Surging Silver Market Shortage: Record Spread Between Futures And Cash Silver

The Market Knows There's A Big Difference Between Silver In Vaults And Silver Available To Market For Delivery

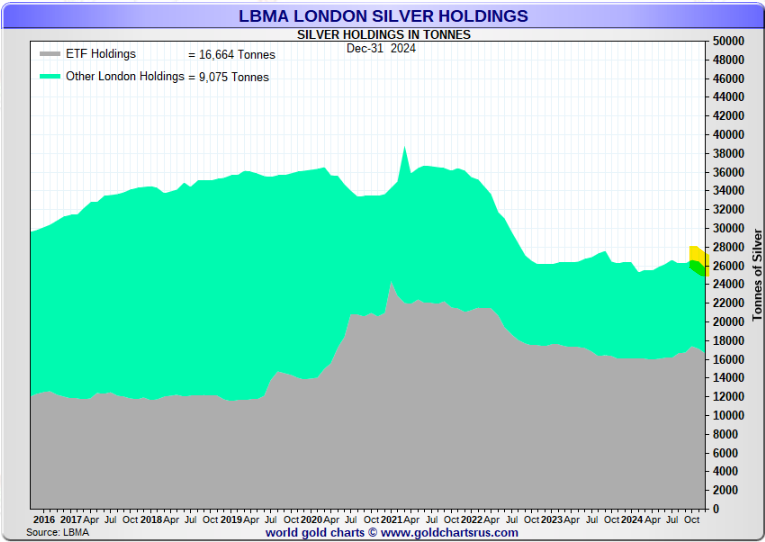

Central to understanding the approaching silver delivery default in the City of London’s silver market is that the London vault stocks of silver published by the London Bullion Market Association (LBMA) are privately held metal and not all of this silver stock is available to market. Only a fraction of that vaulted silver is available to market and this is axiomatic.

This Substack has estimated that, while the Wall Street Journal and market analysts claim that there are hundreds of millions of silver oz. in vaults available for delivery, there may be as little as 10 million (M) to 50M oz. of silver available for delivery from London silver vaults out of London’s total silver vault stock. See this and this.

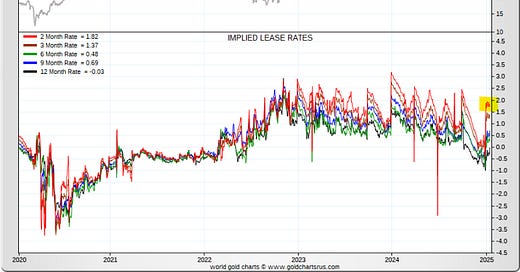

It has been noted previously that as London vault stocks of silver were drawn-down and approaching the 25,500 tonne (820M oz.) level that the market implied lease rates surged indicating very high physical delivery demand and market stress.

The latest data (December 31, 2024) show that London vault stocks of silver have again recently been drawn-down, now nearing 25,700 tonnes (826M oz.), and silver’s implied market lease rate is now rising again indicating physical market stress.

Figure 1 - Silver Implied Lease Rate - 5 Year Chart; source: GoldChartsRUs.com

Figure 2 - London Vault Silver Holdings (Silver Bar Stock) December 31, 2024; source: GoldChartsRUs. com & LBMA

Another indicator continuing to break higher to record levels is price spread between the longest dated or last future contract price for silver and the cash or spot price for silver.

The market is strongly signaling a higher silver price is anticipated and this spread has never been this high previously even at $50 /oz. silver.

Note also that in the past as market liquidity of physical silver becomes critical, the cash/spot price exceeds the futures price - as can be seen in Figure 3 - showing market participants scrambling for immediate silver in hand.

Figure 3 - Silver COMEX Long Futures Contract Price Minus Spot Price; source: GoldChartsRUS.com

Given the estimated 4 billion (B) oz. to 6B oz. of spot silver contracts allowing for immediate delivery and sold into the London cash market, this market continues to be very interesting.

Let’s watch the data.

Best regards,

David Jensen

The only thing I can confirm here in Canada is that Junk silver is very rare compare to a year and half ago

🚀 Has to launch at some point in the not too distant future.