Updated: The London Gold Market Now Seeing Technical Default On Cash/Spot Market Gold Delivery

Next Up, Silver

When Gold argues the cause, eloquence is impotent.

Publilius Syrus

O Gold! I still prefer thee unto paper, which makes bank credit like a bank of vapour.

Lord Byron

UPDATE START

Reuters has issued an updated article regarding Bank of England (BoE) gold and delays in London market availability of gold.

The Reuters article states:

“London bullion market players are racing to borrow gold from central banks, which store bullion in London, following a surge in gold deliveries to the United States on speculation of potential import tariffs there, two sources familiar with the matter said.”

The FT article states:

“The wait to withdraw gold bullion stored in the Bank of England’s vaults has risen from a few days to between four and eight weeks.”

Reuters clarifies that a delay in being able to borrow custodial gold owned by other central banks and stored at BoE vaults in London is at issue not withdrawal of gold from BoE vaults.

The Reuters article further states that 12.2 million (M) oz. have been delivered to U.S. COMEX warehouses over the last two months and that “The size of so-called Loco London free float, the amount of gold readily available to the London OTC market stored in London, has fallen after the jump in supplies to New York.”

Thus all or a portion of the 12.2M oz. of gold shipped to New York has been withdrawn from London warehouses thereby stressing the London gold market.

London Bullion Market Association (LBMA) data show that in the month of December 2024, a total of 963,000 of the 280,000,000 oz. of gold stored in London vaults was withdrawn.

January 2025 London vault data will be released by the LBMA in approximately 4 weeks.

Given the gold liquidity in London vaunted by the LBMA and the London market’s readily available cash/spot contracts for physical gold, it is difficult to explain how a withdrawal of a portion of 12.2M oz. of gold over 2 months from a pool of 280M oz. of gold can stress this market.

With an estimated 380M oz. of promissory note spot/cash gold claims standing in London’s gold market with only a small fraction of the 280M oz. of London vault gold available to market to settle these claims, the picture becomes more clear. That fraction appears to be gossamer.

12.2M oz. of gold withdrawals over two months, even in its entirety, should not be adequate to stress the London gold market if it were liquid and solvent.

UPDATE END

In this prior Substack post of August 2024, utilizing London Bullion Market Association (LBMA) data and surveys by the LBMA of its gold traders, it was estimated that the standing claims in the London cash/spot gold market (contracts of immediate ownership allowing delivery on demand) stood between 300 million (M) and 460M oz.

For the purpose of this post on the London gold market, let’s use an estimated 380M oz. of standing gold claims - the midpoint of the above two numbers - in the London cash gold market as a benchmark for the discussion.

Today’s Financial Times had an interesting headline and article:

Figure 1 - Financial Times Headline January 29, 2025

Reading through the FT’s article, the following information stood out (italics mine):

“The wait to withdraw bullion stored in the Bank of England’s vaults has risen from a few days to between four and eight weeks, according to people familiar with the process, as the central bank struggles to keep up with demand.

People can’t get their hands on gold because so much has been shipped to New York, and the rest is stuck in the queue,” said one industry executive. “Liquidity in the London market has been diminished.”

Since November’s US election, gold traders and financial institutions have moved 393 metric tonnes into the vaults of the Comex commodity exchange in New York, driving its inventory levels up nearly 75 per cent to 926 tonnes — the highest level since August 2022.”

For decades, the LBMA has repeatedly stated that the London cash/spot gold market standard was first two days and then later 3 days for physical delivery after demand and implied that the London spot contracts were as good as gold.

The delay of a few days was for paperwork or delivery from Switzerland to London. Mundane logistics. All good.

Now we see effectively an admission by the FT that the wait is now not 2 to 3 days but 4 to 8 weeks - not just from BoE vaults, as the FT states, but from all London vaults.

That length of time for parties that have sold promissory note spot contracts into the market to source physical gold tells us they don’t actually have gold for delivery but need 4 to 8 weeks to find adequate gold elsewhere followed by a couple of days transport to London.

Given that the cash/spot contracts in London typically specify delivery on demand with a few days for delivery, the 4 week to 8 week lag constitutes technical default.

We Now Know How Much Gold Is Currently Available To Market From London (or Swiss) Vaults For Immediate London Delivery - NONE

The LBMA and the Bank of England (BoE), the latter having the largest gold vault holdings in London, have touted the 279.2M oz. of gold in London vaults as proof of just how massive, liquid, and available London’s gold holdings and the London Gold Market are.

As repeatedly noted, it is not the total vault holdings of London metal that matters but the liquidity, or the amount available to market on demand, that matters.

The LBMA posts London gold vault holdings with a 4 week lag and the latest data at December 31, 2024 shows that there are 279M oz. of gold in London vaults.

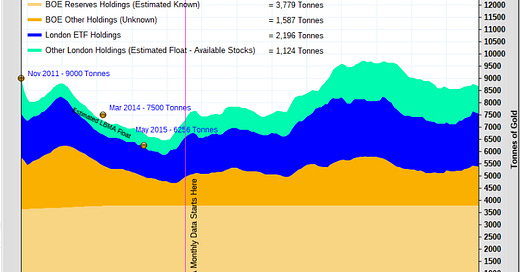

As can be seen in Figure 2, the London ‘float’ which is gold not owned by ETFs or held by the BoE for the UK or in trust for other countries, is only 1,124 tonnes (or 36M oz.) of 279M oz. of gold vault holdings.

The float is the area shaded in green in Figure 2 below.

The 4 to 8 week lag in getting gold delivery in the London cash/sport market tells us that effectively none of of the 36M oz. London float (or the Swiss float for that matter) is currently available to market. Either source could easily provide gold in 3 days if it were available.

Instead, parties that have sold gold spot contracts into the London cash market are having to wait while refineries source gold elsewhere and refine the gold into London ‘good delivery’ bars.

Just paper promissory notes (promises) have been sold into the London cash gold market.

Figure 2 - London Gold Vault Holdings; source: LBMA and GoldChartsRUs.com

Today, Treasury Committee member John Glen, Conservative MP for Salisbury, got right to the point about the London gold shortage at 1:08:20 of the Treasury Committee’s questioning of BoE Governor Andrew Bailey.

In response, Andrew Bailey did not get right to the point about gold in the discussion (total discussion portion is 4 minutes).

Bank of England Governor Andrew Bailey Testifies To UK Treasury Committee January 29, 2025

The open discussion in the UK’s Treasury Committee of the gold liquidity market seizure in London confirms the observation of September 2, 2024 that to make gold delivery in London, the gold first has to be imported.

The question now remains as to for how much longer gold will be available elsewhere in the world for fiat currency purchase at or anywhere near the current fiat gold price to allow the London gold market players to make delivery into more of the 380M oz. of cash/spot market claims sold into the London gold cash market.

The price fixing scheme in the London gold and silver market has been overseen by the BoE since 1987, so we can anticipate that Andy Bailey will say this is all nothing.

Move along.

Best regards,

David Jensen

Good numbers & analysis David, Thanks…seems that the merry-go-round is rapidly slowing…

I sincerely hope the day of unravelling is here.

When it happens, decades of price suppression will end, and reality will assert itself in the markets.

Can't wait!

Thank you for your analysis DJ.