Jump In Silver Futures Delivery Premium Signals Acceleration Of Global Scramble To Secure Physical Silver

“We have gold because we cannot trust governments.”

US President Herbert Hoover

President Hoover’s quote comes somewhat as a surprise as it comes from the ultimate government insider. Hoover would know.

We should also add silver to President Hoover’s quote given its 4,000 year role as a day-to-day medium of secure commerce.

In the silver market we are seeing further and growing signs of physical silver market stress.

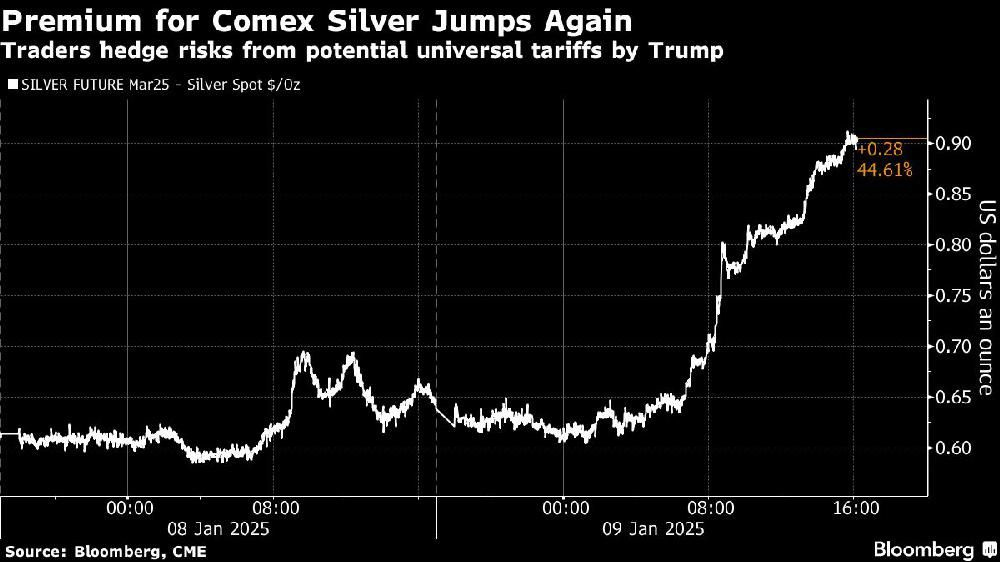

Thursday January 9, 2025 saw a nearly 50% increase in the premium on the price of the NY COMEX March 2025 silver futures contract, relative to the cash market silver price. COMEX silver futures contracts allow purchasers to acquire a delivery position in New York thus indicating market participants are anticipating a coming higher price on silver.

Figure 1 - Silver Premium March 2025 COMEX Futures Contract To Spot Price; source: Bloomberg

On a longer term, the increase in the COMEX futures delivery silver price premium can be seen in Figure 2 below.

Figure 2 - Silver COMEX Futures Contract Price To Spot Price; source: GoldChartsRUS.com

While the break-out higher in silver futures prices vs. the spot price does signal anticipation of a higher future silver price by traders, as need grows in a physical market we will, ultimately, see a sustained inversion of this market structure as market participants bid the cash price of silver higher than the futures prices to take immediate delivery of metal.

The rising premium on futures market silver thus signals an initial indicator of the developing bull market for physical silver.

Given the estimated 4 billion (B) oz. to 6B oz. of cash/spot silver contracts standing in the City of London’s cash market, as the market is seeing an increasing global shortage of silver it is anticipated the global scramble for physical silver is about to get much more intense.

It’s Not Just A US COMEX Market Phenomenon

Bloomberg states that the current silver market action is driven President Trump’s threat of tariffs potentially increasing silver’s import price causing market participants to import and secure silver before such tariffs take effect.

However there are many factors causing rising premia for silver in the global market including safe haven investing to protect from coordinated currency debasement by central bank central planners.

For example, the current silver price premium impacting silver in India is affected by the rapid decay in the buying power of the Indian Rupee as can be seen in Figure 3, not so much Donald Trump.

Figure 3 - Indian Rupee / US Dollar August 2021 - January 2025; source: TradingView.com

Whatever the local factors driving demand for silver in all of the world’s markets, after decades of price containment through the selling of billions of ounces of virtual silver into the world’s largest cash/spot silver market in London, silver’s exceedingly low price relative to its historic high prices ensures its market shortage due to secular underproduction of this essential and valuable monetary metal.

Best regards,

David Jensen

I remember when this take downs used to last for weeks and the price would linger forever.

Today it takes a lot of money to raid the silver market and it gets back up right away.

The BRICS countries always stand for delivering.

We are getting closer and closer every day to the truth of real market price discovery.

Hang on tight, don’t despair, even with the manipulation the price is moving forward

I’m all enough to remember silver oz a $1.20

I’m not planning to die before is at least $120 an OZ

Thanks, David. I am certainly not a trader in silver, but I noticed at about 10:00 AM EST yesterday (Monday) that the (presumably Comex) price of silver was down over 3% and stayed down for the rest of the day as graphed on:

https://www.cnbc.com/quotes/@SI.1

It looked to me like a serious and combined attack by the short bullion banks. But how does this tie in with this article above regarding a future premium increase? Thanks.