Platinum Daily Trading Volume Surges To New All-Time High In New York

Platinum Market Shortage

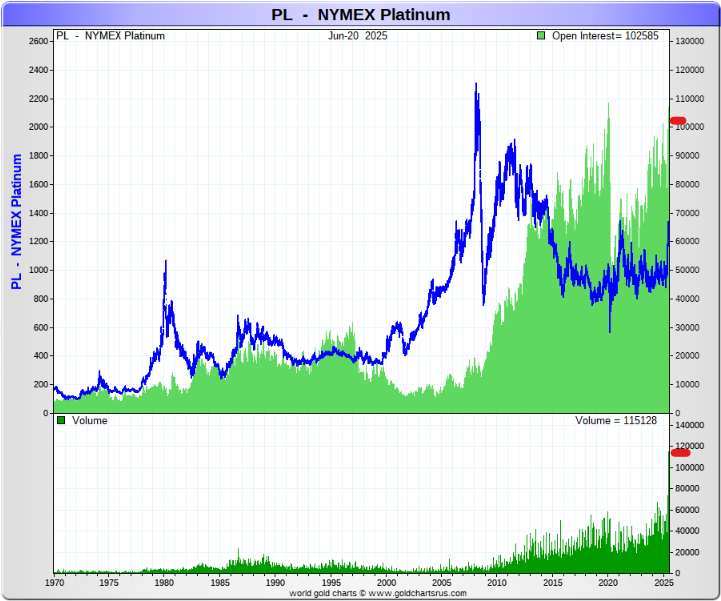

The New York CME COMEX trading volume on Friday June 20, 2025 surged to a new all-time daily high at 115,000 contracts of 50 oz. each up from 61,000 contracts traded the day before.

The sudden surge in NY trading to new all-time highs has our attention.

The latest London market platinum lease rate available is from Wednesday June 18 when the 1-month lease rate stood at 20% p.a. according to former metals trader and market observer Rob Gottlieb .

Figure 1 - CME-COMEX Platinum Price, Futures Open Interest, And Futures Trading Volume; source: GoldChartsRUs.com

Open claims on the NY COMEX stood at 5.1M oz. in comparison to 218,013 oz. Registered vault holdings available for delivery.

Figure 2 - CME-COMEX Platinum New York Vault Holdings And Open Interest (Contract Claims) 2003 -2025; source: GoldChartsRUs.com

The rapidly increasing trading volume and very high lease rate signal the platinum market appears to be increasingly stressed due to shortage.

Best regards,

David Jensen

Let’s hope that when the platinum market blows up all eyes turn to silver. Banksters look like a wounded whale in shark infested waters. Maybe more stock market normies will finally take notice too.