LBMA Gold & Silver Trading Volume Data Seems Incorrect; Surprising London Platinum Trading Volume Data

One of the great mysteries of the City of London’s precious metals market over the decades has been to estimate the trading volume and open interest (standing claims) for immediate ownership of metal in this, the world’s largest cash market for precious metals.

The London Bullion Market Association (LBMA) first started teasing the size of the world’s largest physical gold and silver cash (or spot) market in London in 1997-1998. The idea that 10s of millions of oz. of gold and 100s of millions of oz. of silver were traded in London’s cash market each day stunned market observers globally at that time.

What was not fully comprehended was that the clearing data revealed by the LBMA for gold and silver trading was on a ‘net-settled’ basis. According to the LBMA, “clearing statistics only capture the end-of-day transactions between the clearing accounts. All transactions that take place over the course of the day between any two given counterparts are netted at the end of the day and a single transfer of the net amount is made.”

The LBMA was reporting end-of-day net trading volume between parties during that day - the much larger turnover or gross trading volume was not disclosed to the public.

In August 2011, the LBMA published its ‘2011 Loco London Liquidity Survey’ in The Alchemist Issue #63 that revealed much greater daily trading volume in London’s gold market than was anticipated.

With just 64% of LBMA full members involved in gold trading responding to the survey, survey data revealed that daily turnover or gross trading volume was 9.25x greater than the LBMA disclosed through their monthly clearing data. The LBMA had not previously publicly released the daily turnover or gross trading volume for any metal in the London market.

The survey indicated that, when including survey non-respondents, actual daily gold trading turnover was more than 10x greater than the clearing data that the LBMA had been releasing - perhaps much greater.

When the LBMA’s 2011 gold net clearing data showed that up to 26 million (M) oz. of gold were cleared in London each day this indicated that, in fact, more than 260M oz. of gold were traded daily through the London Gold Market. Almost 3x global annual gold production in 2011. The 2011 daily trading volumes for silver are in low earth orbit.

Figure 1 - 2011 Illustration of London Gold Clearing Statistics vs Total Turnover; source: LBMA Alchemist #63

The liquidity survey also showed that 90% of daily gold trading volume was in spot/cash contracts for immediate gold ownership and delivery. Ownership of physical gold and silver was shown to be trading hands at a shocking level in London.

Except. The spot/cash contracts in London for immediate ownership of gold and silver bars are created by trading parties on an ‘unallocated’ basis - no specific bars of metal are set aside for each of these promissory note contracts and these paper trading contracts can be created without limit.

As such, the LBMA might be better named the London Promissory Note Market Association (LPNMA).

Since the LBMA was created in 1987 under the oversight of the Bank of England (BoE), gold, silver, platinum and palladium traded in the London cash/spot market to set the global price have been converted into virtual, digital assets that can be created with a button push. Until sufficient metal delivery demand happens.

New London Trading Volume Data Released By The LBMA

This writer was searching over the past week for any data related to London platinum market trading volume and came across a release from the LBMA titled LBMA Releases Market Review Q4 2021 dated January 12, 2022.

At the end of this document there is a table showing the average daily volume for gold listed as 28.4M oz. and a daily volume high of 40M oz. of gold in Q4 2021.

It is assumed that these volumes represent the daily turnover or gross trading volume of gold in oz. in London.

The LBMA has released London clearing data for Q4 of 2021 showing daily net settled clearing of gold trades of 15.3M oz. giving a ratio of turnover volume to net-settled clearing volume of only only 1.9x - far less than the 10x from the 2011 London liquidity survey.

In April 2022, the LBMA renamed the release the LBMA Precious Metals Market Report of which 12 of these quarterly reports have been released to date.

Figure 2 shows the calculated ratio of average daily gold turnover in London calculated with data from the LBMA’s Net Clearing Data release and volume as stated in the quarterly LBMA Precious Metals Market Reports.

Figure 3 gives extracted gold and silver market volume data released to date by the Precious Metals Market Reports.

Figure 2 - Daily London Gold Net Clearing Volume (Monthly Average) & Ratio Of Daily Trading Volume vs Average Daily Net Clearing Volume; source: LBMA

Figure 3 - Gold and Silver Trading Data; source: LBMA Precious Metals Market Report

The LBMA Trading Volume Data Look Strange

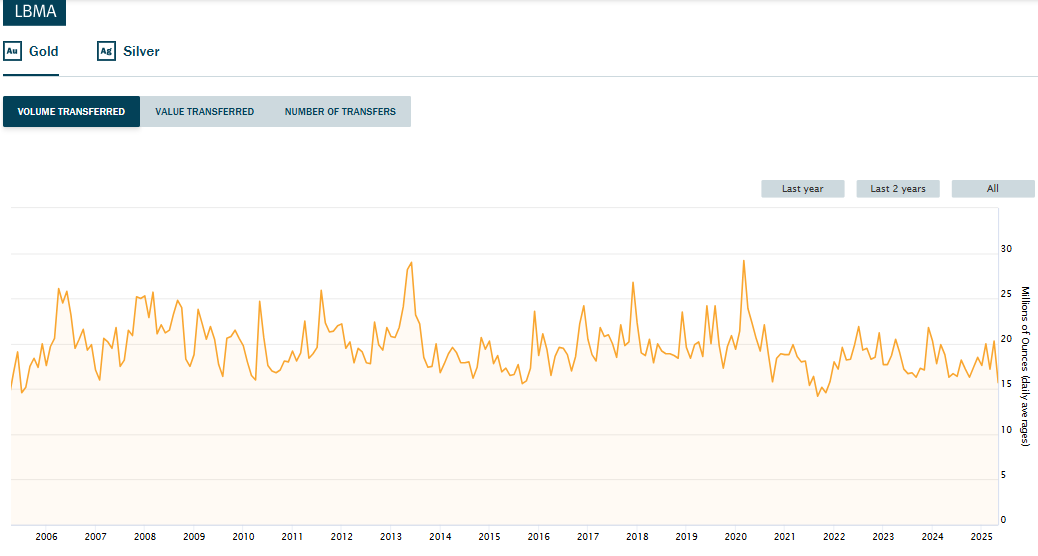

In Figure 4 below, we can see daily average net clearing data from 2005 to date for the London gold market. What is notable about this data is that since 2011, +/- the average daily clearing data has remained relatively constant during a period where gross daily trading volume/turnover has allegedly declined from 10x to less than 1.5x the daily net clearing volume and then back up to 3x the daily net clearing volume.

A central question is how could daily trading volumes decline by 85% while daily net clearing volume barely moved.

It is hard to see how that is possible.

Figure 4 - Daily London Gold Net Clearing Volume (Monthly Average) 2005 - 2025; source: LBMA

In 2019, the LBMA started releasing daily gold trading volumes on proprietary data platforms such as Bloomberg terminals followed by quarterly disclosure of average trading volumes to the public starting in 2022.

Who Has Access To The Reactor Core?

The trading of party-to-party cash contracts for immediate ownership of gold in London is of promissory notes for metal that are bought and sold in London’s over-the-counter (OTC) market.

Trading of these OTC gold, silver, platinum, and palladium private contracts in London is entirely executed on the Aurum electronic platform that is proprietary and owned by the London Precious Metals Clearing Limited (LPMCL) that is domiciled in the square mile City of London.

The LPMCL is a private company that is owned by four shareholders:

HSBC (Hong Kong Shanghai Banking Corporation Ltd.)

ICBC (Industrial and Commercial Bank of China Limited) Standard Bank

JPMorgan

Union Bank of Switzerland (UBS)

Figure 5 - An Illustration Of London Precious Metals Trades Through The Aurum Trading Platform And Its Owner Banks; source: LPMCL

There are banks that have been found guilty for ‘spoofing’ precious metals trades to rig prices in the market.

If the observer stands back far enough and considers the nature of the London market, trading promissory notes for immediate ownership of metal bars with daily trading volumes equating to more than the entire annual production of silver (see: Silver Trading Volume Exceeds 1 Billion oz. (2021) ), the entirety of the market could be considered a spoof.

A Comparative Look At London vs Shanghai Spot Gold Trading Volumes

The Shanghai Gold Exchange (SGE) trades a cash/spot gold contract named Au99.99 consisting of gold allocated for immediate delivery. Daily trading of this contract is approximately 300,000 oz. per day (May 2025).

If we take LBMA statistics at face value, total OTC gold trading turnover in the London gold market is currently ca. 50M oz. per day. Of the total daily trading volume, the LBMA indicates that 90% of the trading consists of spot contracts (~60%) and swaps/forwards (~30%). However, each gold swap/forward contract includes either buying or selling a gold cash/spot contract as an intermediate step.

The London cash/spot gold market is thus more than 160x larger than the SGE spot gold market.

That’s not trading gold.

Scale of Metal Claims Standing In The London Market

The nature of the cash/spot market in London makes it challenging to scale trading to estimate metal ownership claims that are standing there. Institutions and funds hold large amounts of London cash/spot contracts that allow demand for immediate delivery of metal and these holdings are not actively traded.

Open claims in a commodity market typically scale at 2x to 3x the daily trading volume. The nature of the London market is different in that what is held or traded there are cash contracts for immediate ownership and delivery of metal including those claims owned by non-trading investors. The scaling factor to determine total claims in London may then be materially greater than the typical 2x to 3x daily trading volume.

We had an indication of the state of the London market earlier in 2025 when sellers of gold in London could not make delivery upon demand putting them in technical default on their contracts when 30M oz. was withdrawn. This required large amounts of central bank gold to be leased into the market to temporarily mask the situation.

Surprising LBMA Data On London Platinum And Palladium Daily Trading Volumes

The trade association for platinum and palladium trading in London is the London Platinum And Palladium Market (LPPM). However, as with gold and silver, trading of contracts for platinum and palladium occurs on the same Aurum electronic platform that matches buyers and sellers of the London OTC contracts.

The LPPM is somewhat notorious with platinum and palladium market observers in that so little information on London market statistics provided to the public at large. Judge for yourself: https://www.lppm.com/data

The quest for London platinum market data, mentioned at the introduction, did not come up dry but was from an unexpected source: the LBMA.

Starting in early 2023 and sporadically reported every 3 to 9 months since, the LBMA started publishing reports titled “LBMA Daily Trade Reporting Data” that includes a 12-week moving average of the daily dollar value of gold, silver, platinum, and palladium trades in London.

Using the average quarterly prices for platinum and palladium from Johnson Matthey, daily trading volumes of platinum and palladium can be calculated and are shown in Figure 6.

Figure 6 - Average Daily Trading Turnover For Platinum And Palladium in London; data source: LBMA, Johnson Matthey

What is notable in considering Figure 6 data above is that the global platinum market is seeing a 3rd year running in 2025 of ca. 1M oz. supply deficits in an 8M oz. annual global market. Recent lease rates for platinum in London have hit 25% indicating a strong shortage of metal available to market.

And yet this market is trading approaching 3M oz. per day of physical platinum promissory notes in London.

Holders of the London OTC promissory note contracts for platinum have clearly started to ask for delivery of metal and thus the run-up in platinum lease rates as they scramble to secure metal to make delivery.

This small but vital market has no BoE backstop of physical platinum holdings to solve the problem created by the BoE itself when it along with London bullion bankers structured the London unallocated precious metals market in 1987.

Best regards,

David Jensen

David,

Since more than the ANNUAL production of gold is traded DAILY, and that trades are on the basis of IMMEDIATE ownership and delivery, what would be REALLY interesting would be if you could get a view from the BoE (as the regulator of the LBMA) as to how they expect this scam to play out if say just 10% of those who have 'bought' gold turn up requesting delivery.

On a separate issue, I have written to the the UK financial regulator the FCA (as well as to my two pension providers) asking about who actually has 'ownership' of my pension assets, along the lines of:-

1. Where securities are held in pooled form (e.g. a collective securities position, rather than segregated individual positions per person), does the investor (that is to say, myself) have rights attaching to particular securities in the pool? Or is it the case that security entitlement holder (again ‘me’) has only a pro rata share of the interests in the financial asset held by its securities intermediary, and that this is true even if investor positions (my investment positions) are ‘segregated.’

2. Is the investor (me) protected against the insolvency of an intermediary and, if so, how? Or is it the case that (i) an investor is always vulnerable to a securities intermediary that does not itself have interests in a financial asset sufficient to cover all of the securities entitlements that it has created in that financial asset, and that (ii) If the secured creditor has “control” over the financial asset it will have priority over entitlement holders (me), and that (iii) If the securities intermediary is a clearing corporation, the claims of its creditors have priority over the claims of hose such as myself as mere ‘entitlement holders’.

One pension provider has replied, and the upshot (a brief summary) is that:-

• the legal ownership of the underlying assets is with the pension company, not me

• as a policyholder, whilst I have a contractual right to the benefits of the contract, I do NOT have direct or beneficial ownership of the assets

• in insolvency, while policyholder claims take precedence over MOST other claims, but secured creditors would indeed come first -which leaves a theoretical exposure if my pension provider had secured borrowing

And while they suggest Solvency II ensures policyholder priority over most claims, “most” isn’t “all” -and their own admission confirms secured creditors stand ahead.

This all stems from David Rogers Webb's book 'The Great Taking' - as the main thrust of his writing is correct, in that whilst I might have paid for and fully funded these pension invetsment assets, someone else can have a prior claim.

What is really interesting is that the FCA have failed to respond to either my initial letter sent more than a month ago, nor the follow up letter sent recently. Both were sent secured delivery and signed for, so I have evidence that both letters were delivered.

And of course it is the same BoE who is responsible for oversight of the FCA.

So much of the UK financial system appears to be little more than a fraud, with investors savings seemingly held and prioritised to protect the Big Banks - and none of this is widely known to the investing public.

Crimes of SUPERBANK JP Morgan.

1. Market Manipulation.

Precious Metals Rigging (2012–2020) - JPM traders spoofed gold and silver markets for nearly a decade. Outcome: $920 million fine largest ever for spoofing (DOJ, CFTC, SEC). No executive went to jail.

FOREX Cartel Scandal (2015) - JPM admitted to manipulating global currency markets with other banks. Outcome: $550 million in criminal fines.

2. Fraud and Misrepresentation.

Mortgage-Backed Securities Fraud (2008 crisis) - JPM knowingly sold toxic mortgage bonds labelled as "AAA" to pension funds, cities, and nations. Outcome: $13 billion settlement (largest in U.S. banking history). No criminal charges.

"London Whale" Scandal (2012) - Traders hid over $6 billion in losses through deceptive accounting. Internal risk warnings were ignored. Outcome: $920 million fine. No one went to jail.

3. Criminal Enterprise Behavior.

RICO Charges for Precious Metals Desk (2019) - DOJ charged JPM's trading desk under the Racketeer Influenced and Corrupt Organizations Act, RICO is typically used against organized crime. DOJ called JPM's desk a “criminal enterprise inside a bank.” Outcome: Several traders convicted. The bank itself paid fines.

Madoff Money Laundering (2008.) - JPM was Bernie Madoff’s primary banker, ignored over 100 red flags. Internal memo showed suspicions but no action taken.

Outcome: Paid $2 billion in fines to victims. Again, no jail.

4. Enabling Human Suffering.

Military Contractor Financing - JPM funded and profited from defense contractors supplying global conflict zones. Massive lobbying to protect war-based revenue streams.

Fossil Fuel Expansion - JPM is the #1 global financier of fossil fuel projects since the Paris Agreement. Financed over $317 billion in oil, gas, and coal against public climate pledges.

5. Ongoing Corruption.

Epstein Banking Relationship (2023 hearings) - JPM maintained accounts for Jeffrey Epstein after internal alerts flagged him as a high-risk client. Evidence of top-level execs knowingly continuing the relationship. Ongoing lawsuits reveal concealment and enabling.