Shock Silver Price Premium In Shanghai Will Quickly Drain Western Market Vaults

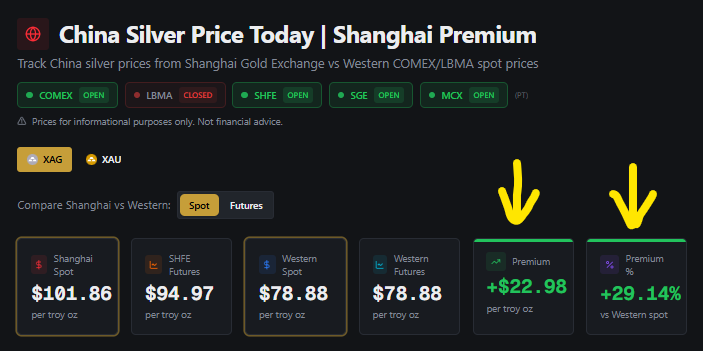

After the 30% silver price smash on the CME COMEX late on Friday January 30, 2026, the Shanghai silver cash price now trades at a +29% or +$22.98 premium to the price in Western markets.

To remove silver from China’s exchange vaults, a 13% VAT tax must first be paid driving the premium for Shanghai wholesale physical silver to +45.8% or +$36.22 over Western exchanges.

The cost of shipping/insuring bulk silver by air freight to China is approximately $2 /oz.

The arbitrage opportunity to ship bulk silver to China is thus over $34 per oz. and this physical silver will rapidly flow from London and New York vaults to China.

Figure 1 - China Silver Price Premium February 2, 2026; source: metalcharts.org

The shock forced silver price reduction in Western digital markets that started on January 30 is driving the enormous price premium and is unsustainable as silver vacates Western vaults to meet voracious Chinese and Asian demand.

Figure 2 - China Silver Premium (green line) February 2025 To February 2026; source: metalcharts.org

If this price disparity continues, expect drastically restricted silver availability in Western markets in the weeks ahead.

Best regards,

David Jensen