Physical Gold Is Being Swept From the London OTC Market At A Record Rate

Paper Leverage Is Cutting Physical Shorts In the World's Largest Gold Market

Physical gold is being drawn from the London gold market at record rates.

In Q2 of 2024, an estimated 329.2 tonnes (10.6M oz.) of physical gold was drawn from the London OTC market.

Figure 1 - Q2 London OTC Market Gold Withdrawals 2000 through 2024; source: gold.org

The LBMA states that current daily trading volume (net settled) cleared in London is 17M oz.

The LBMA estimated in 2011 through its Loco London Liquidity Survey that daily volume was 10x the daily net-settled clearing volume.

This translates to total daily volume of 170M oz. of which an estimated 90% (153M oz.) is spot trading of physical gold as promissory immediate ownership contracts.

An Estimate of Gold Leverage In The London Gold Market

Estimating total open interest (claims) in the market as 2x daily trading volume, translates to 340M oz. (10,575 tonnes) of total gold claims in the London spot market.

Estimating total open interest (claims) in the market as 3x daily trading volume, translates to 510M oz. (15,863 tonnes) of total gold claims in the London spot market.

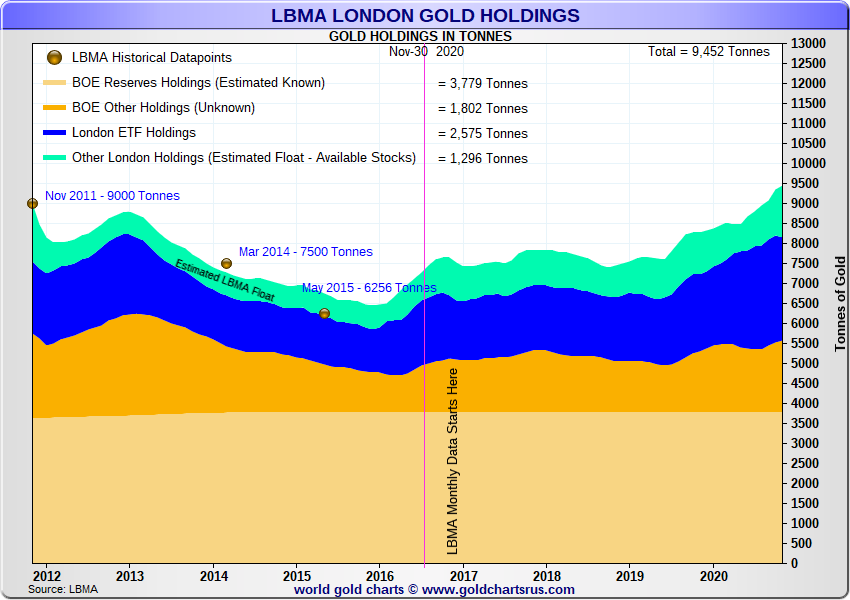

In 2020, it was estimated that 1,296 tonnes of gold in London vaults were not owned by ETFs and other central banks - defined as the LBMA gold ‘float’ in the chart below.

Figure 2 - London Gold Vault Holdings; source: https://www.bullionstar.com/blogs/ronan-manly/behind-the-headlines-of-record-gold-stocks-in-london-vaults/ / goldchartsrus.com

The Q2 2024 OTC gold draw of 329 tonnes cannot be maintained for long if this gold, or a large portion of it, is to come from London vaults.

Best regards,

David Jensen

This actually concerns me. What happened in the nickel market and the latest copper squeeze? I’d like to think “this time it’s different” But I don’t like betting against the Bank of international settlements and their underlings

Thanks for another great article David