US Trade Rebalancing Can Rapidly Lead To A Restructuring Of The Global Currency Regime, Banks, And All Debt Value

Very, Very Rapidly

News is that which somebody wants suppressed.

All the rest is advertising.

William Randolph Hearst

On April 2, 2025, President Trump announced sweeping new tariffs with most trade partners. While the stated purpose was to rebalance trade and reduce the trade deficit (which is necessary), there are inter-related issues leading to this move that are not being discussed by Trump or the financial media.

Debt Currency Impasse

The first issue is the unsustainability of the US economy using the debt-based currency system operated by the US Federal Reserve (Fed) central bank.

Operating a hybrid market-based economy with centrally-planned debt currency creation and interest rates manipulation by its central bank is now at its practical limits.

Total US system debt stands at $102 trillion (T) and is increasing at 5% p.a. after decades of aggressive debt and currency expansion stimulating massive asset and financial bubbles and the stripping of wealth from working individuals and savers.

The US debt-to-GDP ratio stands at 340% vs the historic average of 150% that persisted for decades up to 1980 but now stubbornly elevated goods price inflation is starting to arc higher, once again.

Persistent price inflation caused by currency debasement works against the wish to ‘stimulate’ the economy with easier debt creation that is needed even after the Fed further faked economic growth since 2008 using Quantitative Easing creating $8T of currency to buy assets from the market. And most industrialized country central banks emulated the Fed’s disastrous policy that was only made possible with price fixing of the gold market in London by the Bank of England.

The growth in the debt ratio reinforces the position of Austrian School economists who warned that attempting to grow an economy using fiat debt creation leads to consumption not supported by an increase in productive output of the economy. Ultimately it leads to currency and economic collapse if it is continued.

The restructuring of the US economy by the Fed that made the economy debt-dependent now comes nose-to-nose with price inflation that is forcing interest rates higher.

The current 5% rise in interest rates since 2022 will add an additional $5T of interest payments to the US economy with time as borrowing rates reset and is unsustainable - yet the now-stalling speculative bubble operated by central bank monetary policies demands further debt-currency expansion.

Risk to USD Reserve Currency Status

Because the US Dollar is the world’s reserve currency and is utilized for a large portion of global trade and commodity pricing, US central bank price inflation was exported globally.

The BRICS organization, founded in June 2009 just 6 months after the Fed started QE monetary policy, has now grown to 19 member and partner countries comprising 42% of global GDP and 55% of the world’s population.

Central to BRICS policy is their proposed new BRICS trade currency unit (literally, the BRICS ‘Unit’), that is proposed to include a 40% gold bullion allocation and will utilize block chain distributed ledger technology.

Even a 40% gold allocation will buttress the BRICS Unit vs. fiat currencies and that will, immediately upon its implementation, cause a problem for Western fiat currencies and associated bubble economies relegating these fiat currencies to BRICS something houses.

Trump’s focus on the US trade balance masks the necessity of on-shoring production in advance of the coming BRICS unit. The US economy currently imports $4T of goods and services and exports $3.2T annually yielding a trade deficit of $800 billion (B). The US balance of payments deficit is $1.2T annually.

This continuing ‘exorbitant privilege’, as Charles de Gaulle dubbed it, has arisen because of the need (ability) to export currency to meet the trade and reserve currency needs of a growing global economy (the Triffin Dilemma). This privilege will come to an end likely in the nearer than longer term as implementation of the BRICS Unit will end the US Dollar world reserve currency status and the necessity and capacity for exporting US dollars in return for imported trade items. Importation of goods in return for fiat currency export will become very difficult outside of unified trade blocks.

China Now Has A Very Short Term Problem Potentially Leading To Rapid Demise Of the US Dollar

Each day, China imports 12 million barrels of oil. In addition, at the end of 2020 there were $12.7T of USD denominated loans outstanding globally with 25% or $3.2T of these loans (both bank debt and debt securities) owed by Chinese entities.

Although China has started purchasing some hydrocarbon energy with Yuan, the majority of the $306B of annual oil imports are USD denominated and, assuming a 7% average loan rate on China’s USD denominated debt, China’s USD debt servicing requires an additional $225B annually.

Between oil imports and USD debt servicing by China up to $500B annually of net-USD cashflow into China are needed in order for the Chinese economy and financial system to continue function.

A rapid net-balancing of dollar cash-flows into China can force China and other BRICS members to move toward implementation of the more stable and accessible BRICS Units for trade (and a revaluation of gold by an order of magnitude or more to allow gold to fulfil a daily trade settlement role).

China’s response last Friday of applying 34% tariffs on US goods appear to indicate that they are happy to ramp the trade conflict that can lead to a USD crisis.

Finally, some of the $12.7T of USD denominated foreign loans comprised of bank debt and loan securities sits on the balance sheets of US domiciled banks. If dollar scarcity debt defaults by foreign borrowers are triggered, US banks will not be unscathed.

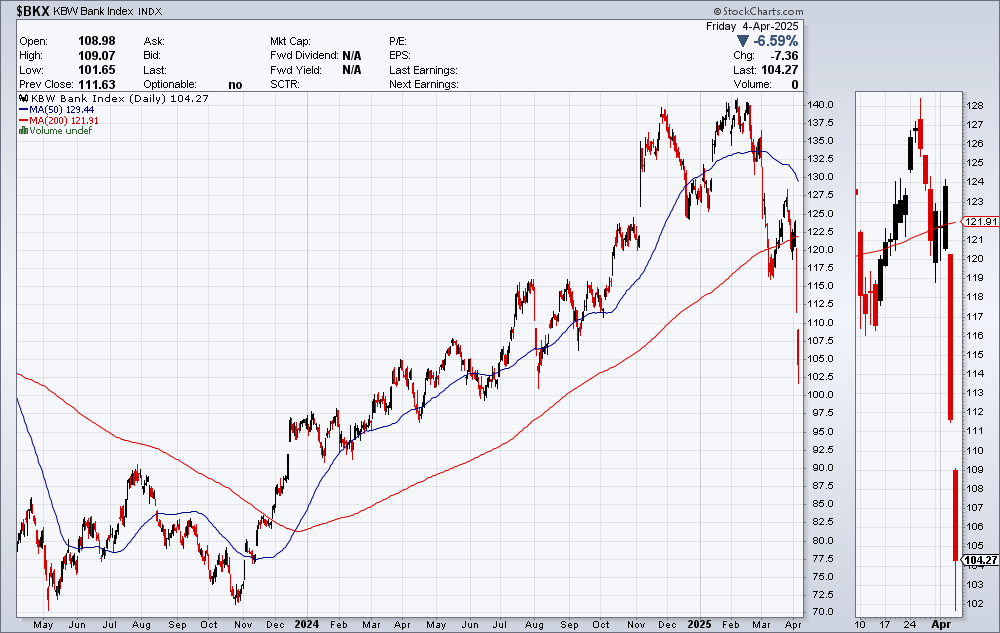

The KBW Bank Index (‘BKX’) dropped by 13% over April 3 and 4 after last week’s tariff announcement.

Figure 1 - KBW Bank Index (‘BKX’); source: StockCharts.com

The currency and trade conflict may escalate very quickly from here and lead to a global currency, bank, and debt restructuring - and much pain for those who do not own gold and silver.

Then the hangover/recovery from the multi-decade central bank bubble party.

Best regards,

David Jensen

There is still some complications I understand in setting up the Unit. I think India is objecting to China’ lead role. Also I think there are hang up on the backing of the other 60% which is local currencies. Lastly - I thought it was all delayed and not really set for roll-out? Maybe I am wrong but this would only be a question on when because eventually I agree it likely happens. The tariffs to me look like a bid to try to crush the Chinese economy which is languishing and needs US purchases to operate profitably. Real estate is also a non-performing issue in China.

yes, there will be short term turbulence as Trump reset finances for US. BUT, We are moving off the federal income tax, shrinking the federal government to a manageable size where tariffs can pay for it, and preparing to end the Federal Reserve and the fiat currency debt slave system. Good time to build a life raft of Gold & SILVER, Constitutional money…

A new day for America & Americans!