"Limited hangout" is intelligence jargon for a form of propaganda in which a selected portion of a scandal, criminal act, sensitive or classified information, etc. is revealed or leaked, without telling the whole story. The intention may be to establish credibility as a critic of something or somebody by engaging in criticism of them while in fact covering up for them by omitting many details; to distance oneself publicly from something using innocuous or vague criticism even when one's own sympathies are privately with them; or to divert public attention away from a more heinous act by leaking information about something less heinous.

This is a common tactic used by political extremist groups on both ends of the political spectrum, as well as by government intelligence agencies caught in scandals.

The focus of this Substack is and has been 1) to warn of the specific danger to worldwide societal and market stability presented by the Bank of England’s creation of the leveraged gold and silver market in the City of London where claims for non-existent gold and silver have been sold to unwitting cash purchasers and 2) to call for the institution of stable sound money to avert the coming disruptions.

The suppression of gold and silver’s monetary policy inflation warning signals, coordinated through Bank for International Settlements (BIS), has compounded global currency and debt market disorder created by central bankers over decades.

This week, BIS member the European Central Bank (ECB) revealed that it appears to have gotten the memo in terms of the imminent danger posed by the leveraged claims in the world’s gold (and silver) markets.

However, the challenge for the ECB and other central banks is how do you now offload blame by warning of the imminent disintegration of this decades-old metals Ponzi scheme without implicating your own institution?

The Limited Hangout

In its May 21, 2025 Financial Stability Review, the ECB gingerly begins the entire discussion on page 39 in a 5 page section titled “What does the record price of gold tell us about risk perceptions in financial markets?” by Maurizio Michael Habib, Oscar Schwartz Blicke, Emilio Siciliano and Jonas Wendelborn.

In what appears to be the ECB’s ‘limited hangout’, the ECB discusses gold and how physical gold delivery in the US against derivatives in the COMEX market highlight the risk of gold delivery default destabilizing the Euro area where a notional value of $1 trillion (T) of gold derivatives are held.

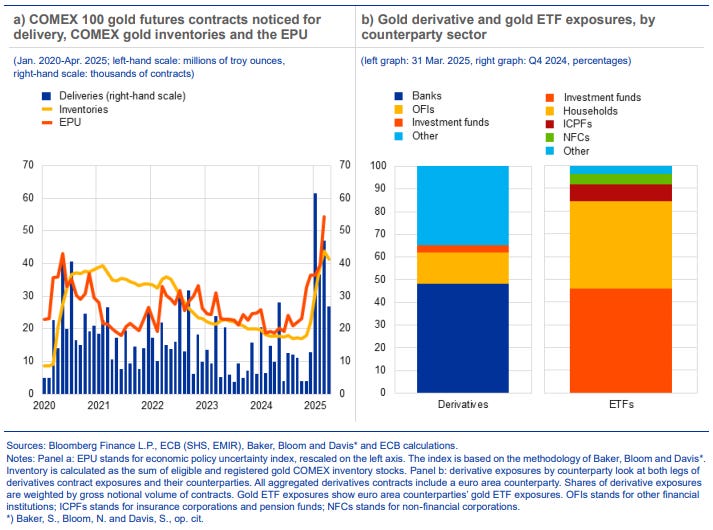

Figure 1 - COMEX Gold Market Statistics and EU Gold Derivative Exposure; source: ECB May 21, 2025 Financial Stability Review

On pg. 42, the ECB report notes: “While gold prices are driven by many factors, investors showed high demand for gold as a safe-haven asset and, at the beginning of 2025, a notable preference for gold futures contracts to be settled physically. These dynamics hint at investors’ expectations that geopolitical risks and policy uncertainty could remain elevated or even intensify in the foreseeable future. Should extreme events materialise, there could be adverse effects on financial stability arising from gold markets. This could occur even though the aggregate exposure of the euro area financial sector appears limited compared with other asset classes, given that commodity markets exhibit a number of vulnerabilities.34 Such vulnerabilities have arisen because commodity markets tend to be concentrated among a few large firms, often involve leverage and have a high degree of opacity deriving from the use of OTC derivatives. Margin calls and the unwinding of leveraged positions could lead to liquidity stress among market participants, potentially propagating the shock through the wider financial system. Additionally, disruptions in the physical gold market could increase the risk of a squeeze. In this case, market participants could be subject to significant margin calls and/or have trouble sourcing and transporting appropriate physical gold for delivery in derivatives contracts, leaving themselves exposed to potentially large losses.”

We see in the quote above the ECB use key words “gold”, “vulnerability”, “concentrated”, “leverage”, “opacity” and, most importantly, “OTC derivatives” where OTC is Over-the-Counter (or private party-to-party) derivative contracts.

However, the report only obliquely mentions the London Gold Market despite the fact that London is the world’s largest gold and silver market, trades exclusively in OTC contracts, and is ‘ground zero’ for the global leveraged silver and gold price fixing scheme created by the Bank of England.

The London Bullion Market Association (LBMA) itself tells us that trading of derivatives is less than 10% of daily trading volume while the remainder is in the form of trading of unallocated (leveraged) cash/spot claims for immediate delivery of gold.

Standing claims for cash/spot gold in London are leveraged hundreds of times against physical gold available for immediate delivery with the Bank of England having to lease gold into the market to cover the nature of the leveraged market when physical delivery was demanded earlier this year.

With an estimated 400M to 600M oz. of cash/spot gold claims and 5B to 8B oz. of cash/spot silver claims standing in London, the real risk to global stability is the leveraged CASH/SPOT market for immediate delivery physical gold and silver in London and not derivative gold claims in an unnamed OTC market.

The ECB does not mention this however, as that would highlight the problem that has been created by these central planners.

While the ECB’s May 2025 Financial Stability Review has very little value in identifying the central issue in the gold and silver markets that we face today, it does serve as an excellent example of a ‘limited hangout’.

Best regards,

David Jensen

Excellent analysis of the recent ECB report. And outlining the reality not like the report. Thank you again David Jensen. Hopefully, this gets read by many and more people wake up to the collusion between the banks, government, media and other organisations. We need the truth. You should be on all Airways.

We need the truth and and end the the fiat ponzi scheme, and not their CBDC, Digital currency, Tokenization. But gold and silver.

Let's see what unfolds, they will never allow the truth and most unfortunately don't want the truth. Let's see what happens. Thanks again for your great work, information and analysis.

Excellent article. I was with friends the other day and they had newspapers in their house. I tried to read some articles with confusion as the result. There's no intent to inform you. It's all magicians tricks to divert from the real news.

I used to consume that garbage.