The London Silver Market is Ground Zero - The COMEX is Not the Center for Silver Price Setting

Focus on the Critical Silver Market

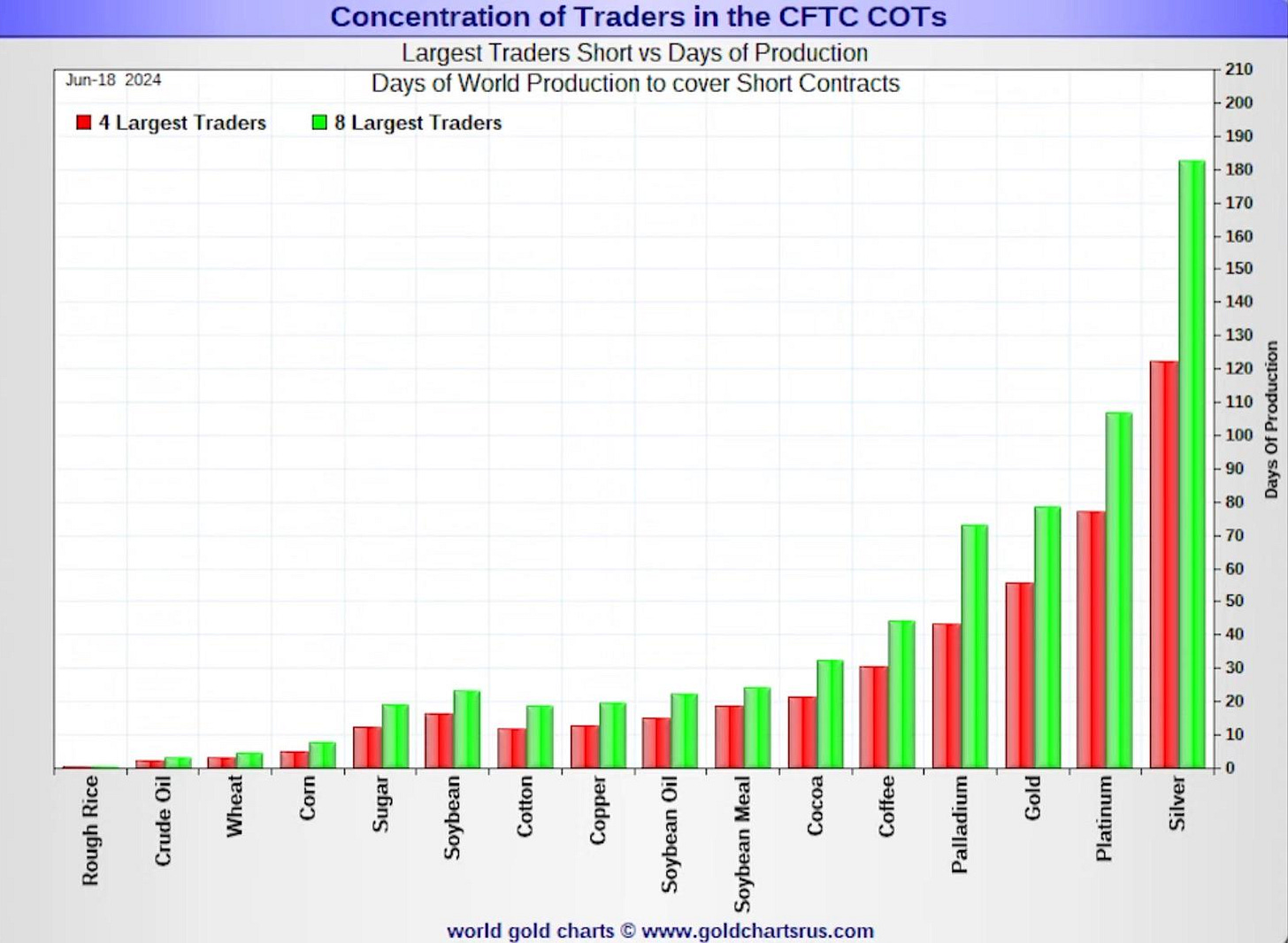

This graph of US COMEX/CME silver futures contract short positions is frequently put forth as proof by silver market commentators that the price of silver is manipulated:

Concentration of COMEX/CME Silver Futures Contract Short Positions

Silver futures can and do influence the price of silver however silver futures represent a bet on where the silver price is going. The COMEX futures market is a price hedging platform.

The physical silver price is set in the cash market - that is where the price of silver is set for miners and refiners of silver and it has been manipulated for decades.

The largest cash market for silver, representing over 90% of global daily cash silver trading, is the City of London’s OTC (Over the Counter) silver market. Here, cash/spot trading of silver contracts sees daily trading that can exceed 300M oz. of ‘net settled’ claims, according to LBMA clearing data, equating to daily turnover of 3B oz. of cash market physical silver claims.

These cash/spot contracts claims are immediate ownership claims for silver bars in the London market and holders believe they can get silver bars for these contracts. The misleading price setting in London arises because the cash/spot contracts for these silver bars are merely promissory notes and can be created without limit.

Total open cash/spot claims in the London cash market is estimated at between 5B and 8B oz. of silver bars. (see: https://jensendavid.substack.com/p/an-estimate-of-bullion-bank-exposure).

The London silver market, operating under oversight by the Bank of England currency creators/monetary regulators, does not disclose total London silver spot market claims in the world’s largest silver market.

Annual mine production of silver is approximately .825B oz. and London and NY market vaults hold about 1.1B oz. of silver of which approximately half is claimed by ETFs. Much of the remainder is owned privately and not available for trading.

The balance sheet for London cash/spot silver bar claims vs globally available silver bars simply does not balance.

Average Daily London Silver Net Settled Silver Clearing Volume, source: https://www.lbma.org.uk/prices-and-data/clearing-data

In closing, commentary about COMEX/CME silver market is interesting however the COMEX is an ancillary physical silver market. While the COMEX provides some silver market data, exclusive focus on the COMEX/CME market is a distraction from the critical physical silver price setting platform in London.

Best regards,

David Jensen

Ah yes musical chairs, hundreds of paper issued silver for every real 1 ounce of silver. When only 1 person can grab the chair for that 1 ounce of real silver there is going to be a lot of unhappy campers and the emperor will be naked in more ways than one.

Do you think industrial silver shortages will be what triggers defaults in the cash market?