Increasing Physical Silver Demand Forcing Panic Buying Phase

Friday’s +7% close for silver’s price capped a remarkable week in the silver market where silver’s price increased +14.5% on the week.

Increasing shortage of physical silver globally even as the price surges in all markets is signaling that silver will move to a panic buying phase as the price fixing mechanism in London, utilized to suppress the price of silver for decades, meets its end.

Price chart prognosticators can put aside their silver price chart estimations of silver’s future price as the market quickly and roughly reprices silver to its appropriate level after decades of price suppression, over consumption, and under production of silver.

The ‘Just Get Silver’ Phase

The scale of the estimated 2 billion (B) oz. of unbacked physical silver cash contracts standing in the City of London’s cash silver market means that some banks and financial institutions that have shorted silver will be decapitated ending up as mere historical artifacts as physical delivery demand accelerates in all global markets.

The near vertical price move for silver that we are seeing when viewing silver on a weekly chart dictates enormous pain is being meted-out on financial institutions as silver’s price is ‘Volkswagened’ to a new price level on a supply-demand basis.

Risk managers will force institutions to cover unbacked silver short positions in the physical market in order to limit financial damage that is becoming more severe on a daily basis.

In addition, individuals globally are increasingly recognizing the destructive impact of serial asset bubbles, many of which are rolling-over, blown by central banks over the past 4 decades and are similarly rapidly moving to secure gold and silver that have no counter-party risk and stand outside the financial and monetary system.

Finally, industrial users of silver are seeing the growing shortage and surging price of silver and are compelled to enter the market to secure silver supply through forward buying.

These factors speak to a rapidly increasing visible shortage of silver creating a rush to secure physical silver in the very short term. Many will say ‘just get it’.

Unrelenting And Increasing Physical Demand

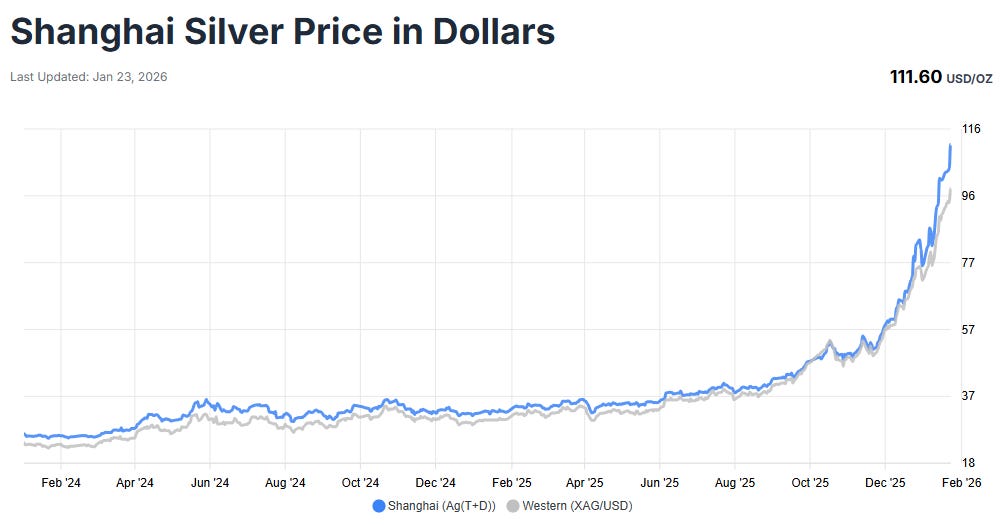

Both India and China are showing large price premia in comparison to surging Western markets.

At market close on Friday, Shanghai’s silver price stood at ~ $13 above Western cash market prices. And this price is without the 13% VAT tax that is applied when silver is withdrawn from Shanghai market vaults.

Further China’s price premium is increasing daily versus New York and London prices increasingly drawing physical silver from points globally.

Figure 1 - Shanghai Silver Price vs. Western Cash Market Price; source: goldsilver.ai

Silver retailers globally are reported as selling out of their silver stock. Even Costco’s North American locations can only offer silver for a few days after being supplied before selling-out.

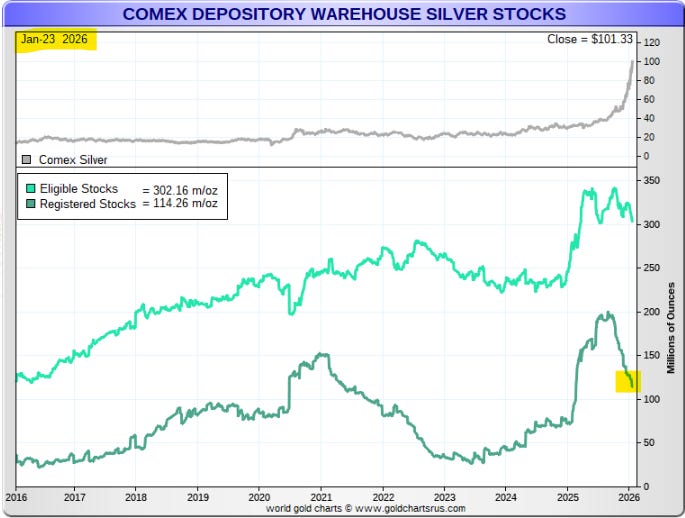

Physical Stockpile Draw Indicates Silver’s Current Price Is Unsustainably Low

Global silver stockpiles are rapidly being drawn-down at current prices.

The ‘registered’ category of silver (silver that is available to market) at the CME COMEX silver vaults in New York show an accelerating pace of draw as silver becomes increasingly scarce and its price is surging.

A much higher price is required to stabilize silver supply to market.

Figure 2 - CME COMEX Silver Vault Stocks (New York); source: GoldChartsRUs.com

Remonetization Of Silver

There are an estimated 5B oz. of silver held by the American public in various forms and 25B oz. of silver above ground globally.

As silver’s price moves higher by multiples of the current price and the destructiveness of centrally planned currency becomes apparent to all, market forces will start to remonetize silver for transaction settlement pushing aside inferior fiat currencies.

This has to be frightening promoters of increased central planning such as BlackRock’s Larry Fink, co-chair of the World Economic Forum (WEF), who this week spoke about the urgent need to ‘very rapidly’ move all assets onto a blockchain ledger in part to lower corruption.

Someone ought to tell Larry.

The natural trend is to decentralize assets and monetary systems to stabilize the global economy and society after the current doom loop of corrupt central planning by ‘regulators’ finishes itself off.

Central planners vs the world.

We’ll see who wins.

Best regards,

David Jensen

Brilliant breakdown of the supply crunch dynamics. The part about risk managers forcing institutions to cover unbacked positions actually captures something most anlysts miss - once that cascade starts, theres no orderly exit given the 2B oz paper overhang. I saw similar forced liquidations play out in nickel markets back in 2022, but the silver story feels way more structural since industrial demand cant just pause.

2026 will be biblical.