A Look At London Silver Bullion Banks' Extinction Risk

I Just Need Some Liquidity, Know What I'm Sayin?

“Help me out.

Yeah, just a taste. All I need is a little taste.

I need $2.5 trillion dollars.

I’ll pay you back.”

Robin Williams discussing the financial industry’s bailout demands in the 2008 Financial Crisis

Since the creation of the LBMA in 1987 with oversight by the Bank of England central bankers and coordination globally by the Bank for International Settlements, bullion banks have been free to sell cash/spot contracts for silver and gold bars into the London market diverting demand from physical metal markets.

Gold and silver were converted in London, for a while, into virtual assets that could be created without limit in that market.

Each spot contract is today only fractionally backed by metal bars with the rolling assumption that the majority of holders of these cash contracts would not ask for delivery in sufficient numbers to recognize that they were holding largely unbacked contracts.

This has changed in the physical silver market with 2024 being the 6th consecutive year of global silver supply deficits.

The worm has turned on the silver paper metal sellers in London.

Exposure Scale of London Silver Bullion Players

With continual issuance of these unallocated cash/spot contracts for immediate ownership of silver, it was recently noted that standing claims for silver bars in London stands at between 4.3 billion (B) oz. and 6.4B oz. in a market globally supplied by just 1.003B oz. annually - and currently in a large and chronic supply deficit.

Assuming a market open interest of standing claims at 5B oz. (between the two above figures) in the London cash market, an estimate of risk exposure of bullion bank balance sheets can be made.

Assumptions:

First, given the scale of cash/spot contract selling, it is likely that a large part of the London open interest of cash silver contracts sold were sold by bullion banks. Assume the bullion banks have issued 80% or 4B oz. of the total estimated standing silver cash contracts.

Second, due to the global dearth of actual physical silver bars available to market in size, we can assume that even if bullion banks had ‘hedged’ by purchasing some spot silver contracts from other bullion banks, such London hedges have little value. The daisy-chained silver market is already very dry.

With silver still trading at just 60% of its 1980 high price, silver is the most undervalued of any major commodity.

We can largely thank the bullion bank issuers and naïve holders of these paper cash/spot silver contracts for having deflected price discovery out of the physical realm into the infinitely supplied virtual silver cul-de-sac.

The cul-de-sac has low priced silver for a reason.

Bullion Bank Extinction Risk

Given the size of these cash market silver claims on bullion bank and a now mal-structured global silver supply chain unable to produce at required scale after decades of mispricing, as the fraud of these cash/spot contracts is discovered, due to the hopeless leverage created by their out-sized issuance, this now creates a terminal risk to bullion bank cash silver note issuers.

Given the very poor metal liquidity in the global physical silver bar market, as holders of the estimated 5B oz. of London cash contracts start to increasingly stand for delivery, as word spreads of silver cash note metal illiquidity these demands for metal delivery are likely to accelerate very quickly.

It is an axiom that frauds always collapse.

As this levered fraud collapses due to physical demand it is not difficult to see a $100 /oz. move higher in price in a short time as a first leg in the coming physical silver market.

Problem: such a $100 /oz. silver price move would create, for starters, a new $400B liability on the balance sheets of levered bullion banks assuming the price would stop at that level.

But silver is a Giffen Good whereby an increasing price paradoxically increases demand guaranteeing an even higher future price for silver once the accelerated demand for silver delivery starts.

Central banks do not hold physical silver to quietly bail-out bullion banks when the demand for delivery accelerates from these London cash/spot contract holders.

This writer is looking for multiple bank ruptures in the silver bullion banking space. And then there is gold.

What to Look For

Rats aren’t fond of sinking ships especially when they’ve lived in comfortable luxury for decades. Watch for broad departures of executives and others from global bullion banks as a sign of an incipient run on silver.

Watch also for incredible deals if you lend silver to intermediaries of these bullion banks - although you may not get the metal back.

Finally, watch for multiple price ‘jolts’ much higher over very short periods of time as Rip Van Winkle risk managers for bullion banks and short selling funds wake up from a period of inaction forcing attempted short covering of these positions in the market.

A Quick Look At COMEX Silver Trading Positions

The CME COMEX is a futures market and not a physical metal market like London. Further, the COMEX Rulebook has numerous provisions that allows for forced cash settlement of trades should COMEX Directors deem it to be in the best interest of the COMEX.

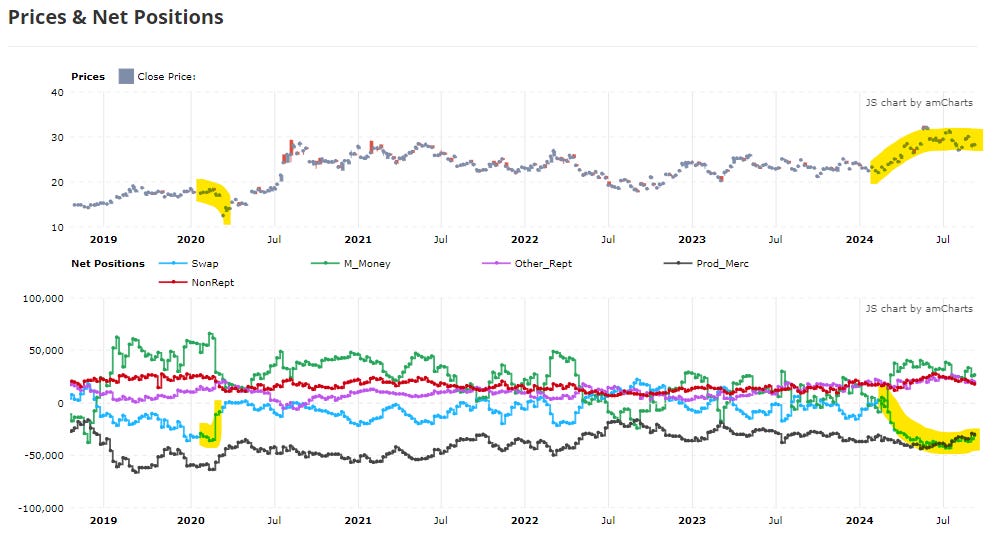

Below we can see the blue line that represents Swap Dealers (bullion banks) as being net short silver of some 158.1M oz. at September 10, 2024.

Note that in early 2020, Swap dealers were able to avoid a material loss by covering their short position before the price rose.

In contrast, at September 10, 2024 Swap Dealers remain net short 158.1M oz. of silver (31,642 tonnes) and unable to cover this short to date even as the price has risen.

Figure 1 - COMEX Silver Price and Trading Positions September 10, 2024 - Swap Dealers (bullion banks, blue line) are net short 158.1M oz. silver; Source: tradingster.com

In Closing

So it was not Russia, Keir Starmer.

It was your paperized London silver and gold market caught out.

I will leave you with Robin Williams’ thoughts on the financial industry that is so fond of socializing its losses:

Best regards,

David Jensen

I keep thinking, just how bad are things going to get in the next few years? I remember a similar feeling in 2008. What should have happened then, has been delayed until now. Soft landing? Yeah, like a huge meteor slamming into the earth. I just cannot see a possible scenario where the whole system doesn’t collapse. Gold & Silver will help, but it is not going to be pleasant for anyone. Just less worse for some. The ironic thing is most people will be totally blindsided in spite of all the warning signs.

I recognize silver as money in of itself, its innate function supported by many eons of history, secular and biblical. In fact, the oldest recorded transaction was with silver, to which the Bible attests, is found in Genesis 23:1-20, wherein Abraham directly buys a burial place for his departed wife, Sarah, using silver as the medium of exchange, i.e., money. He didn't offer promises of payment or sell a paper contract with a certain number of ounces written on it.

And the Bible has this to say about him: Gen 13:2 "And Abram was very rich in cattle, in silver, and in gold."

Presently, in its suppressed state, I see silver as dormant money waiting to come to life again, reborn. Freely allowed to function in its rightful place as natural and lawful money is when I believe we shall see its true value emerge with a vengeance, with unimaginable purchasing power, in proper alignment with gold.

Don't be fooled, ALL original wealth is found in or upon the ground. How or why should real and honest riches be calculated any different today than in Abraham's time a few millennia ago? They are the result of work or energy which has already been done or expended to obtain it, refine it, grow it, or build upon it, etc. Silver and gold best express this like no other form of wealth in their utility to function as money, being the standard against which all else is measured.

Today's banking establishment, via all their debt instruments, stands in stark opposition and is based upon work promised to be done in the future, and not by them but by us of course, with usury on top.

P.S. I hope you don't mind my essay-like comment, but your writing has got me fired up, especially this last one..

Keep hitting the target, David!