Bloomberg Foams The Runway For Arrival Of The Physical Silver Squeeze

The Squeeze Is Already On The Runway

As data clearly indicates that a physical silver squeeze is underway and growing in London, this week Bloomberg News started to report that perhaps a silver squeeze could develop.

In its report, Bloomberg published an implied lease rate graph for London silver showing an implied London lease rate above 6%. Bloomberg’s reported lease rate may be a blended weekly average lease rate, however precious metals market analyst Robert Gottlieb reported that the implied silver lease rate in London hit 9% in London this prior week. We have to keep in mind that the actual London gold lease rate has hit double the calculated implied lease rate recently.

There have been claims that there is ample silver in Swiss and other vaults available to resupply London vaults. However, it is a short truck trip from Switzerland to London through the Chunnel and that silver would have started to move by now in size to London’s silver-depleted vaults thus lowering lease rates.

Figure 1 - London Silver Implied Lease Rate; source: Bloomberg

How Bad Is The London Silver Shortage?

In a word, it’s bad.

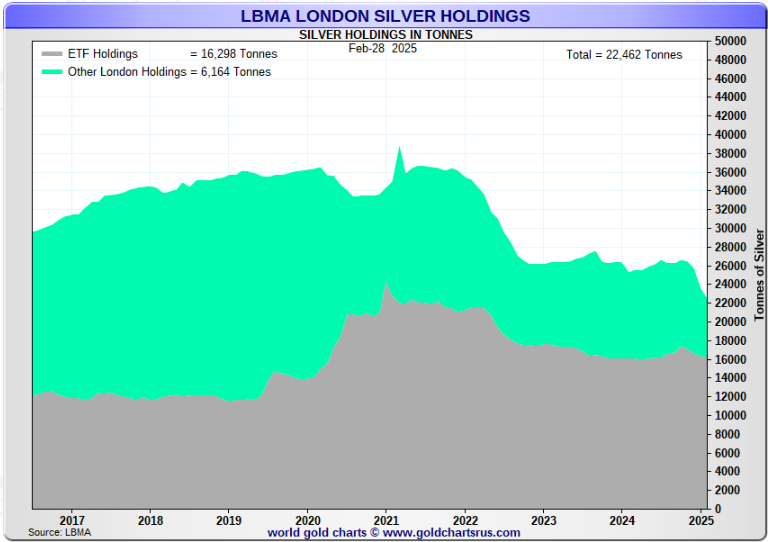

The most recent London silver vault holding data show that at February 28, 2025, there were approximately 198 million (M) oz. or 6,164 tonnes of silver ‘float’ in London vaults that were not held by Exchange Traded Funds for their shareholders.

However, the ‘free float’ of silver actually available to market in London currently is much smaller than 198M oz. The London free float may be as little as a few 10s of millions of oz. of silver and the persistently high London silver lease rate tells us that the London silver vaults are drawn-down of the available silver and are not being replenished.

Figure 2 - London Silver Vault Holdings At February 28, 2025; source: GoldChartsRUs.com, LBMA

In fact, each day over the past weeks there have typically been an additional 3M to 5M oz. of Exchange For Physical (EFP) silver contracts acquired in the New York CME COMEX market that allows purchasers to claim physical silver for immediate delivery in London tightening the squeeze in the London market even further as it is shipped away.

Foaming The Runway For Arrival Of The Silver Squeeze

In the face of this evidence of an extant and growing physical silver squeeze in London, Bloomberg’s March 18, 2025 silver article posited the following:

A high silver lease rate in London for two to three months indicates a serious market shortage has developed and not a short market speed bump. Further, speculating that the silver could come right back to London given the reasons that the silver was moved to New York from London in the first place is more of the order of wishful thinking.

If the silver reinforcements could have arrived from Swiss vaults they would have by now and we are not seeing that in London market data - in fact, the situation is getting worse.

London Silver Leverage Bites

The Loco London Liquidity Survey of 2011, published in the London Bullion Market Association’s (LBMA’s) trade magazine Alchemist #63, showed that total daily gold trading turnover was a minimum 10x the published end-of-day net-settled trading volume.

Applying the LBMA’s market research data to the silver market to scale trading, the average daily silver trading volume in London equates to 2.4 billion (B) oz. of silver daily turnover and standing claims of 5B oz. of silver for immediate London delivery.

In a world that sees mine production of silver at 830M oz. per annum and an increasingly illiquid global physical silver market, this is heading for a spectacular resolution as the market disposes of a decades-old price rigging system operated under the oversight of the Bank of England.

Best regards,

David Jensen

LOL, one eBay seller currently has a 4.7% premium for (20) 1 troz silver buffalo rounds.

Imagine paying a 9% lease rate for PAPER, when you can get the real thing for less.

Keep stacking!

Critical mass triggers the panic surge in precious metal prices. When the big money realizes that the worthless paper is unredeemable, they will start buying at a premium. When that happens the cork will not go back on the champagne bottle. Even investment grade pieces will be bought just to have precious metals in hand.