In 2022 the Federal Reserve began one of its most aggressive increases in interest rates after, just prior, having increased its debt-currency supply by the most rapid rate in history. This column warned that the result would be economic dislocation here and here.

With current US system debt at $95 trillion (T), Fed rate hikes to date will increase annual debt interest payments by $5T per annum for US households and corporations as debt is refinanced at higher rates. The consequences of such a sudden added burden are predictable.

As increased debt financing costs roll through the US economy, the most financially vulnerable individuals and corporations would be expected to first show the impact of these rising costs.

Financial Stress on US Households

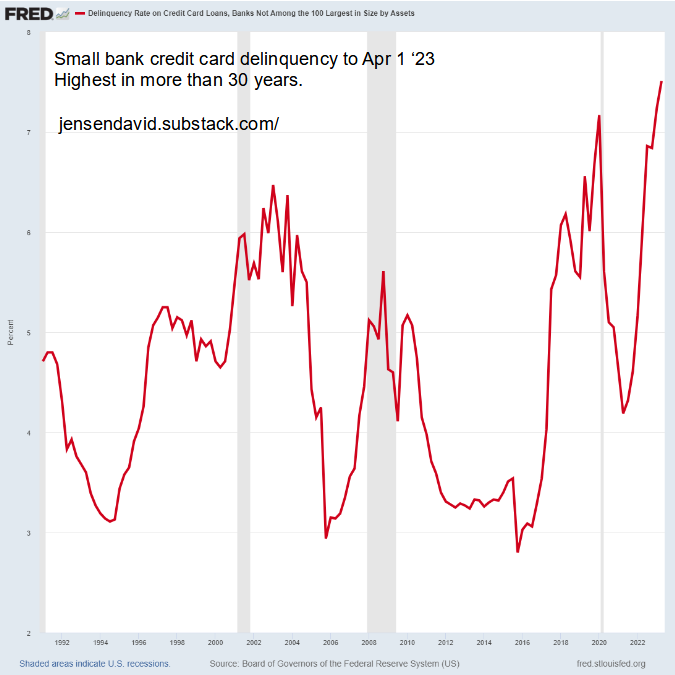

Through April 1, 2023 small banks show the highest credit card delinquency rates since these statistics were first published. Small banks cards represent credit to lower income, Middle American consumers not typically located in the financial centers that benefit from the Fed’s easy money speculative boom - and they are in trouble.

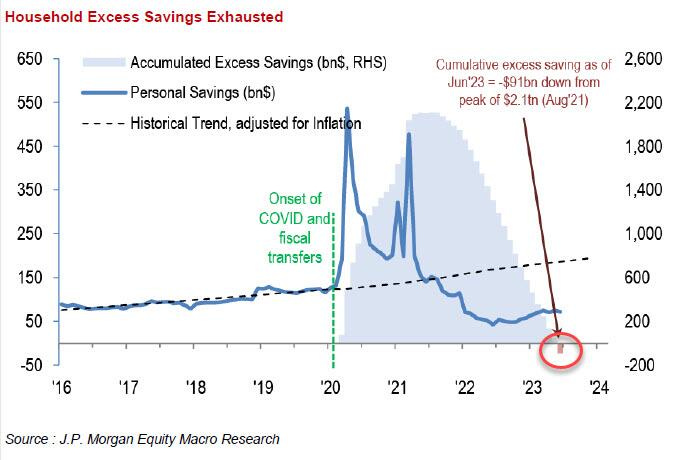

In addition, as the Fed’s inflationary pulse has hit goods prices, Household savings are now much lower than they were before the COVID fright and all excess savings from the COVID ‘stimmy’ programs are now depleted.

It is no surprise then that in a recent GOBankingRates.com survey, 32.9% of respondents had less than $100 in their bank account up from 22% in August 2022.

Compounding the stress on Middle America, not only were all months’ jobs data for 2023 revised lower but 1.2 million native-born Americans lost their jobs in August 2023.

Corporate Financial Decay Also Signals

Financial pressure from the Fed’s rate spike also shows in the Corporate space.

The 12 month rolling average default rate for high yield (speculative grade) corporations through July 2023 stands at 3.2% and is expected to reach up to a 5% twelve month rolling average level by year end.

Already, corporate bankruptcies through July 2023 were higher than in all of 2022.

Given spiraling interest rates, bankruptcies, and job losses, at Jackson Hole in August Fed Chairman Jerome Powell calmed no one when he stated “As is often the case, we are navigating by the stars under cloudy skies.”

(link: https://www.youtube.com/watch?v=u1dV2kHbCAQ&t=811s ).

The Fed has engaged for decades in a policy of repeated and vast credit expansion cycles giving a speculative and credit-driven basis to the economy in lieu of steady growth driven by increased productivity and savings.

These words by economist Ludwig von Mises now resonate:

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

and

“What is needed for a sound expansion of production is additional capital goods, not money or fiduciary media. The credit boom is built on the sands of banknotes and deposits. It must collapse.”

Given that the failure of the credit-distorted economy is rapid and disruptive, it would be unsurprising to see central planners engage in widespread lock-downs in order to implement an even greater centrally-planned system of digital I.D.s and Central Bank Digital Currency, whatever the pretext.

Best regards,

David Jensen

Post Script:

An avalanche takes some time to arrive but then it does:

I agree with David's view, but wonder if "they" can do the same trick successfully again. What we would need is a way bigger resistance this time. In Germany (acc ourworldindata) 78.2% got at least one shot - so 21.8% did resist. The mainstream hated AfD is the rising conservative (anti vaxx) party and is now at 21%. https://dawum.de/Bundestag/

I will become hopeful, when the AfD goes over 21.8% as we need the vaxxed to jump ship!

No, I do not believe in wonders, Germany is toast, but this is where I look for a trend change in the population. Best wishes to all of you!