Inflation Data Points to Higher Interest Rates Upending Bonds and Stocks, and Triggering Banking and Currency Crises

“Inflation is at all times and everywhere a monetary phenomenon.” Milton Friedman

The US Consumer Price Index in February increased to 3.2% year-over-year ticking up by 0.4% month-over-month for the second month in a row. While the current inflation rate is more than 50% higher than the Fed’s target of a 2% annual decrease in the buying power of the dollar, the news is worse than it appears.

Over the past 4 decades as central bank monetary policy have inflated financial markets and asset prices globally, sequestration of the monetary inflation into asset prices has been labelled ‘beneficial inflation’ - a deceptive moniker for sequential central bank asset bubbles.

In the past fours years, monetary central planners now suddenly see their extraordinarily loose monetary policy leaking into sustained consumer goods price inflation - and no wonder given the scale of monetary inflation during and after the COVID fright.

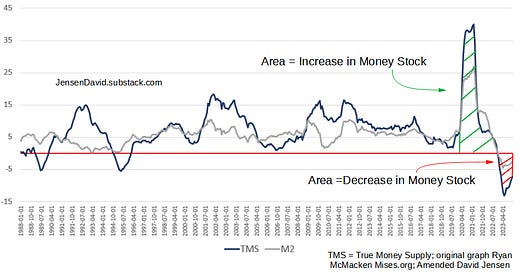

The recent decline in total system currency (the Money Stock) is not even close to the amount of prior currency increase in 2020 - 2022.

The scale of the spike in system currency by the Fed and other Western central banks has triggered price inflation consequently spiking interest rates off the 0% level up to the current 5.5%.

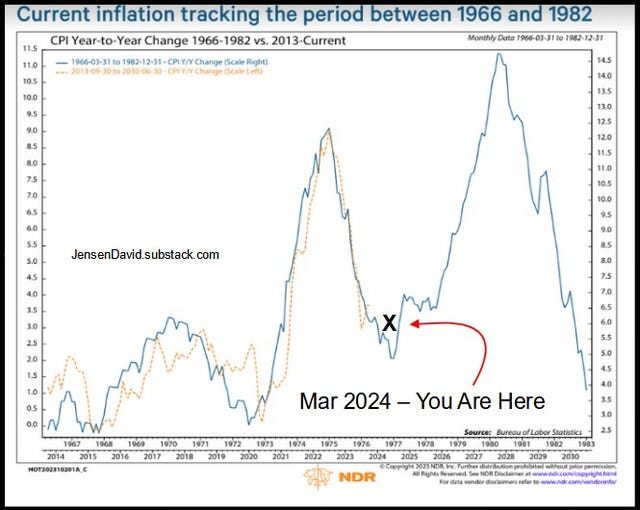

Past loose monetary policy by central bank continues to wash through the economy spurring goods prices higher as the effect of currency dilution manifests over time.

With the world’s increased dependency on leveraged cheap debt over the past 4 decades, current interest rates are already unsustainable at current levels.

Yet given the 1960s and 70s past pattern of price inflation after a similar period of loose monetary policy, we are likely to see now a further run in price inflation with even higher resultant interest rates.

What the world faces as interest rates are forced higher in response to rising prices is a precipitous decline in stocks, bonds, a banking crisis, and currency crises.

There has not been a better time to hold gold and silver than now.

Best regards,

David Jensen