Platinum Commands Our Attention As Shortage And Trading Activity Intensify

Further to the May 22, 2025 post on platinum in this Substack, the global platinum market is showing signs of intense and increasing tightness.

For the second year in a row, 2024 saw a 1 million (M) oz. supply deficit in a global 8M oz. market that is expected to continue for more than the next 5 years going forward as global mine supply of platinum is projected to continue to decline.

Global mine supply is sourced 80% from South Africa and Zimbabwe combined.

Last week, platinum in New York was in ‘backwardation’ with the cash price of platinum being higher than the active futures month signaling a shortage of physical metal in the market.

Bloomberg also noted this past week that the 1-month lease rate for platinum in the London market was up to 14.5% p.a. providing further evidence of physical shortage in the market.

COMEX vault stocks of platinum in New York dropped to 353,000 oz. of platinum as can be seen in Figure 1 below.

For comparison, there are 38,300,000 oz. of gold in New York CME COMEX/NYMEX vaults.

Figure 1 - Platinum Vault Stocks In New York CME COMEX Vaults at June 5, 2025; source: GoldChartsRUs.com

Total open interest futures contract claims for platinum on the COMEX stands at 4.8M oz. in comparison to the 353k oz. of platinum in COMEX vaults.

Friday June 6, 2025 also saw the highest volume of platinum futures trading on the CME COMEX market with 73,458 contracts at 50 oz. each changing hands - see the red dot in the bottom panel of Figure 2 that contains data through June 5, 2025.

Figure 2 - Platinum Daily Price, Open Interest, And Trading Volume for New York COMEX Market 2003 to June 5, 2025; source: GoldChartsRUs.com

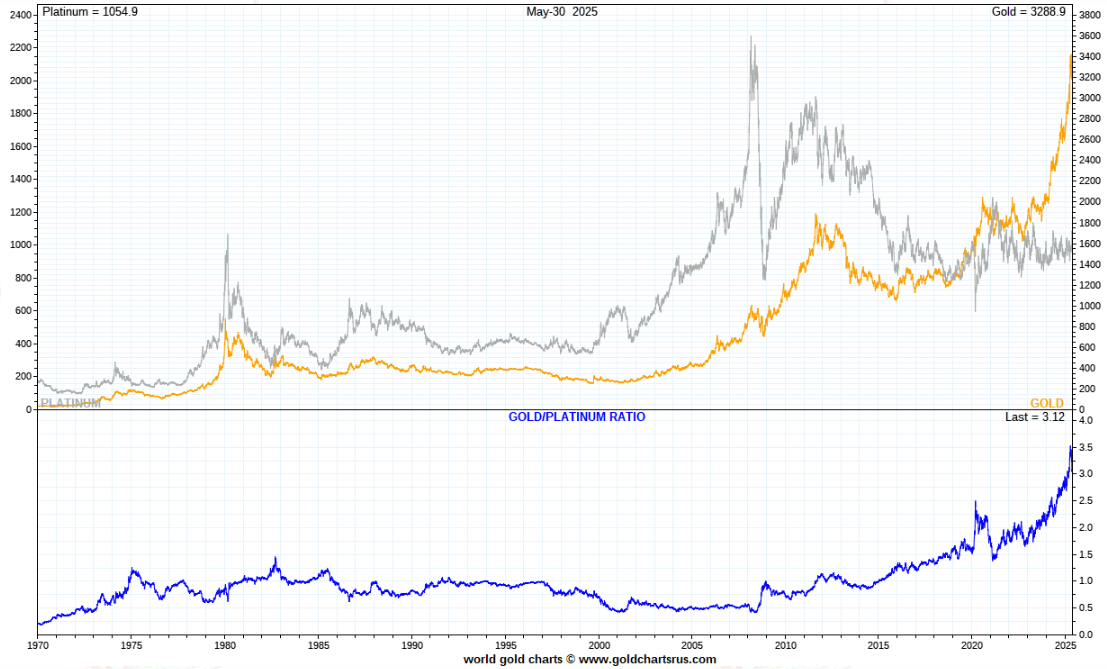

The ratio of the price of gold vs platinum (bottom panel in Figure 3 below) currently stands at approximately 3:1 vs the long-run average of approximately 1:1.

Figure 3 - Platinum and Gold Monthly Prices and Price Ratio 1970 to May 30, 2025; source: GoldChartsRUs.com

Like gold and silver, the world’s largest platinum and palladium cash market in London (LPPM) also trades paper promissory notes that are largely unbacked with metal and the run to secure physical possession against these contracts appears to be extending beyond gold and silver now to platinum as well.

Best regards,

David Jensen

Pt as part of the precious metals goup, in particular is very interesting, in part because physical supply is so much more restricted vs. gold and silver to just a handful of companies relying on primarily South Africa as a single (less than pristine) jurisdiction. About 30% of the mines, globally, are producing at a loss at these prices. In addition, from an article written by Trader Ferg on this platform recently, China holds 80% of the above ground inventory. Given that Pt is critrical in the PHEV and ICE automotive industry, and we have seen how scarce resources are now being used in trade negotiations, it's not hard to imagine a perfect storm emerging within the Pt (and PGM) niche. Cheers John

Incredible detail, David — thank you for breaking this down. The persistent deficit and lease rate spike definitely paint a picture of a tightening physical market. One question I had: given the 3:1 gold-to-platinum price ratio vs. the long-run 1:1 average, do you see a structural reversion trade setting up here — or has platinum’s industrial role (vs. gold’s monetary premium) altered the long-term equilibrium?