In the past 7 days, silver priced in US Dollars (USD) is up 6.53% which is more than any other commodity or precious metal.

In the past 30 days, silver priced in USD is up 11.8% which is more than any other commodity or precious metal.

On a weekly basis, silver has again broken out to a new highest price since 2012.

The financial MSM last wrote about silver as follows:

Financial Times - September 26, 2024

Bloomberg - September 26, 2024

Wall Street Journal - September 27, 2024 - in a less than complete article on silver and the global physical shortage that is driving silver’s price higher.

In August 2024, this Substack article estimated that an enormous 4.2 billion (B) oz. to 6.4B oz. of contracts for cash silver ownership had been sold into the London market potentially exposing large sellers of such cash silver promissory notes to an existential threat.

Because of the enormity of the level of leverage this creates on the actual miniscule amount of silver bars available for delivery in the cash market, it appears that the only market players who could have sold these claims for silver bars into the market are bullion banks - central banks and governments have not disclosed that they trade in the silver market which leaves us to wonder about the large global bullion banking players such as JPMorgan, HSBC, Standard Chartered, etc.

We do not know which of these institutions hold large silver short positions however this writer is following these banks/financial institutions and others:

JPMorgan ticker ‘JPM’ NYSE

HSBC Bank - ‘HSBC’ NYSE

Standard Chartered - ‘STAN’ LSE

Blackrock - ‘BLK’ NYSE - of BlackRock iShares ‘SLV’ silver ETF

Bank of NY Mellon Corp - ‘BK’ NYSE - (trustee of the SLV silver exchange traded fund (ETF))

Deutsche Bank - ‘DB’ NYSE

Bank of America - ‘BAC’ NYSE

Also keep in mind that merely holding a silver long position to offset bar delivery demand risk from a short position is ineffective if the counter-party to the long position defaults on bar delivery, when requested to deliver.

As silver’s price starts to rise first 10s of dollars then more, institutions and banks that have created the large London silver short position stand to lose multiples of that dollar amount except denoted in the billions of dollars and will likely start to default as silver users increasingly demand physical silver delivery to meet needs.

The continuing shortage of silver, after 6 years of annual supply deficits and vault silver stock draw-down, is bound to increase as global supply is stagnant. That would then drive increasing demands for silver delivery in the City of London spot/cash silver market where the billions of oz. of silver promissory notes for immediate metal delivery have been sold.

Please add any other silver market institutions that you feel will be interesting to follow.

A Look At Recent Silver Charts

We can see here that the digital silver spot price has broken-out to a high on a weekly basis last seen in 2012:

Figure 1 Weekly Spot Silver Price Chart 2009 - October 19, 2024; source: TradingView.com

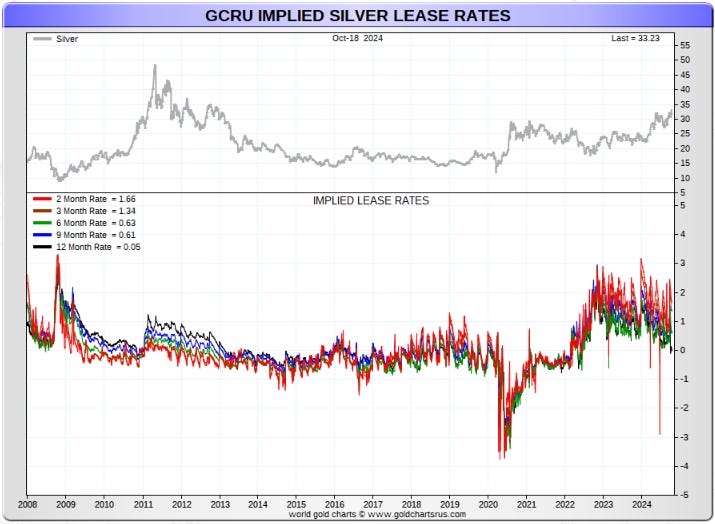

The Implied Silver Lease Rate remains at elevated levels seen during the 2008/2009 Great Financial Crisis signaling physical silver shortage in the global market:

Figure 2 - Implied Silver Lease Rate; source: GoldChartsRUs.com

At October 14, 2024 bullion banks (Swap Dealers - blue line below) remain net short 38,866 x 5,000 oz. silver contracts for a total short position of 194M oz. of silver on the CME/NY COMEX silver futures exchange:

Figure 3 - CME COMEX Silver Futures Prices And Net Positions to October 14, 2024; source: Tradingster.com

Let’s continue to follow this market closely as it appears to be at an important fulcrum point.

Best regards,

David Jensen

lookin next to tuesday 22nd oct BRICS+ meeting....russia´s state fund plans buying gold silver platinum and palladium in order to improve their reserves (recent Jerusalem Post article). If other *waiting list countries*) will follow russia´s calling for physical silver , than the short bullion banks are going to get really in trouble. save the date 22-24 oct Brics+ meeting what will happened announcements there.

What do you think this week David - Lower or Higher?? It seems the silver smack downs are getting smaller and less effective as time passes as it bounces back to where it was much more quicker than say one or two months ago.

If $32.50 was the line in the sand for shorts, you would think those banks and funds would be working together to write this off or get out of their position?? What could they do?? Buffett's off loading of JPM stocks timing was very interesting this past week.