The Bank of England Gold Price Rig Now Leads To A Global Gold Shortage And Oncoming Bond And Currency Chaos

The Perfidy

The Financial Services Act of 1986 directed that the Bank of England (BoE) assume oversight of the London Gold Market and the London Silver Market.

In December 1987, the London Bullion Market Association was incorporated with its Code of Conduct written over the prior 12 months by London Market members under the oversight of the BoE.

Trading of gold and silver in the following BoE gold price control era allowed traders to create and trade cash/spot gold and silver claims - without limit - using promissory notes for immediate gold and silver ownership in London as opposed to trading claims on allocated bars in this, the world’s largest gold and silver cash market.

In addition, independent work by fund manager Richard Pomboy in 1996 and a couple of years later central bank consultant Frank Veneroso and analysts James Turk and Reg Howe, gave compelling evidence of off-balance-sheet gold leasing by central banks in the order of 1,000 to 1,500 tonnes (32 million (M) oz. to 49M oz. per year) coordinated by the Bank for International Settlements (BIS).

This silent supply of leased gold in conjunction with the promissory note pricing system in the London market furthered downward pressure on gold’s price throughout the 1990s.

The Price Of Gold Matters

Starting at 4:20 of the following link is a video of discussion between Steve Forbes and Larry Kudlow on March 25, 2025 where it is again confirmed that Federal Reserve Chairman Alan Greenspan KBE utilized the price of gold as a market primary indicator of anticipated future monetary and price inflation:

The 1970s had seen the price of gold increase by 21x and the price of silver increase by 24x through to 1980 and that run to gold and silver forced the Fed Rate to 19% by 1980, so Greenspan utilizing the price of gold as the market signal of inflation expectations when he took over the Fed is no surprise.

The price of gold (and silver) had served as an important inflation warning system and a limit on Fed monetary policy in the 1970s and could not be ignored.

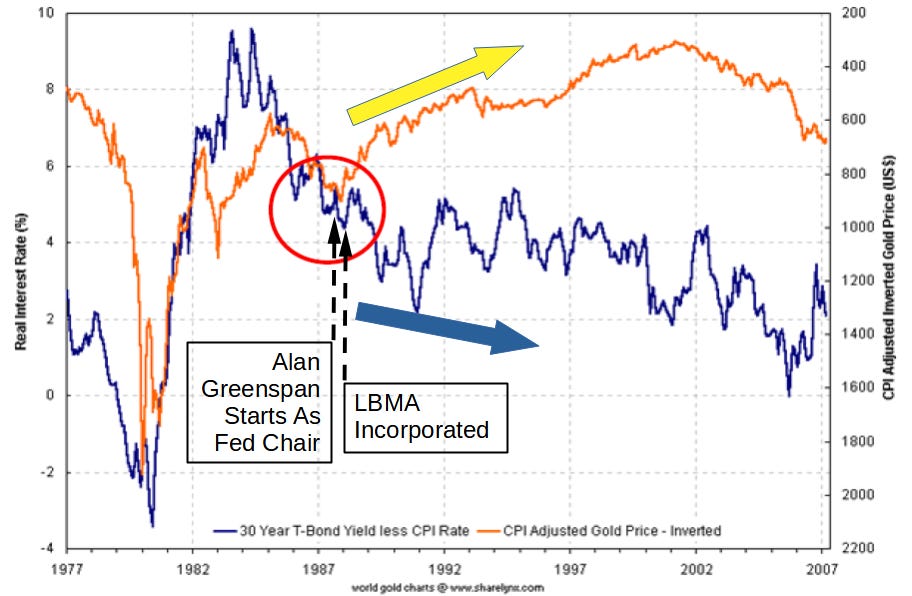

The graph in Figure 1 below shows the price of gold inflation-adjusted to constant 2007 dollars from 1977 to 2007 using the consumer price index (CPI) published by the US Bureau of Labor Statistics (BLS). The gold price is inverted (right scale) and is shown as the orange line.

The blue line below shows real interest rates represented as the 30 year Treasury Rate minus the published CPI rate of price inflation during this same period.

What can be seen in Figure 1 is that, starting in 1987 and for a large part of the Greenspan era, secularly lower real real interest rates could be effected - all the while subversion of the market gold price using the London selling and trading of promissory notes in the cash/spot market ensured that the gold warning signal would not sound. In fact, gold’s price declined.

Greenspan was a ‘maestro’ able to run looser monetary policy and blowing asset bubbles while claiming Fed policy was not inflationary (other than the ‘beneficial’ asset inflation that was occurring).

Greenspan was also able to effect the “Greenspan Put’ where Fed policy responded to the collapse of asset bubbles that it had created by blowing larger asset bubbles with even looser monetary policy. And yet there was muted bond market reaction.

Figure 1 - Constant 2007 Dollar Gold Price (inverted, right scale - orange line) vs Real Interest Rates (left scale - blue line) From 1977 To 2007 Calculated Using BLS CPI Data; source: Reg Howe / goldensextant.com, GoldChartsRUs.com

It May Be (Much) Worse

In comparison to its prior inflation models, monthly inflation figures published by the BLS have been continually reduced over time using substitution effect, geometric vs. arithmetic component weighting, Boskin Commission reductions, hedonic adjustment, etc.

At the time that the above graph was published in 2007, I asked Reg Howe if the graph could be republished utilizing a constant 1980 CPI model to add further insight.

Shadowstats.com publishes a constant CPI measure based-upon the 1980 BLS model and it shows the consumer CPI rate having run at least 2x as hot since 1980 as the officially published CPI inflation rates.

Keep in mind that in 2024 former Treasury Secretary Larry Summers co-authored a paper showing that in recent years actual cost-of-living price inflation ran at twice the BLS published inflation rate (up to 18% p.a. in 2023)

Using a CPI inflation model based-upon the 1980 BLS model to determine a constant-dollar gold price and real interest rates, the results in Figure 2 were obtained.

Figure 2 - Constant 2007 Dollar Gold Price (inverted, right scale - orange line) vs Real Interest Rates (left scale - blue line) From 1977 To 2007 Calculated Using 1980 BLS CPI Model As Estimated By ShadowStats.com; source: Reg Howe / goldensextant.com, GoldChartsRUs.com, ShadowStats.com (SS)

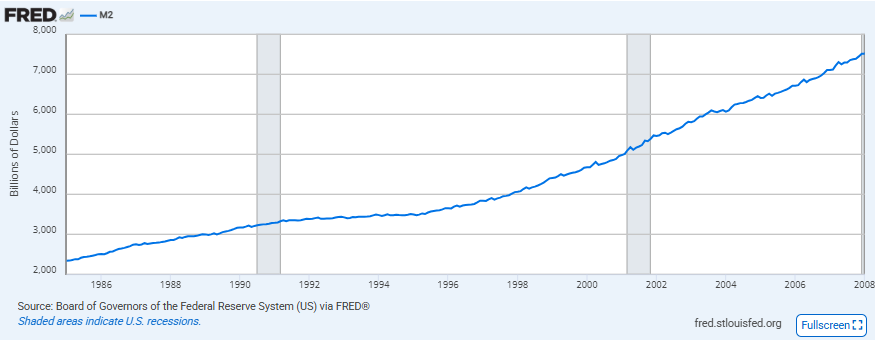

Untethered from the gold price warning system, Greenspan Fed policy saw the M2 Money Stock increase by 140% between 1987 and 2006.

Predictably, asset prices ran.

Figure 3 - US M2 Money Stock ($ billions) 1986-2008; source: St. Louis Federal Reserve

It Should Be No Surprise That Gold And Silver Shortages Are Rising

The power of the market economy in solving shortage and generating societal well-being is through the market pricing mechanism.

When the central planning regulators at central banks short-circuit important market price signals such as the price of gold and interest rates, very bad things happen.

And when central bank monetary policies such as driving a series of escalating asset bubbles in succession are put into effect over decades after shutting-off the gold and silver monetary warning system, chaos will result in the currency and bond markets - this was well known beforehand.

Market price interventions always result in shortage. Gold and silver are no different and it should then surprise no-one that malpricing of gold and silver through the gold and silver promissory note cash markets in London now result in shortages of these safe haven metals. Artificially low prices result in artificially low production and over consumption.

Central Planners Have A Plan For You

What we will see is that those self-same regulators who have been the authors of global chaos are next going to prescribe even more of their central planning to solve your problems that they have created.

Central bank digital currencies (CBDCs), social credit scoring, universal basic income (UBI) will become the rage among central planners for us.

They have miscalculated.

Best regards,

David Jensen

In case there was ever any doubt in your mind about the manipulation of the price of gold, this excellent article explains it all. Remember double-digit interest rates in the 80’s? Coming soon to a western economy near you…

When the British GILT yield on the 10yr bond settles above 5% to form a new base of support, watch for the implosion of the LBMA as the default ratio on the confetti contracts goes from technical to full on, "you are not going to receive your gold & silver so sue us".

Useful also, is to keep an eye on the Straights of Hormuz if the west gets any more frisky with Iran. All they need do is close the channel to oil shipments for about a week or two and you can watch all the $1.3 Trillion in derivatives contracts go pear shaped all at once, which will take down the manipulators in fast fashion.