Moving Toward Failure - London Gold And Silver Data Point Toward The End of London's Metal Price Setting Rig

The price-setting system of selling promissory notes, that do not require specific vaulted bars allocated to buyers, in the world’s largest gold and silver cash/spot immediate ownership market in London can only continue as long as the holders of those promissory notes are content with paper and do not ask for bar delivery.

The currency printers at the UK’s central bank, the Bank of England, have run this price setting scheme since 1987 and current data and indicators are showing market supply stress in both the gold and silver markets.

As the demand for metal delivery grows, the immense leverage of claims for metal vs actual vaulted available metal translates to the London market moving toward a sudden failure of its price setting / price control scheme through default by the issuers of these promissory gold and silver cash/spot claims.

Overview of London Gold Market Stress

With global physical gold demand in Q2 2024 reported at an all-time high and Q2 2024 Over-The-Counter (OTC) physical gold bar delivery demand in London running now at a multi-decade high of 329 tonnes, let’s look at the status of the London leveraged gold market.

The LBMA gives daily net-settled gold clearing volume of 17 million (M) oz. per day in London.

The LBMA also states in their 2011 Loco London Liquidity Survey that daily trading turnover or volume is estimated at 10x the daily net-settled clearing volume giving the latest daily gold trading volume of 170M oz. per day.

Assuming 90% of daily trading in London is in the cash/spot market, total open interest claims of 2x daily trading volume translates to claims for 306M oz. or 9,517 tonnes of cash/spot gold in London.

Assuming total open interest claims of 3x daily trading volume translates to claims for 459M oz. or 14,276 tonnes of spot market gold in London.

Current vault holdings in London not claimed by the BoE or ETFs is 1,304 tonnes (see Figure 1 below).

Note that this 1,304 tonne amount or ‘float’ includes all gold held in London vaults not claimed by the BoE or ETFs and that much of this 1,304 tonne float is tightly held and not available to market.

Compare the 1,304 tonnes of gold float to the 329 tonnes withdrawn from the London OTC market in Q2 2024.

Figure 1; LBMA London Vault Gold Holdings

The draw rate of gold in the London OTC market vs the gold float indicates that some gold must be provided from other sources to allow delivery.

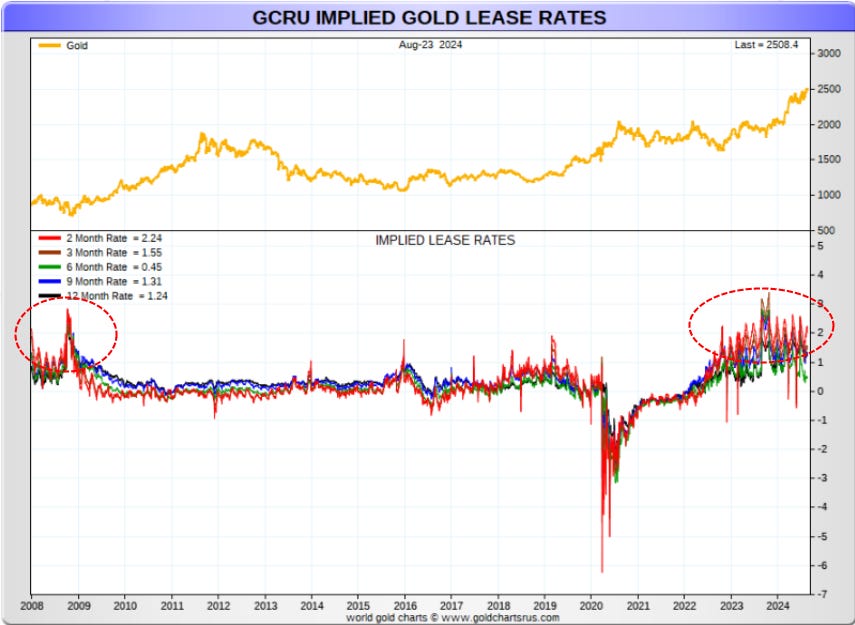

A further indicator that the increasing draw of bars from the London OTC market since 2022 is inducing market stress is that short-term lease rates, that reflect the ability of bullion banks (that have sold cash/spot claims) to borrow gold to make delivery when demanded, has also been elevated since 2022 to levels seen during the 2008 Financial Crisis.

Figure 2; Gold Market Implied Lease Rates

Assuming the low estimate of 9,517 tonnes of gold claims in the London cash/spot market and the fact that we can see the OTC physical gold draw intensifying since 2022, at some point we will see available gold limited and default by parties that have sold paper gold into the London market.

The global gold market will then flip to supply-demand price discovery, unsatiated by paper metal offerings, and much higher prices.

Overview of London Silver Market Stress

The global silver market in 2024 is seeing an annual silver supply deficit for the sixth consecutive year.

The LBMA gives daily net-settled silver clearing volume of 236 million (M) oz. per day in London.

Using the 2011 Loco London Liquidity Survey multiplier of total turnover or trading volume of 10x the daily net-settled clearing volume giving the latest daily silver trading volume of 2.36 Billion (B) oz. per day in London.

Assuming 90% of daily silver trading is in the cash/spot market and assuming total open interest claims of 2x daily trading volume translates to claims for 4.248B oz. or 132,130 tonnes of spot market silver in London.

Assuming total open interest claims of 3x daily trading volume translates to claims for 6.372B oz. or 198,195 tonnes of spot market silver in London.

Current vault silver holdings in London not claimed by ETFs is 10,440 tonnes (see Figure 3 below) - not much in comparison to the above estimated market claims in the London silver cash/spot market.

Figure 3; London Vault Silver Holdings

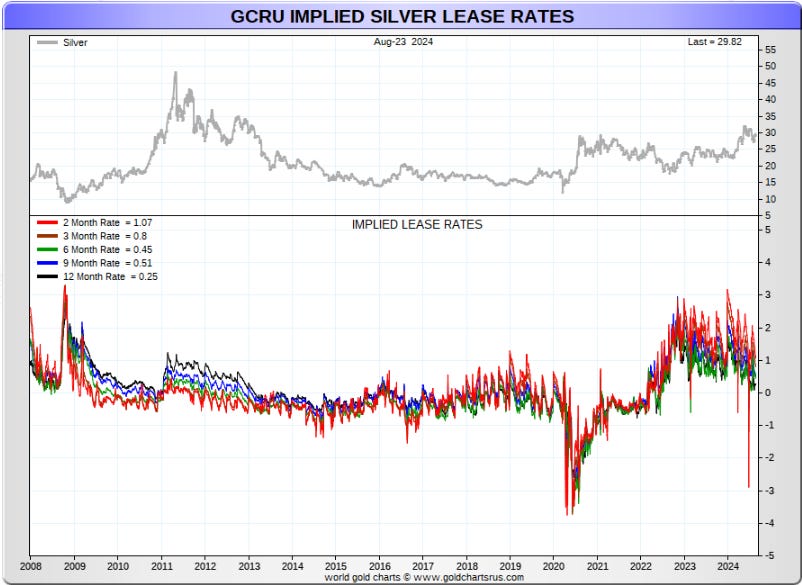

Similar to gold, we can see elevated short-term silver lease rates in the silver market indicating elevated silver supply stress.

Figure 4; Silver Market Implied Lease Rates

In summary, because of the leveraged paper market claims for both gold and silver in the London market and the growing global shortage of gold and silver, both of these metals are trending toward default on the London spot/cash market.

Default in one metal will likely trip to physical supply-demand pricing in both metals - a rapid re-pricing to much higher levels as the decades of faux paper metal supply is resolved.

Best regards,

David Jensen

Phenomenal break down of the situation in London right now. Thank you for sharing

Excellent article. First time I’ve seen how lease rates can be used as evidence of the fraud.

Some gold quotes in case you’re interested:

https://open.substack.com/pub/inverttheinversion/p/ch-113-gold?r=b2h87&utm_medium=ios