Market Data Indicate Approaching London Silver Price-Fixing Implosion As Silver Vacuum Intensifies

Last weeks release of the end-of-February 2025 London silver vault stockpile data were interesting but especially so when considered along with other London silver market data.

The London Bullion Market Association (LBMA) vault data showed 128.5M oz. of silver bar withdrawals from London vaults between early December 2024 and the end of February 2025.

Figure 1 - London Silver and Gold Vault Holdings to February 28, 2025; source - LBMA.

This 128.5M oz. withdrawal represents a 15.1% draw on London silver vault stocks of at 850.6M oz. as they stood at December 1, 2024.

No Silver Market Mania As London Silver Withdrawals Rapidly Increased

The draw on the London silver vaults occurred at a time of very little silver interest by general markets or by retail investors.

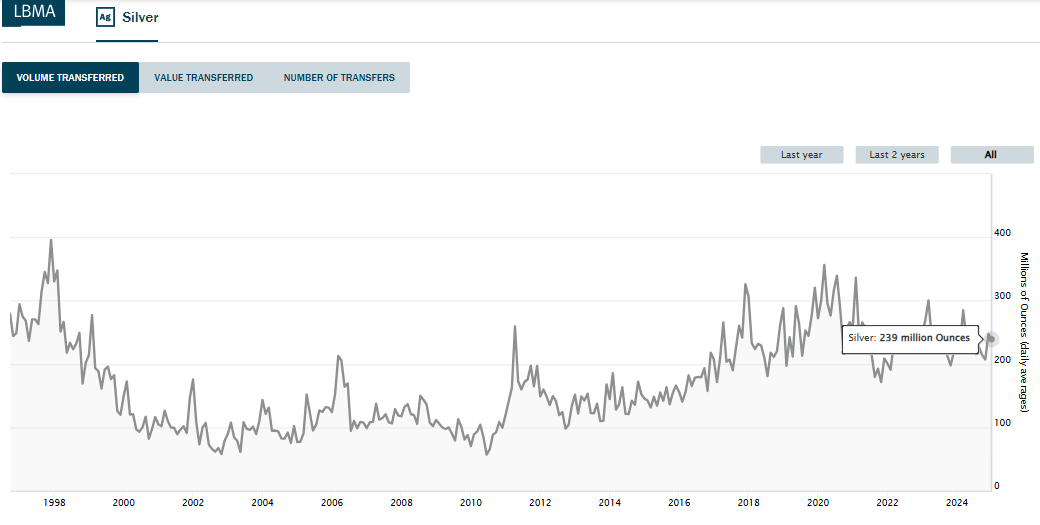

Average London daily net-settled silver trading volume in January 2025 (the latest LBMA silver trading volume data available) at 239M oz./day was down slightly from December 2024

Figure 2 - London Silver Market Average Daily Trading Volume (millions of Troy oz.) to January 2025; source: LBMA.

Keep in mind that the Loco London Liquidity Survey of 2011, published in the LBMA’s trade magazine Alchemist #63, showed that total daily gold trading turnover was a minimum 10x the published daily net-settled trading volume.

This scaling factor was based on 64% of London gold market trading participants responding to the 2011 survey and the actual scaling factor could thus be materially higher than the 10x estimated scaling factor for determining daily gold market gross turnover.

Utilizing this 10x scaling factor to estimate daily silver trading turnover volume, the 239M oz. silver net-settled trading volume scales to 2.4B oz. of silver daily gross turnover volume in January 2025.

The London spot/cash market is roughly 90% of total market turnover and, putting aside the sheer scale of daily trading 2.2B oz. of spot/cash contracts for immediate London silver delivery compared to global annual mine production of 820M oz. of silver, the January London trading volume showed no evidence of trading mania or influx of new interest in London silver compared to other months

Given that there was very little change in London cash/spot market trading volumes, the 3-month withdrawal of 128.5M oz. of silver from London vaults was potentially simply a withdrawal of silver largely by physical silver depositors holding their silver in London vaults rather than new spot/cash market participants buying cash/spot promissory notes to secure London silver delivery.

Given further the increasingly bizarre recent actions and statements of UK Prime Minister Keir Stalin, it should be no surprise that gold and silver bars would start to vacate UK vault repositories.

An Increasingly Intense London Silver Vacuum

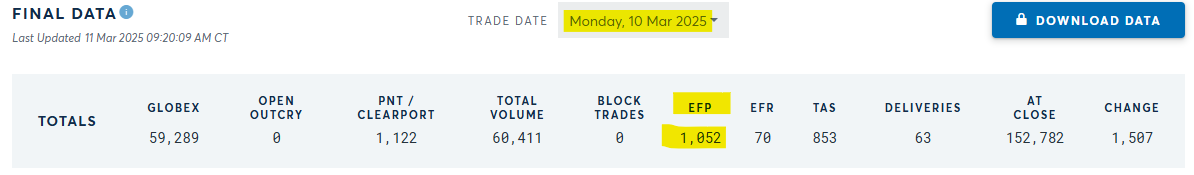

Looking at recent New York CME-COMEX silver futures market data, no relief is coming for the London silver market.

Market participants who wish to convert COMEX silver futures contracts into immediate physical delivery contracts have the option of using Exchange For Physical (EFP) contracts that convert COMEX futures into London spot/cash contracts for immediate bar delivery.

Figure 3 - Daily Exchange For Physical (EFP) 5,000 oz. Silver COMEX Contracts Traded; source: CME COMEX

This data shows a running draw from New York’s COMEX on London silver stocks of 3M to 5M oz. per day and, if it continues at this rate EFP physical withdrawals combined with other withdrawals from London silver vaults are at some point going to wreck the London cash/spot promissory note silver market racket run by the Bank of England.

London’s Silver Float And Free-Float Data Telegraph Compounding London Silver Shortage

While 6,164 tonnes of silver (198M oz.) are held in London silver vaults outside of Exchange Traded Funds (ETF) holdings, not all of this silver ‘Float’ is available to markets (see Figure 4 below).

As mentioned above, some of the 198M oz. silver Float is simply held in London vaults and is not available to market.

The amount of silver Float actually available to market in London can be designated the Free Float however it can only be estimated in this opaque market.

Last week’s spike of London’s silver Implied Lease Rate to 5.5% indicated very tight market conditions with a small Free Float of silver available to market in London. Keeping in mind that in the gold market we’ve recently seen an actual Market Lease Rate for gold being 2x the the calculated Implied Lease Rate, the 5.5% Implied Lease Rate spoke of very tight market conditions.

Today, market analyst Robert Gottlieb reported that the Implied Lease Rate for London silver now stood at 9%.

Keeping in mind that silver flows both in and out of London vaults, London silver may be commanding a Market Lease Rate potentially approaching 20%.

The remaining Free Float of silver in London may only be of the order of a few million or 10’s of millions of oz. of silver and, given the 3 to 5 million oz. of silver EFP contracts purchased for London silver delivery each day on the COMEX alone, the London promissory note silver (and then gold) cash/spot markets could be heading for a rapid extinction.

Figure 4 - London Silver Vault Holdings At February 28, 2025; source: GoldChartsRUs

Markets seldom resolve themselves in a day, however there is a breaking point when the fetid wall of London detritus is going to wash throughout the City of London terminating the promissory note market that has been used by the Bank of England and select bullion banks for decades to price-fix silver and gold to the detriment of humanity.

Let’s keep watching the data.

Best regards,

David Jensen

Keir Stalin 🤣

Impetus:

https://www.youtube.com/watch?v=nHd_1QEC5r4