Increasing Physical Silver Demand Pushes London And New York Silver Markets To Sidelines

As Buyers Flee London

The central driver of the current global silver market run is physical demand that suddenly appeared in late 2024 / early 2025.

NY COMEX vaults saw 230 million (M) oz. added, mostly from London, and that was it for London. By October, London saw physical trading disruption due to a complete lack of market liquidity.

For London spot/cash contract owners who were even a little awake, the signal in 2025 was that they had been had and to ‘GET OUT’. In caps.

With owners of billions of oz. of London claims now starting to fan-out globally looking for actual silver, the implications are profound.

UBS’s estimate of a 300M oz. global silver supply deficit in 2026 has the potential to actually end up being many times that level.

Shortage Signals

London’s implied lease rate for silver which is an indicator of market shortage of metal is seeing an upward turn marking an intensification of market shortage - even at $75 /oz.

The 1 month implied lease rate tenor is now 8.5%.

Figure 1 - London Silver Implied Lease rate (1-Month Tenor) 2019 To Present; source: x.com/KarelMercx

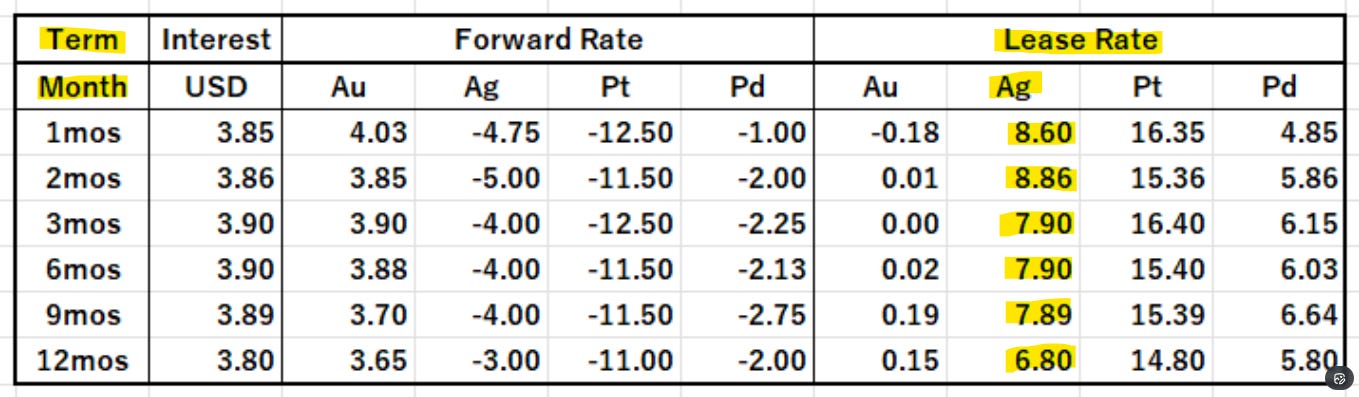

Silver implied lease rates for all tenors (terms) are high indicating broad market shortage in London:

Figure 2 - London Implied Lease Rates (Ag - Silver - highlighted) Dec. 31, 2025; source: Bruce Ikemizu of Japan Bullion Market Association

The World Gets Physical

All trading centers are becoming physical and the muted market response over the last week with the CME COMEX raising silver futures margin requirements to over 30% tells us a lot.

There was no major wash-out in price. The market does not care. Supply silver or get out of the way.

Also of note is that the margin rates were raised to over 30% on the CME COMEX even as silver’s price volatility was less than half of the peak in 2021.

That speaks of desperate (and failed) measures.

Figure 3 - CBOE Silver ETF Implied Price Volatility 2011 To Present; source: TradingView.com

The potential of an extremely rapid price reset higher for silver now appears to be a likelihood.

The byword for 2026: Get Physical.

In your direct possession.

I would like to extend my wish to all my readers for a happy and HEALTHY 2026.

God Bless.

And pass the ammunition.

Best regards,

David Jensen

Happy New Year to all ,as long as you hold onto your P Ms for dear life you will have a prosperous one that's for sure I expect crazy ups and downs in this year do not let them shake or scare you out of your position Michael Oliver talks about " a new reality " I know what he means exactly with bitter knowledge , it will not happen to me again and I hope it never happens to you ever but you must be aware of its possibility , think of a situation that you think is impossible and double it , that is a new reality and if you are not prepared mentally then you can drop like a stone in the money game of life and indeed rise to heights you never expected

Happy new year David. 2026 is the year this paper pricing system breaks.