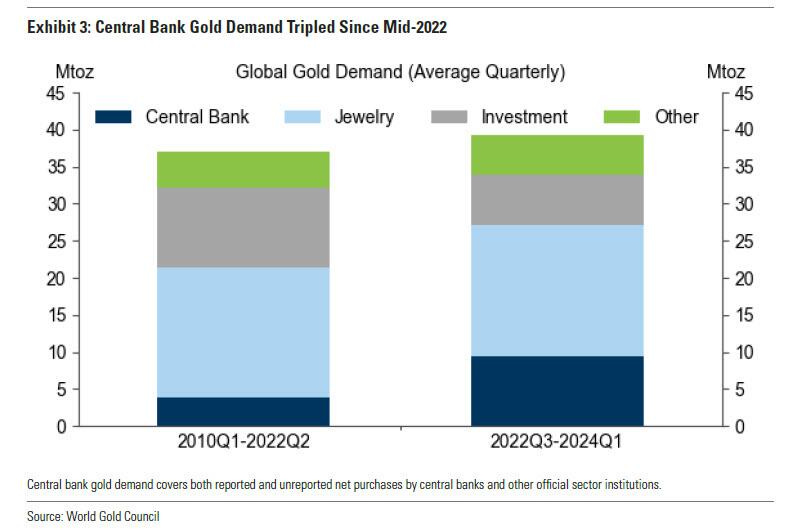

According to the World Gold Council, since mid-2022, central banks and ‘other’ buyers (see chart below) have indeed increased their share of gold purchases underpinning a 6M oz. increase of total gold purchases per year and driving global annual gold market demand to approximately 155M oz. per year.

The total global above-ground gold stock is estimated at 6.8B oz. (or 6,800M oz.).

Graph: Average Quarterly Gold Demand (where ‘Investment’ demand is primarily ETF gold demand)

In fact, the above estimate of global physical gold demand is only a rough estimate with many purchases occurring off-exchange, party-to-party (including the very large City of London Over-the-Counter (OTC) market).

Putting that issue aside, the central problem with Goldman’s theory that geopolitics/conflict are the primary drivers of the gold price increase is that, since October 2022, the price of the other two historic monetary metals - silver and copper - have risen in price nearly precisely as much as the gold price has increased. Central banks are not buying silver and copper.

While geopolitics are a contributing factor to a rising gold price, they are only one factor.

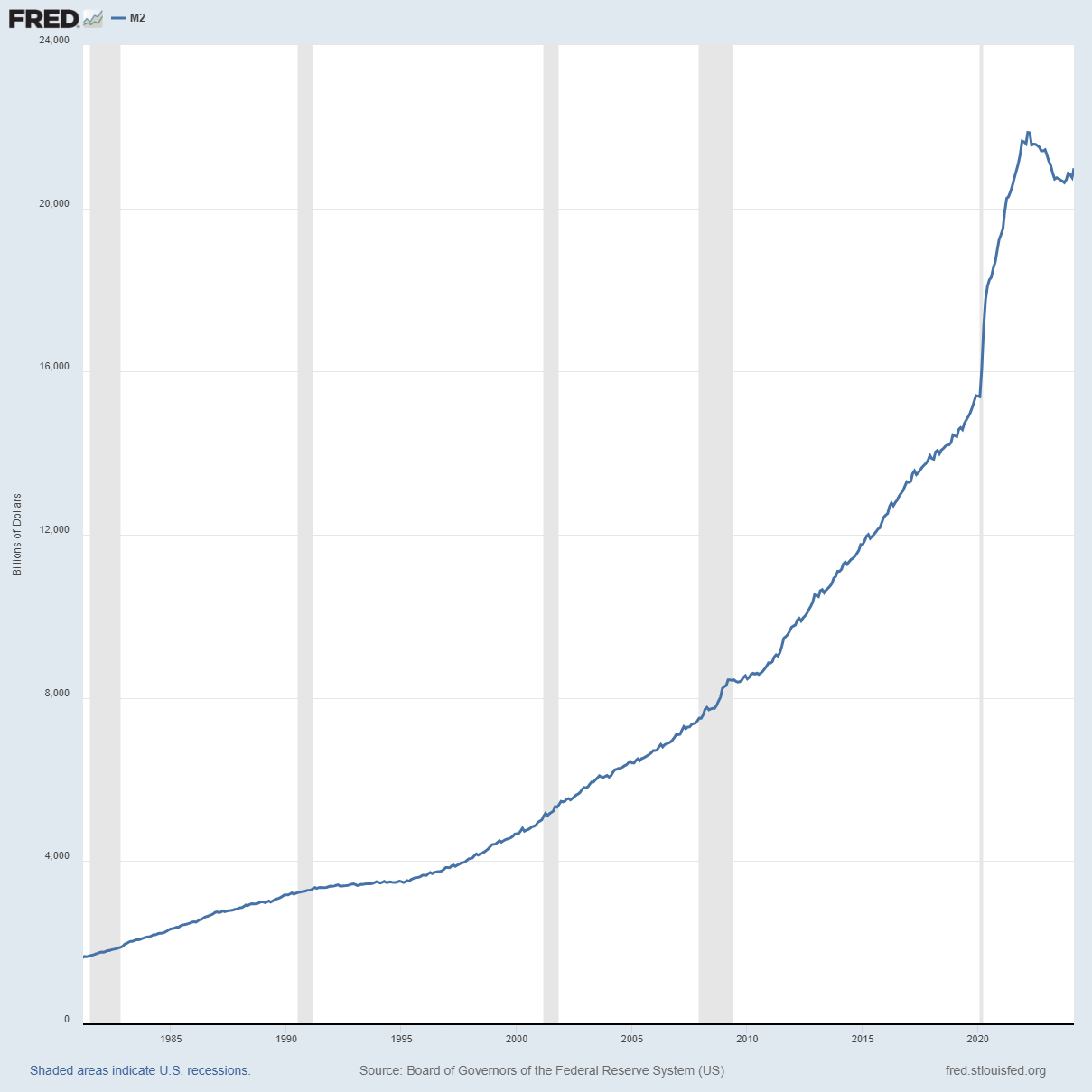

A more rational and supportable position on what is primarily and coherently driving gold but also copper, silver and other prices higher is central bank monetary debasement.

Monetary debasement drives all prices higher, with a lag, as its effects are felt and below we can see that the radical ‘regulators’ at the US Fed have materially ramped-up their creation / debasement of the US dollar starting in 2020. Other central banks also followed suit.

The Bank of England money printers were given oversight and control of the world’s most important gold and silver market in the City of London with the 1986 ‘Big Bang’ financial reforms of the Thatcher Government.

As citizens around the world gradually wake up to what the central planning regulators have done since, we can expect gold and silver, and even copper, to rise to much higher prices and then regain their roles as fair measure money, globally.

Best regards,

David Jensen