The CPI price inflation reports over the past 3 months of January through March 2024 have pointed to higher consumer price trends, not lower, with the Fed’s vaunted ‘supercore’ measure running at an annualized rate of 8% during this period and now mentioned much less by the Fed.

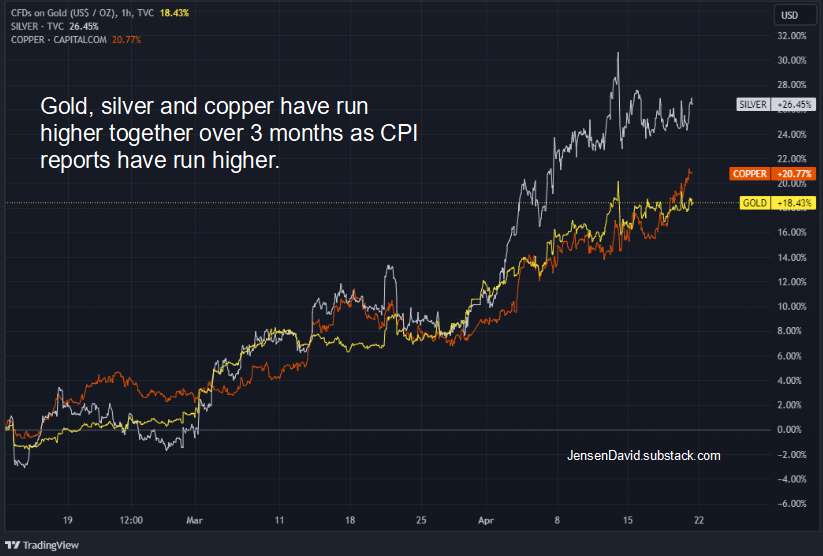

January’s CPI report was released on February 13, 2024 and since that date the three historic monetary metals gold, silver, and copper have bolted higher together at a remarkable rate. Gold has increased in price 18%, copper 21%, and silver 26% in US Dollars (USD).

The run-up in price of these three monetary metals over 3 months is not a subtle signal and these USD denominated metals prices have soared even as the USD has increased in strength vs other fiat debt currencies including the Swiss Franc.

Total above-ground gold stocks are estimated at 6.8B ounces (212,00 tonnes) globally and in this 3 month period, gold has increased in price by $370 USD/oz. This equates to an increase in value of the world’s above-ground gold stock of $2.5 Trillion over three months.

With rising yields (interest rates) from bonds selling-off in this period, the bond market is signaling it is losing confidence in the buying power of currencies run by our central planners. The signal is higher - perhaps much higher - interest rates ahead to compensate bond holders for inflation risk, currency risk, and, in non-government bond issuances, default risk.

This is the End Station

Since 1987 when the Bank of England was given oversight of the world’s primary gold and silver market in the City of London and initiated trading of unlimited promissory notes for gold and silver in lieu of contracts underpinned by allocated bars in vaults, the world’s central banks have engaged in remarkably loose monetary policy with gold and silver manually subdued in their price rise (a warning signal).

The central planners shot the canary.

The S&P500, buoyed by loose money from central banks, is up 20x while the price of paper gold is up 3.7x and paper silver is up just 2.9x.

The Fed has run an annual Money Supply (increase in the Money Stock) well over +5% for decades while the stock, bond, and real estate markets were swollen with capital from ever-lower interest rates.

TMS=True Money Supply, source: Ryan McMaken at mises.org

This obscene compounded increase of M2 debt currency by the central planners has increased M2 now to a total of $21T and total US system debt to $98T. (note: as a ratio of GDP, Canada’s total debt outstanding is much worse than that of the US.)

M2 Money Stock:

The interest rate shock rise from 0% to 5.3% since 2022, with current price inflation data indicating that rates are headed higher, now brings the financial system party to a close.

First Rapid Inflation then Hyperinflation

With the record creation of debt fueling markets higher over decades, visibility of the debasement of currencies has only become visible with higher price inflation recently.

However, as bubbles can’t be inflated to eternity, as the central bank asset bubbles start to collapse, the price and interest rate rises that we see are the consequence of limits on past central bank expansionary policy and will continue higher.

Even as the working class and small businesses are crushed by higher rates, we see that the Fed maintains loose financial conditions in an attempt to keep their asset bubbles inflated and past currency debasement hidden:

Source: Chicago Fed - Index levels below zero indicate looser conditions

Price inflation is driven by currency debasement and not by economic activity. As prices continue to rise capital will increasingly move from bonds, stocks, and currency into the shelter of monetary metals and essential commodities.

Commodities (including precious metals) stand at less than 2% of total investments. As interest rates rise, this 50x leverage can drive monetary metals and, less so, other commodities to price levels that are difficult to fathom. As Ernest Hemingway put it: “Gradually. Then suddenly.”

The rapid decline of currency buying power will signal to the general public the failure of fiat debt currencies and the inevitable return to gold and silver money.

Our governments and central planners will declare the failure of their currency schemes as a failure of the market economy and a necessity for more economic central planning as well as the necessity for central bank digital currencies (CBDCs) to fully control the public.

Nothing could be further from the truth. Prepare to say no to what would be a permanent loss of freedom for humanity.

There has not been a better time to hold gold and silver than now.

Best regards,

David Jensen

P.S. please share this article with your contacts

My question is not if countries go to pm, but how. David sees payments in metal, as does David Brady and Doug Casey ("1/10 ounces Ag we need").

I cannot see this. I expect backed currencies. Isn't this the reason CB have bought so much lately? Isn't this what Sergei Glasjew is trying to install? For years Peter Schiff offers a debit card which pays of stored gold.

The three mentioned men own farms. A friend bought one in Paraguay. He knows others but although unvaxxed, there is not the expected "we are in this together". Our David answered me once: "Find your people!" This is a most problematic task!

Alasdair MacLeod sees the western systems collapsing, but the others thrieving. So do I. We think the SCO will come up with a "gold currency" for trade.

When my savings and butt are out of the west - isn't it better to wait for freedom? For countries to invite? For falling real estate? Every day I think: "Have you done right?"

Great article. Perhaps you could do one on PM lease rates that shows how rapidly their system is failing? TY