NY Fed President John Williams Wants To Contain Inflation Expectations As Gold Shouts Him Down

Gold Is Running And Central Bankers Are Jumping

“… Among the costly risks central banks must avoid are to allow inflation expectations to deviate from their targets, Williams said in a fireside chat with BOJ Deputy Governor Ryozo Himino at the central bank's conference held in Tokyo.

"You want to avoid inflation becoming highly persistent because that could become permanent," Williams said. "And the way to do that is to respond relatively strongly" when inflation begins to deviate from the central bank's target, he added.

Williams said shocks typically do not have long-lasting effects on inflation as long as inflation expectations are well anchored. But he warned there was always uncertainty on how supply-side shocks, such as those caused by the COVID-19 pandemic, could affect public perceptions on future price moves.

"Uncertainty has risen pretty significantly," he said "We have to be very aware that inflation expectations could shift in any way that could be detrimental."

Given such uncertainties, central banks must strive to not just anchor long-term inflation expectations, but ensure shorter-term expectations are "well behaved" so that public perceptions of future price moves emerge back towards central bank targets "within several years," Williams said.

NY Federal Reserve (Fed) President John Williams is in the news today expressing his determination that the Fed must act strongly to control price inflation.

In his public statement, Williams begins by stating that price shocks from supply shocks such as were seen during COVID-19, will typically not last long - so long as the public’s price inflation expectations aren’t allowed to rise.

Williams implies, and Fed Chairman Jerome Powell has clearly stated, that price inflation during COVID-19 was caused by goods shortages and further, that price inflation expectations of the public must be carefully controlled to ensure that price inflation does not become imbedded in the economy.

COVID disruption goods shortages have largely resolved themselves since that time.

Yet below we can see in the Consumer Price Index (CPI) that, strangely, the level of prices in the economy have not come back down from their elevated level and, in fact, prices actually continue to rise.

Figure 1 - Consumer Price Index for All Urban Consumers; source: St. Louis Fed

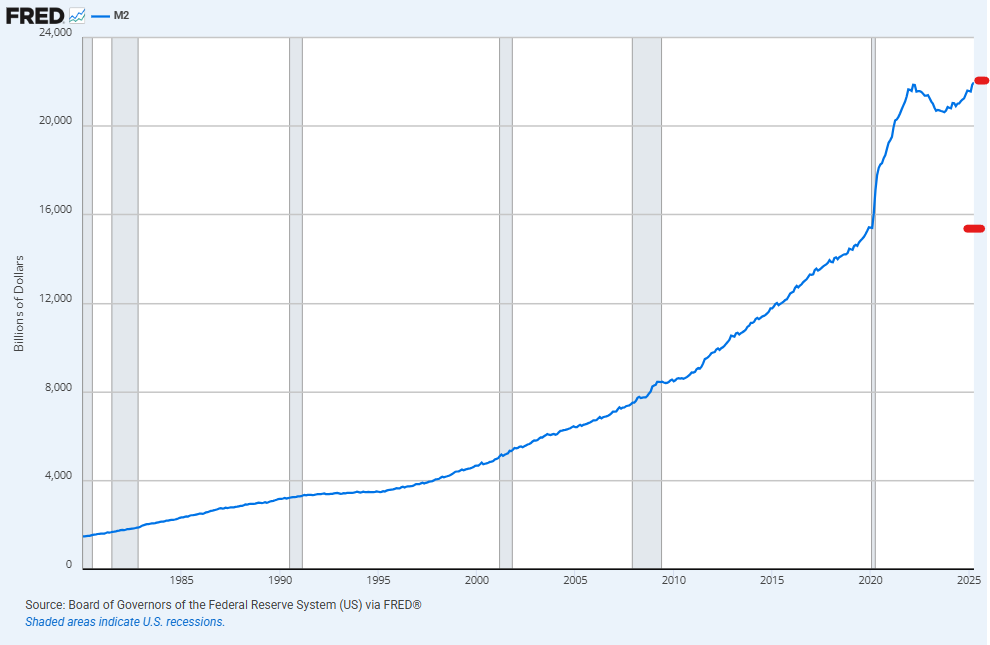

If we look at M2 money stock data from the Fed it is no wonder that prices have not come down from their COVID spike as the Fed increased M2 Money by 42% from January 2020 to March 2022 (from $15.4 trillion (T) to $21.9T USD), debasing the currency, and is currently ramping M2 higher by +4.5% per annum.

Figure 2 - US M2 Money Stock; source: St. Louis Fed

The currency debasement signal is clear and it is no wonder that the price of gold, which Alan Greenspan referred to as a primary indicator of the public’s inflation expectations, is overwhelming its leveraged price containment system and running so strongly higher.

Figure 3 - Gold Price 1980 - 2025 (USD); source: GoldBroker.com

First we had the European Central Bank’s less than fulsome warning about gold last week and now this - perhaps central bankers are noticing what gold is telling us about the public’s expectations and the fact that they are starting to vote with their feet.

So much so that Costco is now limiting how much gold customers can buy.

Best regards,

David Jensen

With Central Banks, it's always a question of watch what they do not what they say. And they are between a rock and a hard place with inflation (by definition ALWAYS a monetary phenomenon - caused by themselves) demanding higher rates and a slowing economy demanding lower rates. Especially when the only thing they can actually control is short rates via Fed funds - the markets set longer rates and so the yield curve and swap rates. So in reality, all the Fed can do is talk. And they do that. A lot.

This is from the same people, who use Financial repression, as their main toolkit for getting the public to pay for Government debt and mismanagement, whilst continuing to spend like drunken sailors.