London Silver Market Verges On Silver Delivery Default As The Increasing Global Silver Shortage Exposes Fraudulent Market Structure

We Are Now In A Very Unstable Market Regime Where Market Structure And Criticality Theory Predict Imminent Market Lock-Up - How Much Silver Is Available?

The London silver market, structured by the Bank of England (BoE) to trade promissory notes in the cash/spot silver and gold market destroying physical metal price discovery, is now verging on physical delivery default and then collapse.

While this day has inevitably arrived after building for decades, even bullion bank analysts are now noting how precariously the global physical silver market now stands.

On January 7, 2025, TD Securities’ Senior Commodity Strategist Daniel Ghali noted in an interview that increasing physical silver repatriation to avoid potential Trump tariffs is leading to a draw on London silver vault stock and the potential for what he terms “stock-out” (market failure) in London.

On January 7, 2025, this Substack reported on the sudden 3.3% drop in the price of Blackrock’s stock price that day with no obvious market catalyst and it may be that the Ghali interview, and its implications for Blackrock that manages $11.5 trillion in assets, was a key driver.

The interview can be seen here:

Ghali estimates that “There might be a billion ounces sitting in the London vaults, but only 300 million of that is actually freely available for purchase, according to our estimates.”

In fact, much less silver than that appears to be available to market from London vaults.

London’s Available Silver Vault Stock

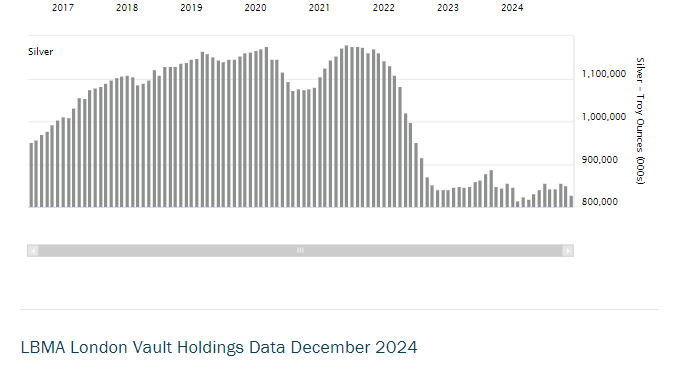

The latest London vault stock data from the London Bullion Market Association (LBMA) states that as December 2024, London vaults held 828 million (M) oz. of silver as can be seen in Figure 1.

Figure 1 - London Silver Vault Stock - December 2024; source: LBMA

Ghali states that the LBMA are “custodians” of this silver. The LBMA are not custodians as that silver is privately held in private vaults in London.

Silver bars held in London vaults by Exchange Traded Funds (ETFs) amounts to 533M oz. leaving a remainder of 295M oz. However, only a portion of the 295M oz. remainder appears to be available to market.

Figure 2 - London Vault Silver Holdings (Silver Bar Stock) November 2024; source: GoldChartsRUs. com & LBMA

Figure 2 above shows that the London vaults flat-lined in their holdings from Q3 2022 to present while global the global physical silver supply deficit ran at approximately 497M oz. over this period.

That the London silver vault stocks have been relatively inelastic during this period of global silver shortage indicates that further silver deliveries “in size” from London vaults are predicated upon silver being first imported before delivery can be made to market in London.

There may currently be as little as 10M oz. to 50M oz. of silver available for delivery to market from London’s silver vaults with the remainder privately and closely held.

The CME COMEX silver market in New York currently holds 74M oz. of Registered Silver bar stock (i.e. available to market).

The year 2025 appears likely to see a further 250M oz. to 500M oz. silver supply deficit that will need to be met with a further draw-down of global vaulted silver stocks.

As an historic monetary and industrial metal with unique qualities, silver is an essential metal and increasingly so for wealth preservation given the current central bank, currency, commercial bank, and financial system instability - physical silver in possession is an asset that is no-one else’s liability.

Silver Market Resolution

Given this backdrop and with an estimated 4 billion (B) oz. and 6B oz. of physical silver contracts sold short into the London cash market where contract holders can stand for immediate delivery, the global silver market is heading for an ‘event’ as contract holders increasingly ask for their metal to meet market need.

Silver market delivery fails and default on metal exchanges with near zero current investment enthusiasm from the Western retail investment market will serve up a global price shock. With the gold-to-silver price ratio standing near 90x and given the current setup, a return to an historic price ratio closer to 15x appears likely to overshoot drastically below that ratio - nobody knows exactly.

Many stories will be told by the financial press as to why the Great Silver Price Reset occurred (Orange Man!) but in reality the proximal causes are not important.

The ultimate cause of the coming silver market seizure, then market failure, that is being revealed is the establishment of a fraudulent price-setting mechanism for gold and silver in London by the BoE with apparent coordination by the Bank For International Settlement (BIS) - our central planning ‘regulators’.

Given the additional and potentially massive estimated liability that Blackrock and other bullion bank players may face in the London market (multiply 4B oz. to 6B oz. of silver contracts by your estimated price move), the sudden revelation of the true availability of silver and the impact of the knock-on price excursion to the balance sheet of financial institutions will distress many of those institutions. Give that some thought.

In the end, frauds always collapse so what is happening is no surprise.

Best regards,

David Jensen

I remember this anecdote when some guy from SLV did a TV interview to prove that they really really have the silver, and during the interview he held a silver bar into the camera.

His mistake: the serial number of the bar was visible.

The next day they got a call i think from UBS saying, "We're sorry, but that's our silver bar !"

Most interesting development. It seems to have caused a medical problem with me... I am having trouble stopping a slow, growing smile that most people find inexplicable. Perhaps there are those on this board that may understand. :)