Preface

Both US and Canadian banks and their underlying fiat debt currency system are fundamentally unsound from three perspectives:

Banks maintain ‘fractional reserve’ holdings whereby they directly hold only a small fraction their liabilities to customer deposit accounts in the form of cash. The vast majority of bank assets are held in at-risk assets such as loans, mortgages, etc. Canadian banks, for example, directly hold only $161B CAD in cash and near-cash assets to match customer deposits totaling $6,000B ($6T). A decline in the assets that the banks are betting to generate a profit can rapidly destabilize these leveraged banks that have total market capitalization of $490B on assets of $8,867B. A decline in bank asset values of less than 6% bankrupts the banks.

The banks are inherently unsound as they ‘borrow short and lend long’. Depositor accounts at the banks are legally defined as loans to the banks by depositors many of which depositors can legally demand to be returned in the short term. The banks in turn lend out and make financial bets with depositor cash in the form of loans, mortgages, purchasing bonds of third parties, etc. that, overall, are longer-term than the customer deposit accounts. This mismatch between banks borrowing short-term from depositors and lending long-term to bank borrowers creates a fundamental system instability that will manifest should enough depositors demand a return of their cash as the banks are limited in their ability to convert long-term loans back into cash.

Economists, especially from the Austrian School, have shown that central banks attempting to create growth by lowering interest rates to increase fiat debt does not create real growth. Instead it creates leveraged consumption where debt-based spending in the economy outstrips the productive output of the economy. If this continues over time, as the debt grows it will ultimately cause a collapse of the debt and the fiat debt-based currency that we utilize today. The use of debt to create artificial growth can clearly be seen in the following graph where US debt (blue line) that drives consumption and growth is now increasing exponentially compared to economic output (red line). Economic growth is reliant upon increasing borrowing multiples of the annual increase in GDP. The economy is being faked.

While the consequences of loose monetary policies by central banks is well known, the short-run benefits for the banking sector, financial markets, and governments are always too much for these parties to resist to the certain long-term demise of the broad population of our countries.

And with central banks, the ‘lenders of last resort’ to the financial sector providing gambling insurance in the form of rolling bail-outs, the costs have been minimal for them to date.

With goods price inflation already running, the ability of central banks to fake asset prices to bail out the system with their monetary juice has run out.

Latest Data Shows Economic and Asset Destabilization

Central planners at our central banks have created a speculative asset bubble and consumption craze as interest rates have been secularly decreased over the past decades creating wave after wave of increasingly easy money policy.

As interest rates were driven lower, assets of all types have been bid relentlessly higher. This can be seen in stock index levels, bond values, and real estate prices over the last decades.

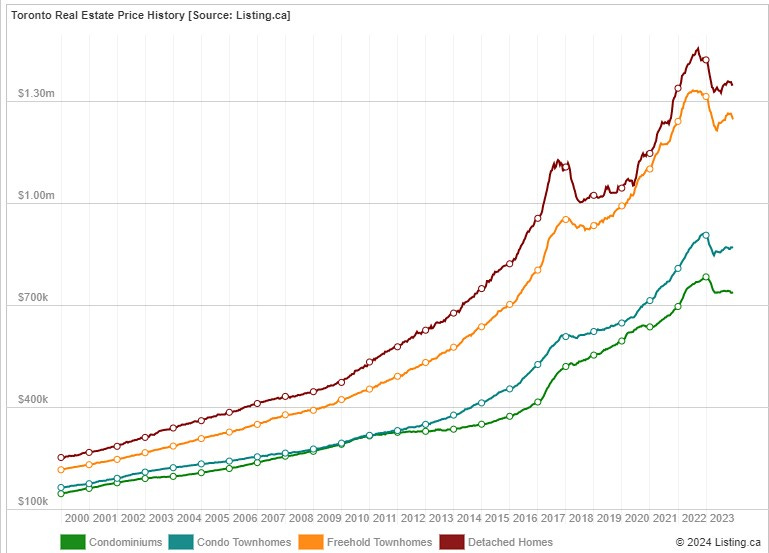

Below we can see the relentless 500+% increase in Toronto real estate prices in 23 years that rode on the back of continuing lower interest rates set by central bank planners with the support of legislative bodies and the commercial banks themselves.

Bank of Canada Rate 1990 to 2024:

The shock increase in rates from March 2022 to today both in Canada and the US has now begun to roll-over the speculative drive higher in asset prices.

Bond prices have been pushed much lower and declining home real estate sales volume sends the signal that, following a sudden drop in Commercial Real Estate prices, residential real estate values are next up on the chopping block.

Material declines in sales volume presage materially lower real estate prices and the 12-month moving average of home sales volume (gold line below) in Toronto now at 2001 levels foretells an event. :

Mortgage originations in the US are now at 1995 levels given the Fed’s interest rate shock:

With the spike in interest rates since 2022, the most leveraged borrowers are now showing distress with more to follow.

US small bank credit card borrowers are in delinquency at the highest rate since this measure was first published in 1991:

It is not just credit cards. It is clear that rents, even after running higher, have not kept up with the cost of multi-family building mortgages for the most leveraged landlords:

Watch the Banks

Bank assets - both in the commercial and consumer space - are taking a hit. As a consequence, there has been increased inter-bank borrowing by banks in the SOFR overnight market to the tune now of $1.8T each day to meet bank cash liquidity requirements - higher than during the 2008 Financial Crisis.

While the SOFR overnight inter-bank interest rate has not yet moved materially higher for a sustained period, this is the next expected consequence of continuing greater borrowing needs of banks as their assets decline in value due to both devaluation and default from the suddenly higher interest rate environment.

The ‘reverse repo’ market where banks park their ‘excess’ deposits has been steadily eroding in part due to bank withdrawals by depositors who can obtain higher yield and/or lower risk elsewhere as well as asset value decline.

With the reverse repo market balance now at $440B, it is well below the $700B indicator signal level where, at the margins, the most leveraged banks would be entering distress territory.

As this next leg of debt default and asset decline takes hold, interest rates will ultimately move higher compounding the debt and asset bubble unwind.

Stay tuned for a flurry of bank announcements signaling visible onset of the next leg.

Conclusion - You cannot increase system debt to $98T at 0% rates and then spike rates to 5.5%. The Fed knows better.

The unsound and unstable banking and fiat debt currency system created by our governments and financial institutions has reached its limit after decades of stimulated speculative excess.

Without question, the central planners will stress that the economic and social dislocation was due to insufficient central planning control and that Central Bank Digital Currency giving more control to governments over citizens is essential.

Nothing could be further from the truth as intervention by governments and the financial industry, utilizing the monetary levers they created, artificially drove the market economy to the sky for their short term benefit, in the first place.

Gold and silver bullion are about to become the rage as society votes with their feet (and their savings) against these usual suspects.

Best regards,

David Jensen

Clear and concise description of the situation. Thank You!

Thank you, David; you hit key data! My published research via The Claremont Colleges:

‘Financial’/‘monetary’/‘derivative’ house-of-cards collapse? Remember: Superior mechanics already proven by Ben Franklin with monetary reform and public banking, backed by Thomas Edison, 86% of Economics professors

https://carlbherman.blogspot.com/2023/03/financialmonetaryderivative-house-of.html