Data Indicate The Global Physical Silver Shortage Intensified In Week 1 of 2025

The Silver Shortage Gets Worse

Diversification is a damn poor surrogate for knowledge.

Marty Whitman

The physical squeeze due to a global shortage of silver that we noted building through the last weeks of 2024 continues now through the first week of 2025.

In considering the latest data of building global silver bar shortages at exchanges, keep in mind that the November 2024 clearing data from London’s silver market indicates that the net standing claims for physical silver bars in London’s cash/spot silver market is estimated between 3.9 billion (B) oz. (using a 2x multiplier of daily gross London turnover vs. open interest) and 5.8B oz. (using a 3x multiplier of daily gross London turnover vs. open interest).

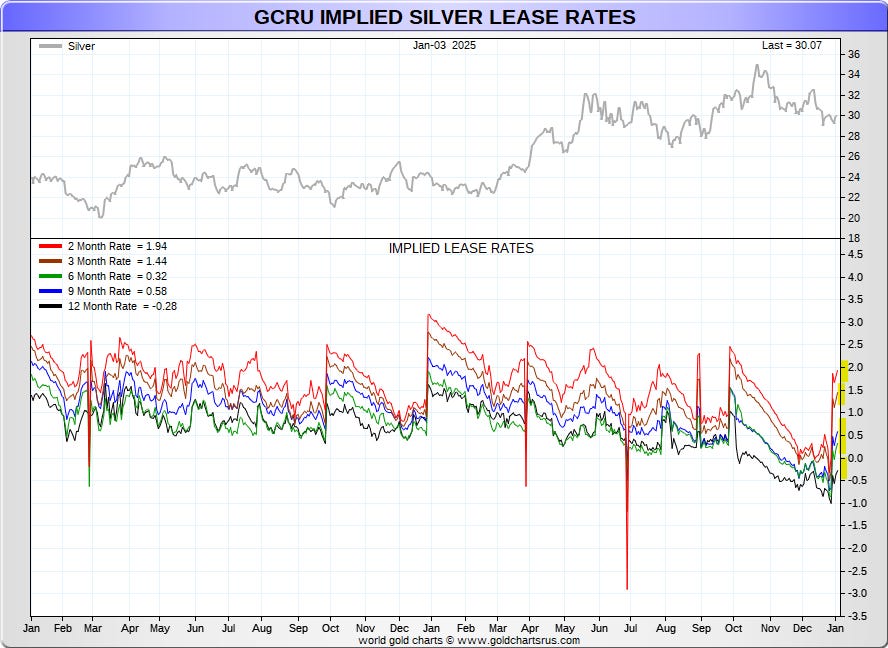

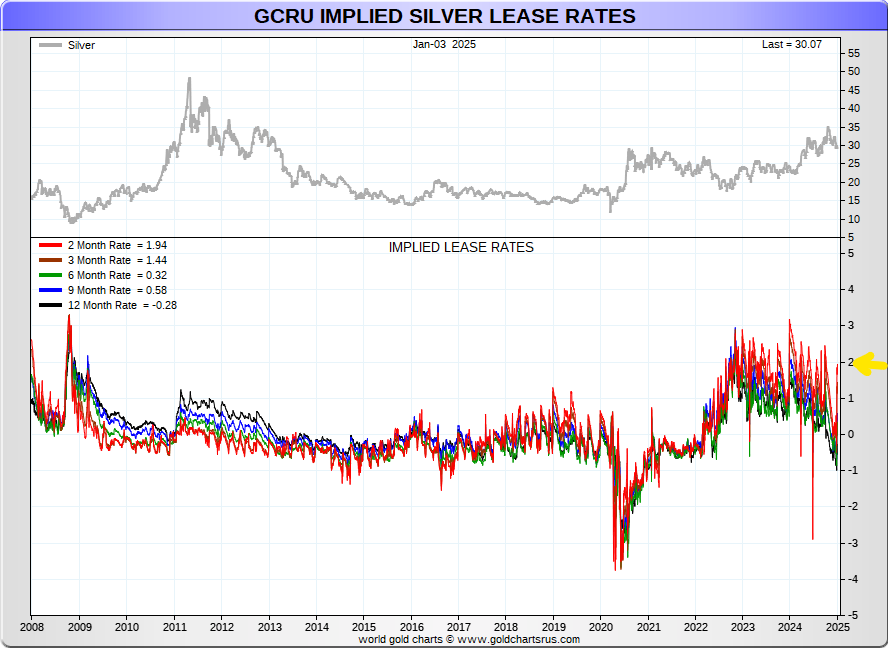

Silver’s implied lease rate has increased across all lease tenors in 2025 indicating growing physical silver bar shortage. See Figures 1. and 2. below:

Figure 1 - Silver Implied Lease Rate - 2 Year Chart; source: GoldChartsRUs.com

Figure 2 - Silver Implied Lease Rate - 17 Year Chart; source: GoldChartsRUs.com

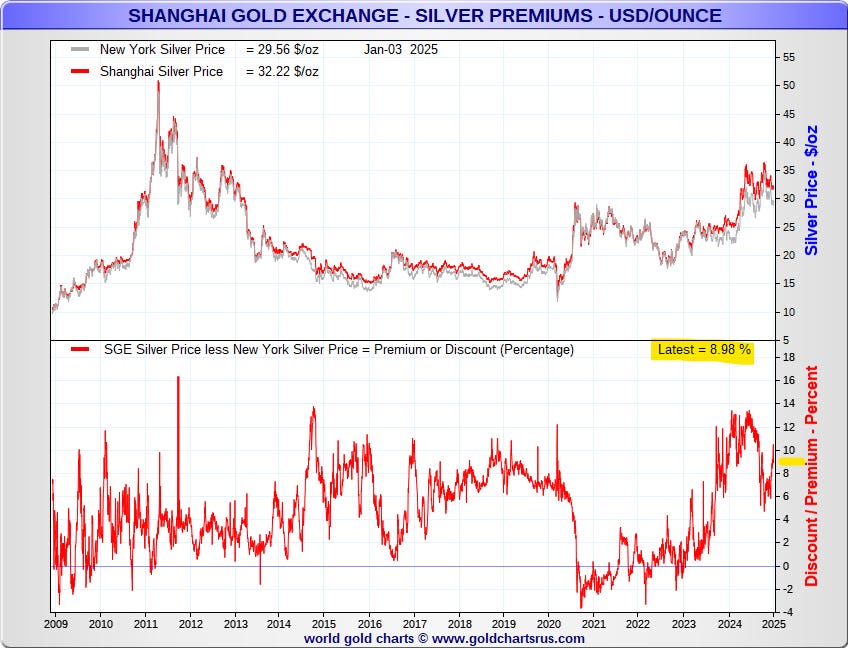

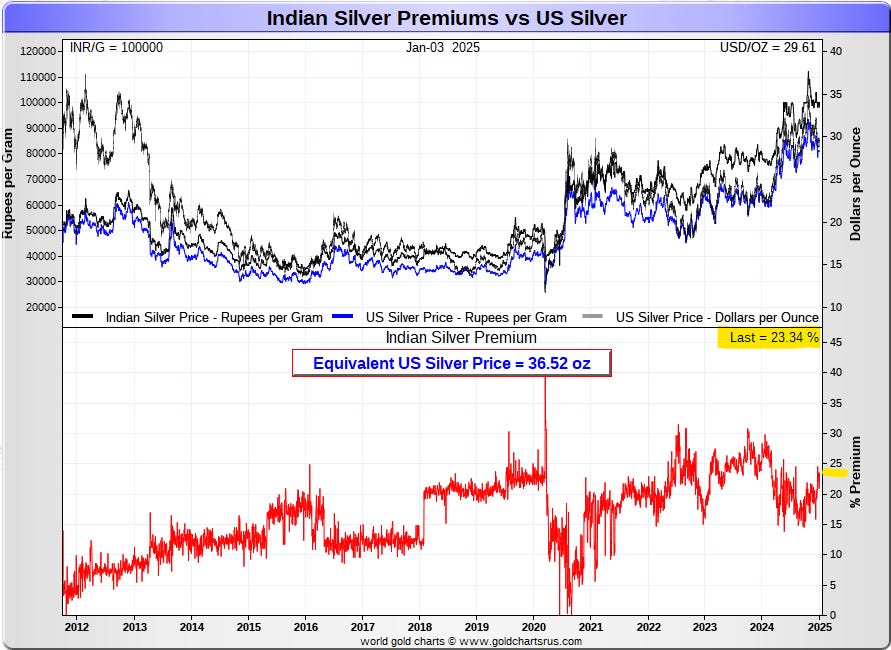

The premium for physical silver remains high in both the Chinese and Indian market exchanges:

Figure 3 - Silver Premium On The Shanghai Gold Exchange - 19 Year Chart; source: GoldChartsRUs.com

Figure 4 - Silver Premium In India - 13 Year Chart; source: GoldChartsRUs.com

Both the Chinese CNH Yuan and the Indian Rupee have been rapidly devaluing vs. the USD of late, which will intensify price inflation in those economies, so it is no surprise that these markets should see similar rapid local demand building for physical silver safe haven.

However, growing physical demand will at some point terminate the physical silver (and gold) promissory note spot/cash market in London where several billion oz. of silver can be demanded for immediate delivery from an increasingly dry silver market.

At that point, the bullion banks and the Exchange Traded Funds (ETFs), the latter of whom Jeff Currie (formerly Goldman Sachs’ Global Head of Commodity Research) claimed had shorted silver that is beneficially owned by their shareholders into the market, will be torched.

This may help to explain why Blackrock’s CEO Larry Fink has been rubbing-up on the UK’s Prime Minister Keir Starmer of late. Blackrock manages the largest silver ETF in the world iShares Silver Trust ‘SLV’ and may need Keir’s help - right now.

The growing global physical silver market total deficit estimate for 2024 has recently been increased by The Silver Institute to 282 million (M) oz. from 265M oz. of silver. The physical silver shortage in 2025 will likely be worse.

Disappearing silver inventories are not helping those who are short silver to sleep well.

Best regards,

David Jensen

As anecdotal evidence that seems, from where I sit, possibly to support your thesis re Fink and Starmer, in the last few weeks of 2024, my ISA provider told me I could no longer keep Sprott PSLV holdings in the ISA wrapper, and Keir doubled the capital gains tax I will consequently be expected to pay. Feels like being nudged.

So when the whole promissory note shenanigans goes tits up any found to have been involved in what, for want of a better word is a fraud, then they would be in deep doodoo alongside those who are meant to be "overseeing" the whole thing would they not. In a normal world anything like that would be a career ending move, would it not🤔