London Silver Market Is Being Squeezed

There Are No Central Bank London Physical Silver Reserves That Can Be Leased Into The London OTC Market As A Stop-Gap Measure, As Is Happening With Gold

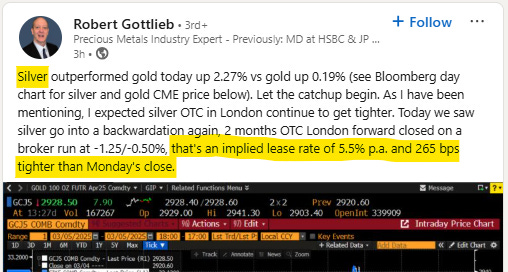

This was posted in LinkedIn a few hours ago today by Robert Gottleib.

It tells the story of an Implied Lease Rate for silver in London that surged to 5.5% today.

As we’ve seen with gold recently, the actual London Lease Rate can be materially higher, almost double, the Implied Lease Rate.

Will try to source actual London silver lease data for comparison.

Over the past 3 days, there have been between 1.0 million (M) oz. and 2.5M oz. per day of silver Exchange For Physical (EFP) contracts transacted on the New York CME COMEX exchange allowing for physical delivery of silver bars switched from the COMEX to the London silver market. Added physical delivery demand pressure.

While there are 770M oz. of silver in London vaults the lease rates indicate that very little of the London silver vault holdings are currently available to market.

Best regards,

David Jensen

Robert Gottlieb provides an incredibly rare window as to how Bullion Banks senior execs think. As such, it is invaluable. I fully agree with his comments on the silver market and am positioned accordingly. As you warned us many times David, silver is the real underbelly of the fraudulent paper pricing scheme.

Smells like something is approaching the fan? Would $50 again be the magic triple top and Is it finally getting close to “get it while you still can…”?