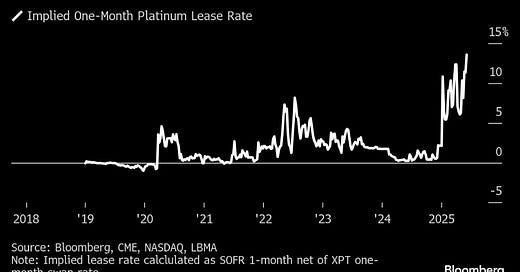

On June 8, 2025 Bloomberg published an article noting the soaring lease rate for platinum in London and showing the lease rate approaching 15%.

That was followed this past week by former metals trader and precious metals analyst Rob Gottlieb reporting that the 1-month London OTC platinum lease rate had increased to 24.5%.

Figure 1 shows a mark-up (in yellow) of Bloomberg’s platinum lease graph showing the scale of Gottlieb’s reported spike in the London platinum lease rate.

Figure 1 - Graph Of 1-Month London Platinum Lease Rate 2019 to 2025 Marked To Show Lease Rate Surge Reported by Robb Gottlieb; original graph source: Bloomberg

The sudden spike in the London platinum lease rate indicates that there is an intensifying shortage of physical platinum bars in London - and because it only takes a matter of days to move these (heavy) bars from Swiss vaults to London, we can deduce that the market shortage of platinum extends to Switzerland as well.

Physical commodity shortage is ultimately fatal to a leveraged paper promissory note price management/price fixing schemes as has been created and operated by the Bank of England (BoE) in London’s precious metals market for decades.

Remember, it is not a question how much metal remains in warehouse vaults in this increasingly tight market but how much metal is available to market at these prices.

The surging platinum lease rate tells us that it’s not much.

Extreme Paper Leverage Spells Doom For The Price Fixers

The platinum market is tiny in comparison to gold and silver. The 8 million (M) oz. per year global platinum market now faces a third year running with an approximately 1M oz. per year supply deficit.

While the London Platinum & Palladium Market publishes almost no market data, we can look to the New York CME-COMEX platinum futures market for a sense of how leveraged this paper market has become.

It can be seen in Figure 2 below that the COMEX market’s open interest (paper claims for metal) and trading volumes are now surging to historic highs.

Figure 2 - CME-COMEX Platinum Trading Data 2003 -2025; source: GoldChartsRUs.com

Even more disturbing is the scale of open interest or standing open claims in the COMEX.

The bottom panel in Figure 3 shows that while there 5.4M oz. of COMEX futures contract claims, there are only 218,862 oz. of ‘registered’ category platinum vault holdings that are available for delivery.

We can be sure that as the physical platinum shortage grows in the City of London, platinum delivery demand will migrate to the COMEX to secure delivery.

Figure 3 - CME-COMEX Platinum Vault Holdings And Open Interest (Contract Claims) 2003 -2025; source: GoldChartsRUs.com

The platinum market now stands at a critical juncture for platinum supply that can only be met by (much) higher prices.

In the meantime, it is likely that default for physical delivery in the London and New York markets will occur.

And the failure to meet physical delivery demands in the platinum market will with time knock-on into other leveraged markets such as City of London’s silver and gold market.

That is inevitable given the decades of price fixing that have occurred in London’s ‘paperized’ precious metals markets.

The Consequences Of Precious Metals Markets Price Fixing Failure

Price fixing, especially in the London gold and silver market, was ultimately a system to artificially (fraudulently) lower global interest rates that leads us to the largest debt bubble in history with global debt now standing at over $300 trillion.

Precious metals have always competed as safe havens against bonds and we can anticipate that, as investment continues to aggressively move into these metals to protect savings against the global debt and asset price bubbles created by our central bank central planners, metal availability will become negligible, metal prices will soar as will interest rates, and the whole sorry paper era will end. So war.

Mistakes were made.

Who could have known?

Best regards,

David Jensen

Thanks for the honest article. Interesting how quickly Platinum got out of control yet, judging by the price action this week, they are still able to "cap" the Silver market in both London and NY using paper promises?

Platinum is much more likely to be the lead in unravelling the paper market as above ground stocks are tiny, inventory is tightly held, and there's no huge pool of potential recycling material (unlike silver) or Central Bank holdings available to be leased (unlike gold). We saw a correction in open interest and ABRDN Platinum on Friday but I'm still very bullish.

My 6E PGM basket has barely moved, limiting any supply response, and the price increase is too small and too recent to cause any real long term demand destruction (especially if it drags Palladium higher).