High Future Silver Price Volatility Indicator Asks For Attention

In the financial markets, volatility is defined as the tendency of the price of an asset to move up OR down, relative to its price, over a given time period. The higher the volatility, the higher the tendency of an asset price to have larger relative price moves - again, both up or down.

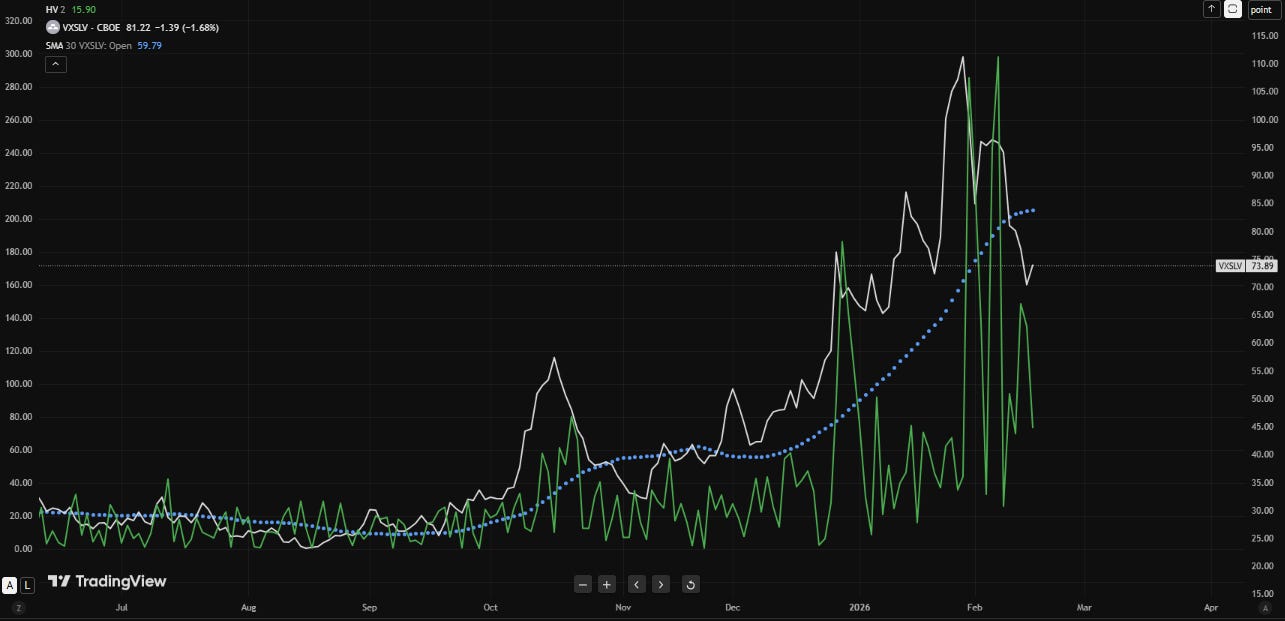

As the price of silver ran higher over the past 6 months, the daily price moves relative to silver’s price, measured as volatility, also began to run higher then spiked with sudden, heavy selling on January 30, 2026 and again subsequently with disorderly price spikes down driven by CME COMEX digital market trading. See the lower panel in Figure 1 below that tracks silver’s price volatility.

On January 30, 2026 silver’s price dropped by more than 30% and was described as a 10 sigma price event. Pretty rare.

Figure 1 - Silver Cash Price (White) And Daily Silver Price Volatility (Green) May 2025 to February 2026; source: TradingView.com

Market Estimation Of Approaching Silver Price Volatility

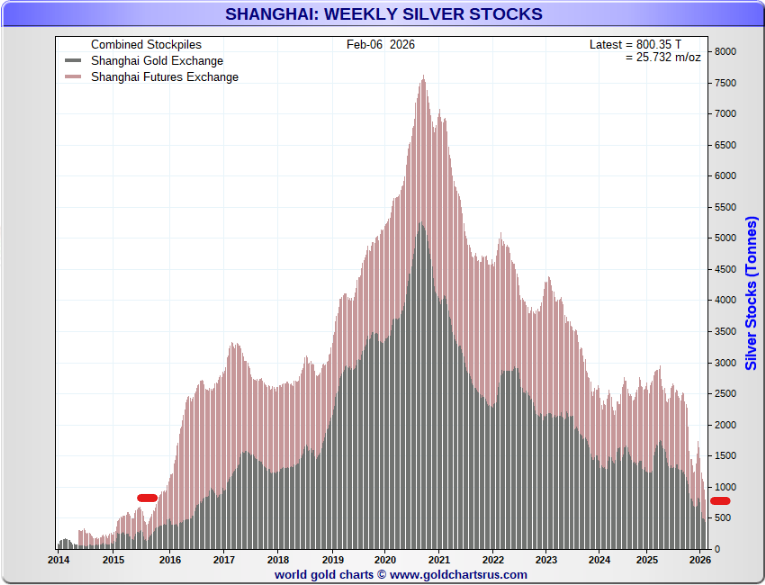

While the volatility measure of silver’s price moves report the size of daily silver price moves relative to its price, there is a forward measure of the market’s anticipation of price volatility over the next 30 days, or implied volatility, that can be measured from the options market positions for i-Shares ‘SLV’ exchange traded fund (ETF). This volatility measure is called the ‘CBOE Silver ETF Volatility Index’.

Again, the CBOE Silver ETF Volatility Index is the market’s forward-looking view of how volatile silver’s price will be over a 30 day period.

In the Figure 2 graph below, ‘VXSLV’ (white line) represents this forward looking measure of anticipated silver price volatility (CBOE Silver ETF Volatility Index) and the dotted blue line represents the VXSLV 30 day moving average.

The green line ‘HV’ below represents measured daily silver price volatility.

What can be seen in Figure 2 is that 1) VXSLV currently generally moves higher in advance of spikes in silver’s daily price volatility and 2) that the price of silver, using SLV-ETF’s price as a proxy, remains in a very volatile regime as indicated by the elevated level of the 30-day moving average of VXSLV.

Elevated volatility has accompanied the price of silver’s move generally higher over the past 6 months.

Figure 2 - ‘VXSLV’ CBOE Silver ETF Volatility Index vs ‘HV’ Measure Of Daily Silver Price Volatility; source: TradingView.com

Volatility - Price Increase Or Decrease?

The elevated level of the CBOE Silver ETF Volatility Index is indicating that the market forward view is that the price of silver is in an regime of elevated price moves greater than historically usual.

The question then is whether the silver options market’s projection of increased future price volatility represents a prediction of generally higher or lower large silver price moves.

Let’s look at silver inventory levels in Shanghai and New York trading centers to see if there is any indication of what may drive silver’s price in the near term.

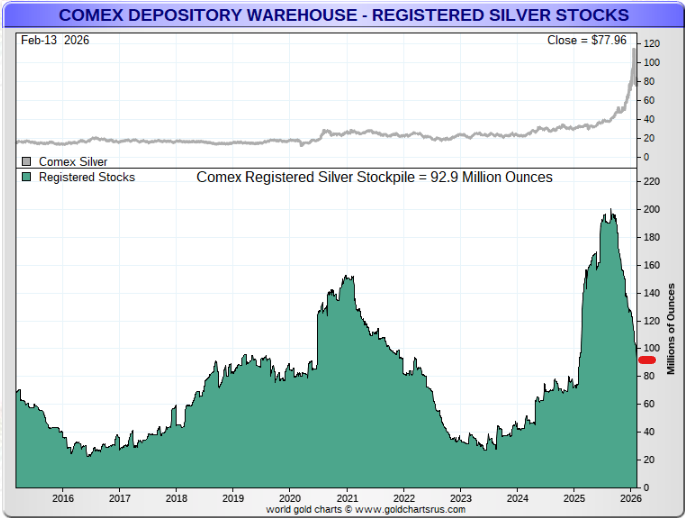

Figure 3 - Shanghai Gold Exchange And Shanghai Futures Exchange Silver Inventory 2013 to 2026; source: GoldChartsRUs.com

CME COMEX New York ‘Registered’ silver vault holdings (silver available to market):

Figure 4 - CME COMEX ‘Registered’ Silver Vault Holdings 2015 to 2026; source: GoldChartsRUs.com

Best regards,

David Jensen

Jobs growth in the U S has been readjusted DOWN a million

The Government has NOT reported cancer deaths in the U S since 2022, why ? ( vaccine )

Epstein and his disgusting horror story gets more light shone upon it daily

We live ON a farm and WE are the livestock , take this pill buy this stock ,we know best

We love you ,especially your children ( boiled or fried )

What I am trying to say in a post filled with irony is that they lie to you, from the TOP all the time and these lies go down from the top through the bureaucracy and the bought and paid for media into the peoples consciousness as the truth and a direction from a loving leadership it is like thinking that the workers in the abattoir have your best interests at heart if you were a cow

Resist Resist become as self sufficient as possible , get real stuff do not listen to their criminal B/S , try and form pockets of like minded people , you will be considered a bit of a nutcase but folks will come round . I followed QANON when it was active and now 10 years later Pizza and cream cheese and jerky are back in the lexicon BIG TIME no one is going to save you and yours except YOU

How did we all miss that magic hidden billion ounces of silver that has now come out and been sold in a fever?😉