The Fed's Panicked U-Turn

What caused the Fed's monetary course reversal over just two weeks?

On December 13, 2023 the Fed U-turned from a staunch inflation fighting policy stance two weeks prior to signaling that it was preparing for rate cuts.

This raised the question of what could have changed in two weeks to cause such a reversal.

If we look at key metrics such as M2 Money, the Consumer Price Index (CPI), and the Gross Domestic Product (GDP) of the US economy, these measures were signaling increasing price inflation pressure and relaxing conditions according to the prevailing economic worldview.

To be sure, the US economy with $97 Trillion of total system debt cannot sustain the burden imposed by the Fed of a 5.5% shock interest rate increase over the past 1.75 years. That’s more than $5T per annum of increased interest payments as interest rates reset throughout the economy if the 5.5% rate is maintained.

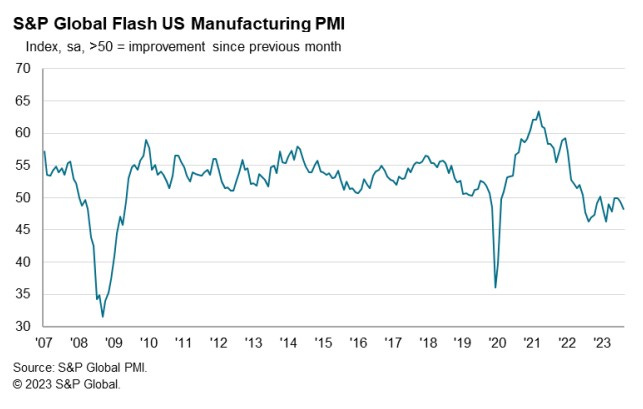

And while manufacturing did signal a down-turn in most recent monthly data, this alone would not have been sufficient to drive such a dramatic policy reversal by the Fed.

It’s the Banks

The answer to the Fed’s split personality appears to lie in the banking system.

Already in the spring of 2023, it was noted that US banks held more than $2 Trillion of balance sheet losses from the Fed’s shock rate increase not acknowledged on bank balance sheets where the assets are held at book value.

This increasing impairment of the banks led to howls of protest from the banking sector - most recently from Jamie Dimon CEO of JPMorgan Chase.

What did change this past week was a sudden decline over three days of $155 Billion in the overnight Reverse Repurchase (Repo) Market accounts at the Fed - from $838 Billion down to $683 Billion (an 18.5% decline) - where banks hold their ‘excess’ cash reserves.

Market analysts had set $700 Billion as the estimated point of Reverse Repo reserve holdings below which would signal the more marginal banks being forced to start to liquidate impaired assets into the market to meet liquidity requirements.

Suddenly, as marginal banks start to convulse, the Fed reflexively starts to signal that price inflation is well in hand and the Fed can look to loosen their monetary policy.

Not so.

Implications

There are two primary concerns going forward:

Re-emergence of the banking crisis from the Spring of 2023 as banks start to sell assets showing the condition of their balance sheets in current market conditions

A rapid increase in price inflation from further currency debasement by the Fed.

Over the past 40 years, the Fed’s central planners have run increasingly loose monetary policy that has distorted the economy to now require 4 added units of debt per unit of of GDP growth each year - monetary easing now primarily drives price inflation.

Re-emergence of the continuing banking crisis will drive enormous market volatility and, paradoxically, higher yields in the bond market as debtor default raises its head.

And loosening of monetary policy by the Fed will drive a second leg of price inflation in the economy ultimately forcing rates higher.

We’ve Seen This Movie Before

The money printers at central banks have been well aware of the damage that their first loose then tight monetary policy has wrought on the general public.

We now see the situation where the central banks will do what they do and loosen again as the banking crisis metastasizes in the markets and economy ultimately leading to much higher price inflation and ending in a currency crisis.

I will leave you with this:

Gold and silver bullion in direct possession.

Best regards,

David Jensen

All in Silver & Gold !