Physical Shortage Stress Hits Global Silver Market As 2025 New Year Begins

That Nagging Silver Shortage Comes Back

In this new year, the preparations and actions you take early can tremendously benefit you in the years ahead. Do not tarry.

Happy New Year.

The year 2025 starts and we note that the silver market ended 2024 showing building stress globally in the physical market.

The physical silver market stress can be seen with several indicators.

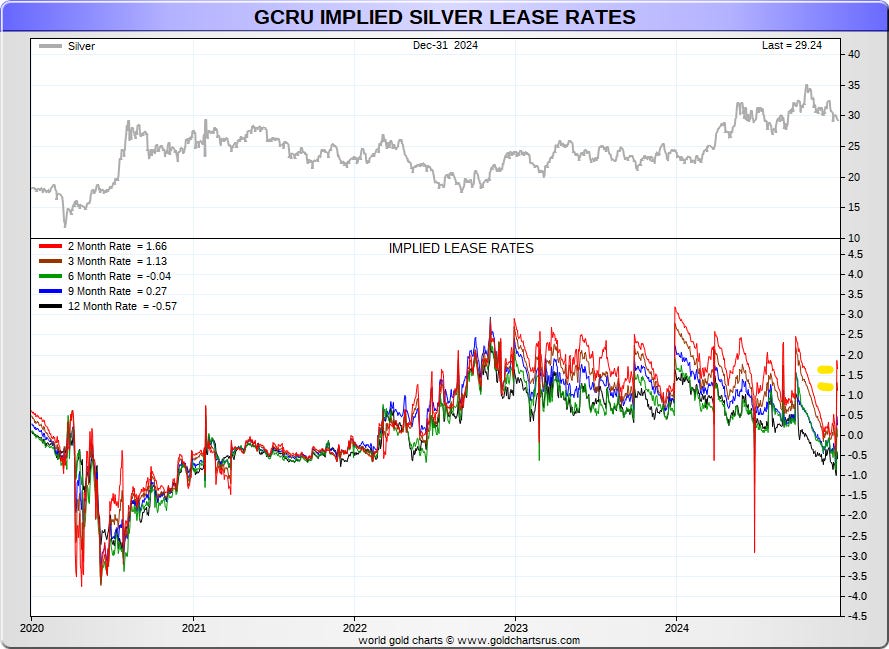

After strangely running down over the last months of 2024 and into the teeth 2024’s record net deficit of physical silver, silver’s 2-month and 3-month lease tenors suddenly shot higher, signaling metal shortage, as can be seen in Figure 1 and Figure 2 below.

Figure 1 - Silver Implied Lease Rate - 5 Year Chart; source: GoldChartsRUs.com

Figure 2 - Silver Implied Lease Rate - 17 Year Chart; source: GoldChartsRUs.com

Contributing to the stress signaled in the silver lease rates spike is the sudden jump in the CME COMEX deliveries of silver in December to 45.8 million (M) oz. which would consist of both local New York delivery as well as Exchange for Physical (EFP) delivery where a NY COMEX contract is transferred for deliver in London.

Figure 3 - CME COMEX Monthly Silver Deliveries - 19 Year Chart; source: GoldChartsRUs.com

The increasing premium price for physical silver in both Shanghai and in India also signaled physical market shortage there - it was not just in Western markets.

Figure 4 - Silver Premium On The Shanghai Gold Exchange - 19 Year Chart; source: GoldChartsRUs.com

Figure 5 - Silver Premium In India Gold Exchange - 13 Year Chart; source: GoldChartsRUs.com

Finally, we can see that bullion banks (Swap Dealers - blue line in Figure 6 below) covered half of their short positions in the CME COMEX market contributing to the 45.8M oz. of silver delivered into the CME COMEX market.

Bullion Banks remain net short 106M oz. of silver in the CME COMEX market at December 23, 2024.

Figure 6 - CME COMEX Silver Price and Trading Positions at December 23, 2024 - Swap Dealers (i.e. Bullion Banks, blue line) are net short 106M oz. silver; Source: tradingster.com

Dwarfing all of this is the London physical silver market where the LBMA reports October 2024’s average daily silver trading of 214.6M oz. on a net settled basis in London’s promissory note silver market. (Here’s some paper for which you can immediately get silver metal, we promise.)

According to the London Bullion Market Association’s (LBMA) 2011 Loco London Liquidity Survey for gold, this daily net settled turnover translates to a total gross daily turnover in the London silver market of 2.146B oz. or 10x the net settled amount.

Of the 2.146B oz. of silver contracts traded daily, the LBMA estimates that 90% of this volume, or 1.93B oz., is traded daily in immediate ownership cash/spot contracts.

Using even a low 2x daily turnover multiplier, this implies total standing claims for silver in the London cash/spot market of 3.86B oz.

Compare this 3.86B oz. of London cash/spot silver claims in October 2024 to the total London vault silver holdings of 851M oz. which have shown to be illiquid as they have barely moved during 2024’s record global net deficit of physical silver estimated to be 265M oz. by The Silver Institute.

Bullion banks have started to cover their CME COMEX silver short positions that, in turn, are a small fraction of the London physical silver short positions and as the global physical silver market signals growing stress in physical silver availability.

2025 starts off in a very interesting fashion in the global silver market. Are you ready?

Best regards,

David Jensen

Great article David .. thank you .It’s going to blow , we don’t know when , but now is the time to get busy .. that’s my take . Happy New Year 🤙🏻

David, A happy new year to you. It seems that they are going to kick off almost straight into a storm of demand with only "thin air paper" to offer backed by other people's actual physical, which was already sold many times over in 2024. Are traders bothered that the metals they are buying this year, are probably the same metals they bought last year and in fact still hold having never sold those contracts. I mean, we all know that the whole thing,(the LBMA) is a mess and a bit of a farce but really, would traders buy the same metals twice in order to keep up the chirade? Obviously chaos would ensue if they had to halt trading like what happened in the nickel market so I've probably just answered my own question and they would just continue to buy contracts for the same metal they already hold. If this is the case then 2025 is going to be quite a year and you're going to be very busy along with writing some entertaining stuff for us to read. I can hardly wait.