The platinum and palladium markets appear to be the tightest of the 4 precious metals markets (gold, silver, platinum, and palladium) in London and New York.

The London Platinum and Palladium Market (LPPM) (the world’s largest platinum and palladium market) is opaque providing no vault data or trading volume data for these strategic and essential metals however we can get a glimpse of how tight this market is through the New York futures market.

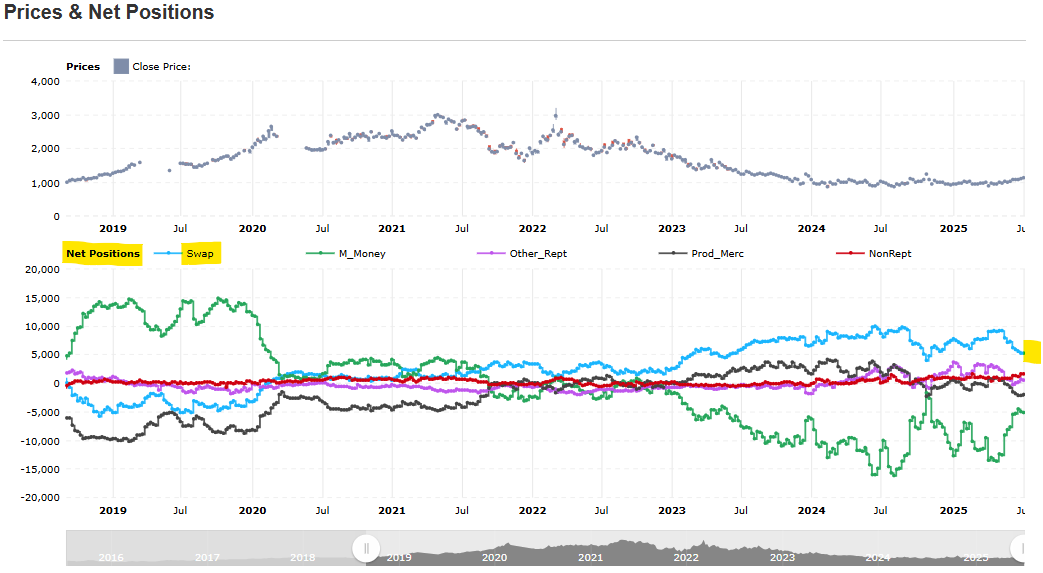

Palladium

CME COMEX exchange vaults in New York hold 31,000 oz. of palladium available for delivery against 1.995 million (M) oz. of palladium futures contracts open in that market.

Bullion banks (‘Swap Dealers’) are net long 5,236 contracts (262k oz.) in this market.

Figure 1 - NY CME COMEX Market Net Palladium Futures Positions at July 7, 2025; source: tradingster.com

Figure 2 - NY CME COMEX Market Palladium Vault Holdings and Futures Open Interest; source: GoldChartsRUs.com

Platinum

In the platinum market, former bullion trader and metals market analyst Rob Gottlieb reports the 3-month London platinum lease rates standing at 17.5% on July 11, 2025 - the London physical platinum market remains tight. In June, the 1-month London platinum lease rate hit 25%.

Recall LBMA average turnover data shows daily average platinum trading volume in the London LPPM market at 2.75M oz. per day in Q1 2025 where contracts for immediate ownership of physical platinum are traded in an 8M oz. per annum global physical market.

CME COMEX exchange vaults in New York hold 161,000 oz. of palladium available for delivery against 4.7 million (M) oz. of palladium futures contracts open in that market.

Bullion banks (‘Swap Dealers’) are net short 1,224 contracts (61k oz.) in the New York market.

Figure 3 - NY CME COMEX Market Net Platinum Futures Positions at July 7, 2025; source: tradingster.com

Figure 4 - NY CME COMEX Market Platinum Vault Holdings and Futures Open Interest; source: GoldChartsRUs.com

We can expect that the tightest of the leveraged promissory note precious metals markets in London and New York will fail first and platinum and palladium need to be watched closely as valuable physical assets are swept off the market.

Meanwhile, the London 3-month silver lease rates stands at 6% and it is signaling a resurgent supply problem.

Best regards,

David Jensen

David; I don't touch platinum and paladium, mostly because they are such thin markets. They both have huge potential for gains. But, I don't think they are any place for a small investor or even speculator? If they have any merit at all, it is as a catch-up trade to gold.

However, as "Industrial metals" they are even more susceptible to the fraudulent "Kiss of death" applied to silver in my youth. PGMs have no history as monetary metals and little as jewellery which was and still is the underpinning for silver.

BTW, I see more and more need fore what you called, "The millet index". I know you were laughing at me. But, 'gold in terms of Dollars' is increasingly irrelevant. I see better measures of gold's value, than in terms of fiat currency which has no intrinsic value.

For some reason I wasn't able to comment yesterday.....Horrible!

From the lack of comments, I have to guess that everyone is tired of being wrong.....D

We seem to be in some new reality.

History suggests that everything will crash (including metals) Technicals say metals cannot crash from here, and the "Funnymetals" scream "Fake News" on every side?

Remember that "Survival" and solvency, are the goals.